The Canadian housing market’s latest statistics indicate a promising shift towards stabilization. With a modest increase in home sales, a recovery in new listings, and a positive trend in prices, the market appears to be finding its balance. The increase in supply and the recent Bank of Canada rate hikes are expected to moderate price growth in the coming months, creating a more balanced and favorable environment for both buyers and sellers.

ALSO READ: US Housing Market Predictions

Canada Housing Market Trends 2023

The Canadian Real Estate Association (CREA) has recently released its statistics for July 2023, revealing promising trends in the national housing market. These figures provide valuable insights into the current state of real estate in Canada.

The Canadian real estate market, as of July 2023, exhibits signs of stability and resilience. While there has been a slight decline in month-over-month home sales, the year-over-year numbers are strong, and the market is adapting to changing economic conditions and interest rate adjustments.

Buyers are benefiting from increased choice and a more balanced market, while prices are moderating, leading to a positive outlook for the future of Canada’s real estate landscape. Let’s delve into the key highlights:

Key Points from the Canadian Housing Report

- National home sales edged down 0.7% month-over-month in July.

- Actual (not seasonally adjusted) monthly activity came in 8.7% above July 2022.

- The number of newly listed properties rose 5.6% month-over-month.

- The MLS® Home Price Index (HPI) climbed 1.1% month-over-month and was down just 1.5% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 6.3% year-over-year increase in July.

National Home Sales in July

In the month of July 2023, national home sales experienced a marginal change, showing a decrease of 0.7% compared to the previous month. However, when considering the actual (not seasonally adjusted) monthly activity, it registered a remarkable 8.7% increase compared to July 2022.

Newly Listed Properties

The number of newly listed properties saw a notable rise, increasing by 5.6% on a month-over-month basis.

MLS® Home Price Index (HPI)

The MLS® Home Price Index (HPI) demonstrated a 1.1% month-over-month climb, while on a year-over-year basis, it experienced a modest decline of 1.5%. These figures reflect a balanced market.

National Average Sale Price

The actual (not seasonally adjusted) national average sale price witnessed a substantial year-over-year increase of 6.3% in July 2023, indicating the resilience of the real estate market.

Market Activity

The housing market in Canada has shown signs of stability since May, with sales experiencing growth in more than half of all local markets in July. However, a decline in the Greater Toronto Area (GTA) slightly affected the national figures. Sales also decreased in the Fraser Valley, but this was offset by gains in Montreal, Edmonton, and Calgary.

Largest Year-Over-Year Increase

July 2023 recorded an impressive year-over-year increase in transactions, with an 8.7% rise compared to July 2022. This marks the largest national sales increase in over two years.

Expert Opinions

Larry Cerqua, Chair of CREA, commented, “July continued along the same trend we’ve seen emerge in recent months, with sales leveling off and new listings returning in more normal numbers. This has been giving buyers more choice and balancing the market, which as of July was also slowing the rate of price growth.”

Shaun Cathcart, CREA’s Senior Economist, noted, “Sales and price growth are already showing signs of tapering off further in August in response to the Bank of Canada’s mid-July rate hike and messaging regarding above-target inflation for longer than previously expected. We’re probably looking at another round of ‘back to the sidelines’ for some buyers until there’s a higher level of certainty around interest rates going forward.”

New Listings and Inventory

July saw a 5.6% increase in newly listed homes, continuing a positive trend that began in earlier months. This trend has gradually improved the housing market, bringing it closer to average levels after reaching a 20-year low in March.

The sales-to-new listings ratio eased slightly to 59.2% in July, down from 63% in June. However, it remains above the long-term average of 55.2%.

At the end of July 2023, there were 3.2 months of inventory on a national basis, which is a slight increase from May and June but still lower than the levels observed at the beginning of the year.

MLS® Home Price Index (HPI) Update

The Aggregate Composite MLS® HPI experienced a 1.1% month-over-month increase in July 2023. While this is a larger increase for a single month, it is only about half the gains seen in the preceding months. This reflects the stabilization of sales as new listings recover.

Despite the smaller national gain, most local markets continued to see price increases between June and July, marking a trend that has been consistent since April. The Aggregate Composite MLS® HPI now sits just 1.5% below year-ago levels, the smallest decline since October 2022.

National Average Home Price

In July 2023, the actual (not seasonally adjusted) national average home price reached $668,754. This represents a substantial 6.3% increase from July 2022, showcasing the resilience and strength of the Canadian real estate market.

Canada Housing Market Forecast: Will it Crash or Not?

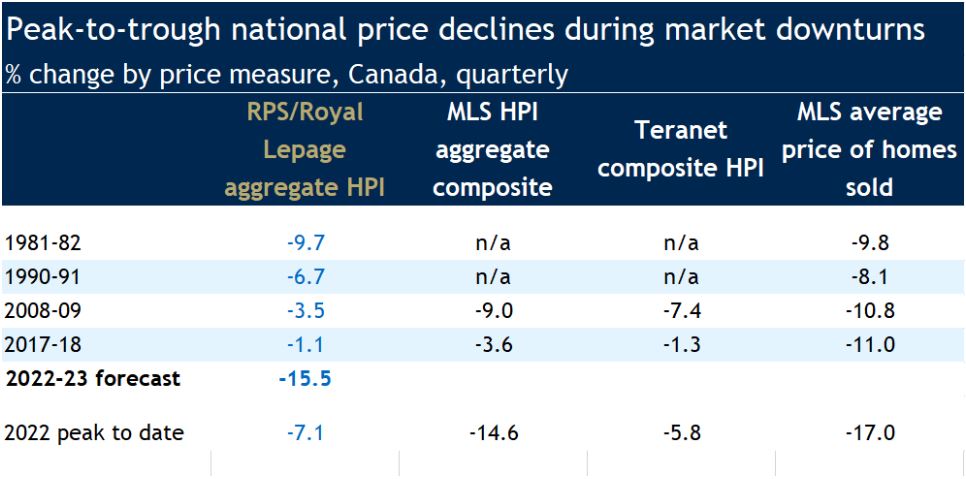

The Canadian housing market has been a hot topic lately, with many wondering if it will crash or not. Here’s what we predict will happen. The question on everyone’s mind is when will it reach its bottom? According to RBC’s recent economic analysis, the bottom is predicted to happen in Spring 2023. However, this does not mean that the housing correction has run its course. RBC is forecasting a peak-to-trough decline of 15% in home prices across the country, with about half of this decline still to come.

Ontario, British Columbia, and Alberta will experience a peak-to-trough dip of 19%, 16%, and 6%, respectively. It is important to note that this decline only offsets some of the immense home price gains between late 2020 and February 2022. RBC states that “the dramatic swing in the market since March 2022 is a cyclical event marking the transition out of highly unusual circumstances—a global pandemic and exceptionally low-interest rates. Structurally the market is sound.”

The slowdown in home sales nationwide has significantly moderated since the Fall of 2022, mainly because housing activity is already deeply depressed in most markets. This leaves little remaining downside, except for a major economic recession. The housing market recovery will slowly begin later in 2023, especially with affordability issues and the weakened economy holding back prospective homebuyers. The pace of recovery will gradually pick up in 2024 when the economy stabilizes, market inflation softens, and the Bank of Canada begins to trim down its key interest rate imposed in March 2022.

Impact on Buyers and Sellers For buyers, the forecast means that it may be a good time to purchase a home if they have the financial means to do so. With the decline in home prices, buyers will have the opportunity to purchase a home at a more affordable price. However, buyers need to consider their financial situation and whether they can handle the potential increase in mortgage rates when the Bank of Canada begins to trim down its key interest rate in 2024.

For sellers, the forecast means that they may need to adjust their expectations for their home’s selling price. With the decline in home prices, sellers may need to lower their asking price to attract buyers. It is also important to note that the housing market recovery will be slow, and sellers may need to be patient and flexible with their selling strategy.

Here are more insights from the report:

Activity is Quiet, But the Bottom is Near

Home resales have been declining since the market frenzy of 2020, but we believe the market is hitting bottom this spring. Resales are the quietest they’ve been in years, and we expect a bottom to form in the coming months. While some markets may recover faster than others, the primary reason for the slowdown is the lack of activity, and unless the economy dives, there’s little downside left.

Interest Rates are Stabilizing, But Won’t Prop Up the Market

The Bank of Canada’s rate hiking cycle is on hold, and we don’t expect any rate cuts until 2024. This should help stabilize the market, but won’t be enough to prop it up. Any downward drift in longer-term bond yields over the next year will be viewed as a positive sign of a turnaround, but the interest rate environment will remain restrictive for a while.

Prices are Expected to Drop Further in the Near Term

Home prices will continue to decline in the coming months, with the national RPS HPI likely to fall another 8% by the third quarter from fourth-quarter levels. Markets in B.C. and Ontario still face the biggest downside risk, with peak-to-trough price forecasts ranging from -19% in Ontario to -5% in Newfoundland and Labrador. Buyers will continue to face affordability challenges, especially in expensive markets like B.C. and Ontario. This means a quick market rebound is unlikely, and affordability issues will stand in the way of a material easing in buyers’ budget constraints.

Solid Market Fundamentals Despite the Correction

The market correction since March 2022 is a cyclical event marking the transition out of highly unusual circumstances like a global pandemic and exceptionally low-interest rates. However, structurally the market is sound. Inventories are still historically low, and Canada’s population growth is the highest in generations. Booming immigration will continue to fuel demand through the medium term and beyond.

Homebuilding is Key to Long-Term Balance

The recent track record for construction has been underwhelming, and homebuilding needs to ramp up considerably to accommodate the growth in households and address the housing affordability crisis in many Canadian cities. We estimate that at least 270,000 units must be built per year by 2025, but it’s unclear whether the construction industry has the capacity to do so in the face of significant labor shortages.

Canadian Provincial Housing Predictions

On a lighter note, the Canadian housing market, much like the human body, has experienced a correction from its pandemic highs. It has been a tough year for the market, but there is a glimmer of hope on the horizon. With falling interest rates, a tight labor market, elevated household savings and heightened immigration, experts expect the market to find a bottom by the end of this year. It’s like a phoenix rising from the ashes, ready to take flight once again.

A new report from Desjardins‘ economics team says that the Canadian housing market has experienced a significant correction from its peak during the pandemic. Existing home sales have dropped by over 38% from their peak in February 2022, and new listings have also decreased by almost 20% over the same period. The average home price has fallen by nearly 20%, while the benchmark home price, which adjusts for market composition, has decreased by approximately 14%.

This decline in sales, but relatively steady listings, has moved the national housing market into a more balanced territory compared to the start of last year when it leaned significantly in favor of sellers. Looking ahead, they predict that the Canadian housing market will hit its bottom by the end of the year. The Bank of Canada’s recent pivot suggests that the central bank is likely to remain on hold for the foreseeable future and may even begin cutting rates before the year is out.

However, high-interest rates will continue to affect housing market activity, while the effects of previous rate hikes have yet to be fully felt in the economy. The Canadian housing market’s correction may have a significant impact on Canadians, including a potential recession in 2023. Despite this, experts remain optimistic that the housing market will eventually recover.

While the national housing market is important, it’s important to note that all real estate is local. Each province has its unique economic developments, and this can lead to widely varying outcomes in the housing market. For example, Ontario, Canada’s most populous province, has borne the brunt of the housing market correction so far. However, it continues to attract immigrants, which should help underpin the residential real estate rebound as interest rates continue to decline.

British Columbia, which also relies heavily on the real estate sector, finds itself in a similar situation to Ontario. However, it too continues to welcome large numbers of newcomers, which should help drive the residential real estate rebound.

Quebec, on the other hand, is expected to continue to deteriorate in the coming months. Despite resumed immigration after the pandemic hiatus, it hasn’t been enough to spur new construction due to high-interest rates, leaving developers struggling to turn a profit.

One of the biggest surprises of 2022 was the resiliency of the housing markets of the Maritime provinces. Despite seeing the largest run-up in prices in Canada during the pandemic, prices have yet to adjust as much as they have in Central Canada or British Columbia. However, we may be seeing the early stages of a reversal in that trend, as a push from pandemic-related migration has now subsided.

The Prairie provinces, on the other hand, are expected to be at the top of the growth leaderboard in 2023. Commodity-driven growth is characterizing their outlook, with high commodity prices and an influx of newcomers to Canada and Canadians from other provinces looking for employment opportunities and more affordable housing options.

Overall, Canada’s housing market is on the path to recovery. We expect sales activity to gradually grind lower through 2023 before rebounding in the second half of the year and into 2024. Falling borrowing costs and support from elevated levels of immigration should help drive the market forward. While each province has its unique outlook, the housing market as a whole is set to soar once again.

More Topics For Reading:

Housing Market Forecast 2024 & 2025: Predictions for Next 5 Years

Where Are Housing Prices Falling in 2022?

Is it a Good Time to Buy a House or Should Wait Until 2024

Housing Affordability Crisis is Increasing in the United States

The Hottest Real Estate Markets of 2022

This article shouldn’t be used to make real estate or financial decisions. Some of this article’s information came from referenced websites. Norada Real Estate Investments provides no express or implied claims, warranties, or guarantees that the material is accurate, reliable, or current. All information should be validated using the below references. Norada Real Estate Investments does not predict the future Canadian housing market. Buying a property needs research, planning, and budgeting. Not all investments are good. Always do research and consult a real estate investment counselor.

Sources:

- https://stats.crea.ca/en-CA/

- https://wowa.ca/reports/canada-housing-market

- https://www.desjardins.com/qc/en/savings-investment/economic-studies/canadian-residential-real-estate-february-9-2023.html#