Housing Market Predictions for 2023

In this blog post, we’ll be discussing what experts are forecasting for the United States housing market in 2023. Will house prices go down in 2023? There is no one-size-fits-all answer to this question, as the housing market in the United States will likely vary depending on location and other factors. However, some experts believe that the market will decline in 2023, while others believe that home prices will rise.

Most experts in the housing industry predict less buyer demand, lower prices, and higher borrowing rates. Rate increases, along with a shortage of availability, have pushed many purchasers to the sidelines. Home prices may fall slightly, but not drastically as they did in 2008. Some believe that the housing market will continue to outperform compared to the pre-pandemic.

The housing market is always in flux, and predictions for the future can be challenging to make. However, experts are making some educated guesses about what we can expect in the coming years. Here’s a look at some housing market predictions for 2023.

According to a Forbes Advisor article, home prices are expected to continue to come down slowly, making it difficult for many homebuyers to access affordable housing.

ALSO READ: Lastest National Housing Market Trends

However, the article notes that there may be some relief for buyers in the form of more inventory becoming available on the market. This may help to level out the playing field, making it easier for more people to find a home that they can afford. Another prediction from US News & World Report is that the housing market will experience a relatively shallow recession that stops and starts in 2023.

This prediction assumes that inflation will be under control by 2024, allowing mortgage rates to remain stable. In this scenario, home prices are expected to rise, but at a slower pace than they have been in recent years.

Will Home Prices Drop in 2023: What Do Market Trends Predict?

Here’s when home prices can drop. While this may appear to be oversimplified, it is how markets work. Prices drop when demand is met. There is now an excessive demand for houses in several property markets, and there simply aren’t enough homes to sell to prospective purchasers. Home construction has increased in recent years, although they are still far behind. Thus, big drops in housing prices would necessitate considerable drops in buyer demand.

Demand falls mostly as a result of higher interest rates or a general weakening of the economy. Rising interest rates would ultimately need far less demand and far more housing supply than we now have. Even if price growth slows this year, a drastic fall in home prices is quite unlikely. As a result, there will be no fall in house values; rather, a pullback, which is natural for any asset class. According to many experts, in the United States, house price growth is forecasted to “moderate” or maybe slightly drop in 2023.

Fannie Mae, a leading authority in real estate data and insights, has updated its quarterly home price forecast. Their revised growth projection for 2023 is notably optimistic, demonstrating that home prices will not drop in 2023. It is a substantial upward adjustment from their earlier forecast.

Measured by the Fannie Mae Home Price Index (FNM-HPI), they anticipate a remarkable 6.7% growth on a Q4/Q4 basis, up from their previous prediction of 3.9%. This surge can be largely attributed to the unexpected influx of transaction data during the third quarter of the year.

Remarkably, house prices have exhibited greater resilience than anticipated, even in the face of higher mortgage rates and the challenges associated with affordability. However, Fannie Mae still foresees a slowdown in house price growth in the coming years. Their prediction for 2024 suggests a deceleration, with house price growth projected to slow down to 2.8% on a Q4/Q4 basis.

On the front of total home sales, Fannie Mae has made a slight downward revision to their forecast. This adjustment is driven by a more pessimistic outlook on mortgage rates. They now estimate sales to reach 4.81 million and 4.80 million in 2023 and 2024 respectively, a drop from their earlier projection of 4.84 million and 4.88 million.

Despite this dip in the sales forecast, the higher anticipated house prices have led to an unchanged prediction for mortgage origination volumes in 2023, expected to reach $1.56 trillion. The outlook for 2024 has been revised slightly upwards to $1.90 trillion, previously predicted at $1.88 trillion.

In summary, Fannie Mae’s insights provide a valuable glimpse into the trajectory of the housing market, shedding light on the dynamics of home prices, sales, and mortgage origination volumes. These projections offer essential guidance for stakeholders navigating the ever-evolving landscape of the real estate market.

Will Home Prices Drop Next Year?

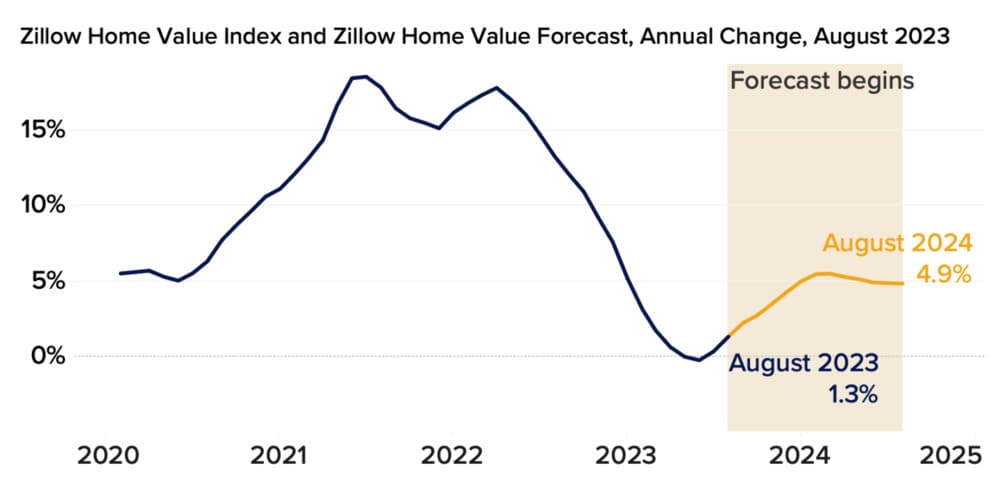

Recently, Zillow revised its forecast regarding the nation’s typical home value. This adjustment is attributed to the anticipation of higher mortgage rates and a slight decrease in market tightness.

Zillow forecasts the National Zillow Home Value Index (ZHVI) to experience a rise of 4.9% from August 2023 through August 2024. This is a modification from their earlier prediction of a 6.5% increase from July 2023 to July 2024.

Examining the trends for the month of August, an unexpected late-summer uptick was noted in the number of new for-sale listings entering the market. According to Zillow’s records, new listings increased by 4.0% from July to August. This marks the first time in Zillow’s recorded history that the inflow of listings increased over a two-month span.

It’s essential to note, however, that even with this increase, August’s new listings total, as well as the total for-sale inventory, remains considerably below typical pre-pandemic levels. Despite this, the unusual late-summer supply uptick contributed to a certain degree of easing in market conditions, consequently affecting the outlook for home values.

The persistently tight inventory conditions, combined with the lingering impact of elevated mortgage rates, are expected to continue limiting sales volume in the upcoming months. Zillow predicts 4.1 million existing home sales to occur in 2023, reflecting an 18% decline from 2022. This prediction is a slight adjustment from the previous estimation of 4.2 million sales.

Top 5 Metros Where Home Prices Will Drop

Some regional markets are projected to see home price declines. In their latest forecast, they now predict that home values will fall 203 of the nation’s 894 regional housing markets between September 2023 and September 2024. Greenville MSA tops the list with the highest expected decline of 9.9% in home prices by Sept 2024.

Top 5 Metros Where Home Prices Will Increase

Zillow still predicts that the vast majority of regional housing markets will see home values appreciating in 2023. Among the 894 regional housing markets Zillow economists analyzed, 678 housing markets are predicted to see rising house prices over the next twelve months ending with September 2024. 13 markets are predicted to remain flat for home price growth. The housing market in Thomaston, GA is forecasted to see the highest year-over-year house price growth of 8.6%.

Predictions from the CoreLogic’s Data – October 2023

CoreLogic, a leading provider of real estate data, offers comprehensive analysis and forecasts.

Home prices across the United States, including distressed sales, exhibited a 3.7% year-over-year increase in August 2023 as compared to the same month in 2022. Furthermore, on a month-over-month basis, prices showed a 0.3% increase in August 2023 compared to July 2023.

Forecasted Price Trends: Will Home Prices Drop?

According to CoreLogic’s Home Price Index (HPI) Forecast, we can expect month-over-month increases of 0.2% from August 2023 to September 2023. Looking ahead, from August 2023 to August 2024, there is a projected year-over-year increase of 3.4% in home prices.

Notably, in August, New England states witnessed the most significant year-over-year price gains. States like New Hampshire, Maine, Vermont, and Rhode Island saw notable spikes, showcasing 9.4% and 8.9% increases, respectively.

Expert Insights and Market Forecast

Chief Economist for CoreLogic, Selma Hepp, acknowledges the challenges posed by rising mortgage rates affecting affordability. Despite this, she emphasizes that strong demand, a healthy labor market, and robust wage growth sustain the growth in home prices, aligning with seasonal averages. However, with a slower buying season ahead and the increasing costs of homeownership, additional monthly gains may slow down.

US Housing Markets Where Home Prices Will Drop

CoreLogic’s Market Risk Indicator (MRI) provides valuable insights into the health of housing markets, predicting the probability of price declines over the next 12 months. In this analysis, we focus on markets that carry a very high risk of a decline in home prices.

1. Spokane-Spokane Valley, WA

At the top of the list is Spokane-Spokane Valley in Washington, where the MRI indicates a very high risk with a 70% probability or more of home price decline in the coming year. Factors contributing to this risk could include economic conditions, housing inventory, and demand-supply dynamics.

2. Cape Coral-Fort Myers, FL

Cape Coral-Fort Myers in Florida also stands out as a market with a very high risk of home price decline. Economic fluctuations or changes in the local real estate landscape could contribute to this assessment, highlighting the importance of closely monitoring this market for potential shifts.

3. Youngstown-Warren-Boardman OH-PA

The Youngstown-Warren-Boardman region spanning Ohio and Pennsylvania is another market flagged with a very high risk of a home price decline. Economic factors and local market conditions may be influencing this prediction, emphasizing the need for prudent decisions in this market.

4. Ocala, FL

Ocala in Florida is also identified as a market facing a very high risk of home price decline. Monitoring the economic and housing trends in this area is crucial for stakeholders to make informed decisions.

5. Deltona-Daytona Beach-Ormond Beach, FL

Deltona-Daytona Beach-Ormond Beach region in Florida is noted as a market with a very high risk of home price decline. Real estate participants should stay vigilant and adapt strategies based on evolving market dynamics in this area.

Conclusion: Will Housing Prices Drop in 2023?

The broader outlook from several housing analysts is that housing demand will continue to surge due to several factors. For e.g; the millennials have aged into their prime homebuying years, and they are now the fastest-growing segment of home buyers. In 2018, millennial homeownership was at a record low but the situation has changed markedly. They are no longer holding back when it comes to homeownership.

According to the 2023 Home Buyers and Sellers Generational Trends report from the National Association of Realtors, the demand for homes is increasing among baby boomers, who now make up the largest generation of homebuyers in the US, accounting for 39% of home buyers in 2022, up from 29% in 2021.

On the other hand, younger and older millennials’ combined share of homebuyers decreased from 43% in 2021 to 28% in 2022. Generation X made up 24% of total buyers, and Generation Z makes up 4% of homebuyers, with 30% of Gen Z moving directly from a family member’s home into homeownership.

Furthermore, buyers are now moving farther distances, with younger boomers moving the greatest distance at a median of 90 miles away. Additionally, all generations agreed that the most common reason to sell was to be closer to friends and family. Buyers expect to live in their homes for 15 years on average, up from 12 years in 2021.

Overall, the report suggests that demand for homes is growing among baby boomers and Generation Z while decreasing among younger and older millennials. Buyers are moving farther distances, with a desire to be closer to friends and family being the most common reason to sell. Buyers also view owning a home as a good investment, with a majority of buyers using a real estate agent to help with the purchase.

Hence, housing prices cannot drop drastically. Although the housing market appears to be cooling from 2023 through 2024, there are some bright spots. Economic forecasters, despite the recent recession, continue to expect robust demand from purchasers (millennials) and high home price increases in the housing market.

With homebuyers active and supply still lacking, the current trend of home prices will not see a major downfall. Despite a sluggish market and waning buyer enthusiasm, we anticipate that home demand will continue to outstrip available inventory. Increasing rental costs should add to this expected development.

However, as the number of available homes increases, the demand for housing should decrease owing to affordability concerns. As a result, we are not on the verge of a housing market crash. The rate of home price growth during the two years of the pandemic was unsustainable, and higher mortgage rates combined with increased inventory will result in slower home price growth but unlikely any big price decline.

Of course, these predictions are just that – predictions. The housing market can be unpredictable, and unforeseen factors can always come into play. However, these educated guesses can give us a general idea of what we can expect in the coming years. If you’re planning to buy or sell a home, it may be helpful to keep these predictions in mind as you make your plans.

As the US housing market moves forward in 2023, it will be interesting to see how the various factors impacting home prices unfold. The balance between supply and demand, affordability concerns, economic conditions, and policy changes will continue to shape the trajectory of home prices nationwide.

Whether you’re a potential homebuyer, seller, or industry observer, staying informed about the latest trends and forecasts can provide valuable insights into the US housing market. By understanding these dynamics, you can navigate the market more effectively and make informed decisions that align with your goals and aspirations.

Sources:

- https://www.zillow.com/research/data/

- https://www.fhfa.gov/AboutUs/reportsplans/Pages/FHFA-Reports.aspx

- https://www.noradarealestate.com/blog/housing-market-predictions/

- https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

- https://www.zillow.com/resources/stay-informed/housing-market-predictions-2023/

- https://www.corelogic.com/intelligence/u-s-home-price-insights-march-2023/

- https://realestate.usnews.com/real-estate/housing-market-index/articles/housing-market-predictions-for-the-next-5-years

- https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/

- https://www.nar.realtor/newsroom/baby-boomers-overtake-millennials-as-largest-generation-of-home-buyers