Following the Fed’s announcement of a big rate cut in September, we expect mortgage rates to stay in the low 6% range through the end of the year, with further declines potentially reaching the high 5% range by next spring. These lower rates will offer some relief to homebuyers who have struggled with high rates in recent years, likely encouraging more buyers to return to the market.

However, the effect of lower mortgage rates will differ across markets based on mortgage usage. In general, markets with a greater usage of mortgages will be more sensitive to rate changes while areas with a higher share of outright home ownership may see less effect from the rate decrease. Notably, according to our analysis, 84% of existing mortgages have a rate of 6% or lower. In other words, as mortgage rates approach the 6% level, we can expect to see more homeowners ‘unlocked’, especially in areas with high mortgage usage.

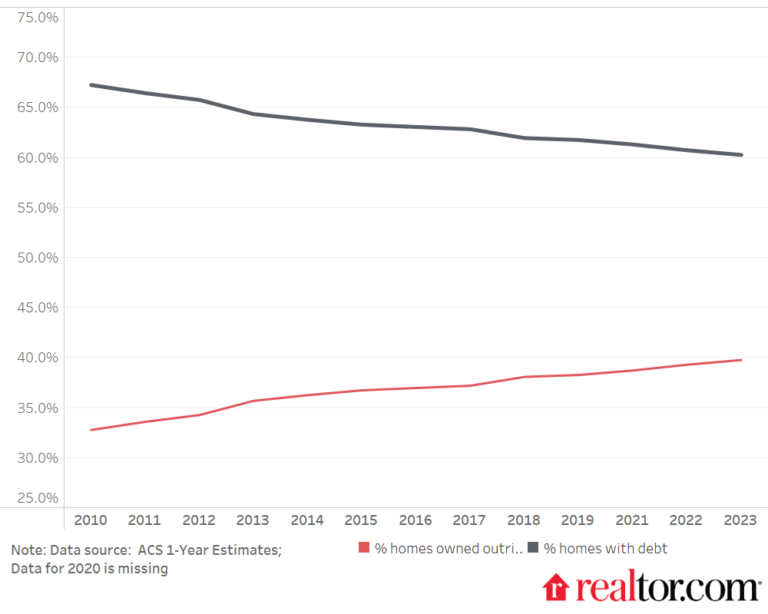

In order to understand the differences in geographic impact of lower mortgage rates, we utilize the 2023 1-Year Estimate from the American Community Survey. According to the data, 60.2% of homeowners in the United States lived in homes with a mortgage and 39.8% of owners owned their homes free and clear. In fact, the share of homeowners with debt has dropped in recent years, leading to an increase in outright home ownership. Back in 2010, the share of homes with debt was 67.2% and the share of outright ownership was 32.8%.

Figure 1: Increase in the proportion of homes owned outright amid decrease in mortgaged homes

At the state level, as mortgage rates trend downward, we can expect increased housing activity in areas like the District of Columbia, Maryland, Colorado, Utah, and California, where we see a higher share of homeowners residing in homes with mortgages. Conversely, housing markets in West Virginia, Mississippi, Louisiana, New Mexico, and Arkansas are likely to see less impact from lower rates, as a larger share of homeowners in these states own their homes outright.

Table 1: States Where Mortgages are Most Common

| State | % of Owner Occupied Homes With A Mortgage | % of Owner Occupied Homes Without A Mortgage |

| District of Columbia | 77.3% | 22.7% |

| Maryland | 70.7% | 29.3% |

| Colorado | 69.1% | 30.9% |

| Utah | 68.1% | 31.9% |

| California | 67.1% | 32.9% |

| Massachusetts | 66.4% | 33.6% |

| Virginia | 66.3% | 33.7% |

| Rhode Island | 65.7% | 34.3% |

| Washington | 65.6% | 34.4% |

| Delaware | 64.6% | 35.4% |

| Nevada | 64.5% | 35.5% |

| New Jersey | 63.9% | 36.1% |

| Minnesota | 63.8% | 36.2% |

| Oregon | 63.8% | 36.2% |

| Indiana | 63.5% | 36.5% |

| Connecticut | 63.5% | 36.5% |

| Georgia | 63.2% | 36.8% |

| New Hampshire | 62.5% | 37.5% |

| Hawaii | 62.2% | 37.8% |

| Idaho | 61.5% | 38.5% |

| North Carolina | 61.3% | 38.7% |

| Arizona | 61.1% | 38.9% |

| Wisconsin | 60.8% | 39.2% |

| Vermont | 60.4% | 39.6% |

| Illinois | 60.3% | 39.7% |

| Ohio | 60.1% | 39.9% |

| Missouri | 59.7% | 40.3% |

| Iowa | 59.3% | 40.7% |

| Nebraska | 58.9% | 41.1% |

| Tennessee | 57.7% | 42.3% |

| South Carolina | 57.5% | 42.5% |

| New York | 57.4% | 42.6% |

| Alaska | 57.3% | 42.7% |

| Michigan | 57.2% | 42.8% |

| Kansas | 57.1% | 42.9% |

| Pennsylvania | 57.1% | 42.9% |

| Kentucky | 56.1% | 43.9% |

| Maine | 56.1% | 43.9% |

| Texas | 55.8% | 44.2% |

| Florida | 55.7% | 44.3% |

| Montana | 55.2% | 44.8% |

| South Dakota | 55.1% | 44.9% |

| Alabama | 54.1% | 45.9% |

| Wyoming | 53.2% | 46.8% |

| Oklahoma | 52.9% | 47.1% |

| North Dakota | 52.8% | 47.2% |

| Arkansas | 52.6% | 47.4% |

| New Mexico | 52.2% | 47.8% |

| Louisiana | 51.7% | 48.3% |

| Mississippi | 48.0% | 52.0% |

| West Virginia | 44.4% | 55.6% |

| Data source: 2023 ACS 1-Year Estimate | ||

Among the top 50 metros, homeowners in Washington DC might be more sensitive to the impact of lower rates, given the high utilization of mortgages. Specifically, in 2023, 74.7% of homeowners in the DC area lived in housing units with a mortgage. [efn_note] Figures for the Washington-Arlington-Alexandria, DC-VA-MD-WV metro area differ from the “state-level” figures for the District of Columbia because the metro area data includes surrounding counties in Virginia, Maryland, and West Virginia.[/efn_note]Put differently, only 25.3% of homeowners in DC owned their homes outright, without a mortgage. Meanwhile, Denver, CO (72.4%), Raleigh, NC (72.0%), Virginia Beach, VA (71.0%), and Portland, OR (69.8%) are all among the markets with a higher proportion of homeowners carrying mortgages.

Furthermore, markets with a higher share of outright ownership could exhibit a degree of insulation from the impact of lower mortgage rates. Notably, New Orleans, LA stood out with the highest share of homeowners who own their homes outright among the largest 50 markets at 45.8%, followed by Pittsburgh, PA at 45.2%, Buffalo, NY at 45.2%, Miami, FL at 43.8% and Tampa, FL at 42.9%.

Interestingly, our analysis finds that markets with higher homeownership rates tend to have a greater share of outright ownership. Additionally, there is a strong correlation between a larger proportion of older homeowners (aged 65 and above) and the prevalence of outright homeownership.

In markets with elevated homeownership rates, individuals typically purchase homes at a younger age. As property values appreciate over time, homeowners can leverage the accumulated equity to either refinance their mortgages or sell and downsize, avoiding the need for new mortgage debt. This trend is particularly beneficial for older homeowners, who have had more time to benefit from both home value appreciation and equity growth

Figure 2: Markets with higher homeownership rates and a greater proportion of older homeowners tend to have a larger share of outright homeownership

Table 2: Metro Areas Where Mortgages are Most Common

| Metro | % of Owner Occupied Homes With A Mortgage | % of Owner Occupied Homes Without A Mortgage |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 74.7% | 25.3% |

| Denver-Aurora-Lakewood, CO | 72.4% | 27.6% |

| Raleigh-Cary, NC | 72.0% | 28.0% |

| Virginia Beach-Norfolk-Newport News, VA-NC | 71.0% | 29.0% |

| Portland-Vancouver-Hillsboro, OR-WA | 69.8% | 30.2% |

| Baltimore-Columbia-Towson, MD | 69.5% | 30.5% |

| Seattle-Tacoma-Bellevue, WA | 69.4% | 30.6% |

| Atlanta-Sandy Springs-Alpharetta, GA | 69.4% | 30.6% |

| Indianapolis-Carmel-Anderson, IN | 69.0% | 31.0% |

| San Diego-Chula Vista-Carlsbad, CA | 68.9% | 31.1% |

| Minneapolis-St. Paul-Bloomington, MN-WI | 68.9% | 31.1% |

| Sacramento-Roseville-Folsom, CA | 68.9% | 31.1% |

| Charlotte-Concord-Gastonia, NC-SC | 68.7% | 31.3% |

| Riverside-San Bernardino-Ontario, CA | 68.6% | 31.4% |

| Columbus, OH | 68.3% | 31.7% |

| Richmond, VA | 68.1% | 31.9% |

| Los Angeles-Long Beach-Anaheim, CA | 67.9% | 32.1% |

| San Francisco-Oakland-Berkeley, CA | 67.7% | 32.3% |

| Boston-Cambridge-Newton, MA-NH | 67.6% | 32.4% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 66.6% | 33.4% |

| Las Vegas-Henderson-Paradise, NV | 66.5% | 33.5% |

| Austin-Round Rock-Georgetown, TX | 66.3% | 33.7% |

| San Jose-Sunnyvale-Santa Clara, CA | 65.7% | 34.3% |

| Phoenix-Mesa-Chandler, AZ | 65.6% | 34.4% |

| Providence-Warwick, RI-MA | 65.5% | 34.5% |

| Cincinnati, OH-KY-IN | 65.5% | 34.5% |

| Milwaukee-Waukesha, WI | 64.9% | 35.1% |

| Chicago-Naperville-Elgin, IL-IN-WI | 64.1% | 35.9% |

| Hartford-East Hartford-Middletown, CT | 64.0% | 36.0% |

| Jacksonville, FL | 64.0% | 36.0% |

| St. Louis, MO-IL | 63.6% | 36.4% |

| Kansas City, MO-KS | 63.6% | 36.4% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 63.6% | 36.4% |

| Louisville/Jefferson County, KY-IN | 63.4% | 36.6% |

| Orlando-Kissimmee-Sanford, FL | 63.3% | 36.7% |

| Dallas-Fort Worth-Arlington, TX | 62.8% | 37.2% |

| Memphis, TN-MS-AR | 62.2% | 37.8% |

| New York-Newark-Jersey City, NY-NJ-PA | 61.0% | 39.0% |

| San Antonio-New Braunfels, TX | 60.2% | 39.8% |

| Rochester, NY | 59.6% | 40.4% |

| Cleveland-Elyria, OH | 59.5% | 40.5% |

| Oklahoma City, OK | 59.0% | 41.0% |

| Houston-The Woodlands-Sugar Land, TX | 58.8% | 41.2% |

| Birmingham-Hoover, AL | 58.5% | 41.5% |

| Detroit-Warren-Dearborn, MI | 58.3% | 41.7% |

| Tampa-St. Petersburg-Clearwater, FL | 57.1% | 42.9% |

| Miami-Fort Lauderdale-Pompano Beach, FL | 56.2% | 43.8% |

| Pittsburgh, PA | 54.8% | 45.2% |

| Buffalo-Cheektowaga, NY | 54.8% | 45.2% |

| New Orleans-Metairie, LA | 54.2% | 45.8% |

| Data source: 2023 ACS 1-Year Estimate | ||