The year 2023 has been marked by a series of bank failures, leaving many to wonder what the impact of these failures will be on the housing market and the wider economy. Bank failures have been a common occurrence throughout history, often causing ripples throughout the economy. The housing market, in particular, is vulnerable to the effects of bank failures.

The 2008 financial crisis, which saw a large number of banks fail, is still fresh in the minds of many homeowners and investors. The collapse of banks can have a significant impact on the housing market. One of the primary ways that banks influence the housing market is through their role in real estate lending.

Banks provide loans to individuals and businesses for property purchases, which fuels the housing market. When banks fail, there is often a reduction in lending, which can slow down the housing market. The impact of bank failures on the housing market can be seen in the 2008 financial crisis. Many banks failed, and there was a significant reduction in lending. This caused the housing market to crash, and many homeowners found themselves underwater on their mortgages. The resulting foreclosures caused a glut of homes on the market, further depressing prices.

ALSO READ: Which Banks Are in Danger of Failing or Collapse?

In addition to the housing market, bank failures can also have a broader impact on the economy. Banks are an essential part of the financial system, and when they fail, it can lead to a reduction in lending across the board. This can slow down business investment, which can lead to a recession. The failure of banks can also cause a loss of confidence in the financial system. When people lose faith in the banking system, they may withdraw their savings, causing a run on the bank. This can further exacerbate the bank’s financial problems and lead to more failures.

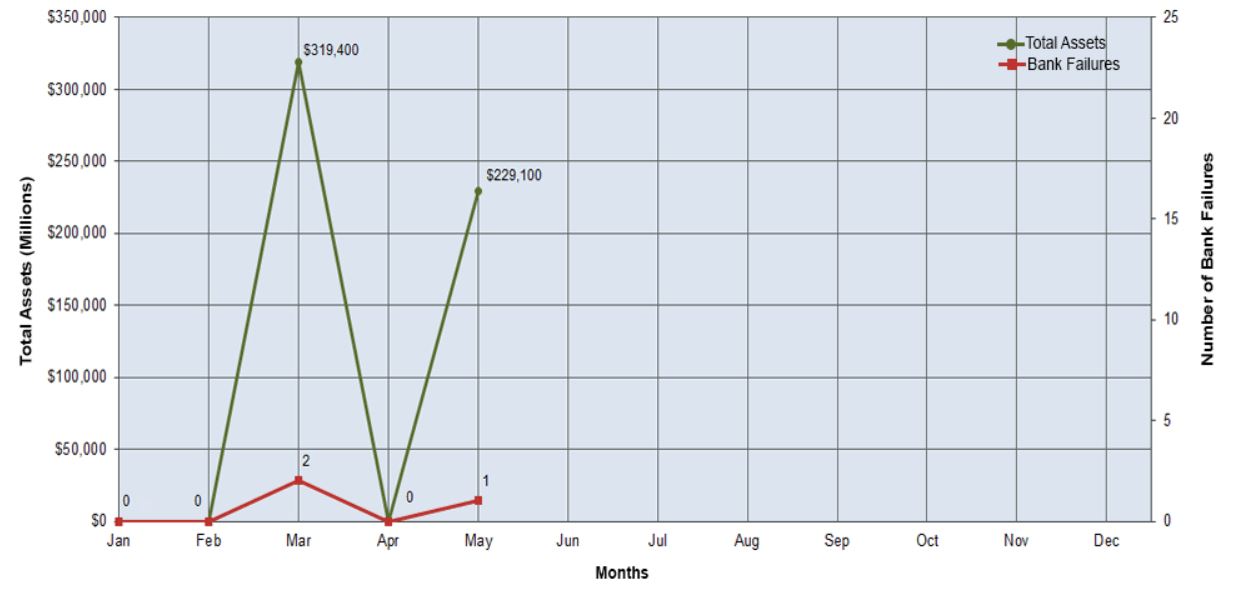

Bank Failures in 2023 – SVB, Signature Bank, First Republic Bank

The recent failures of banks such as Silicon Valley Bank (SVB) and Signature Bank may raise concerns about the stability of the real estate industry, particularly in terms of lending. However, it is important to note that these individual bank failures are unlikely to cause a widespread crash like the one that occurred in the 2008 financial crisis. The real estate industry has undergone significant changes and improvements in risk management and regulatory oversight since then, which have helped to mitigate the potential for large-scale collapse.

Two banks, Silicon Valley Bank (SVB) and Silvergate, collapsed for radically different reasons within 48 hours. Silvergate failed due to taking deposits and investing in cryptocurrencies. As cryptocurrency values fell, they didn’t have the liquidity to pay depositors as they withdrew their money. On the other hand, SVB invested in US Treasuries, which are considered a “safe asset”, but their maturities mismatched their deposits. SVB bought longer-term treasuries, leading to declining bond prices as yields rose.

Furthermore, as rates increased, speculative investments in startups declined, leading to young companies withdrawing funds for payroll/operating expenses. The SVB failure was a classic bank run where a few got nervous about SVB and rapidly withdrew their funds while SVB assets had declined due to rising yields and a lack of liquidity.

Both failures are classic errors that regulators should have caught. The regulators are always focusing on the last crisis rather than evaluating how much the economy has changed. Investing in cryptocurrencies should not have been allowed by an FDIC-insured bank as these are not “marketable securities”.

Furthermore, not catching a mismatch in the maturities of their assets is an elementary mistake in finance. Unfortunately, many more “failures” of banks and other financial institutions are expected to occur due to rising interest rates, which will lead to more stress in the economy and on financial institutions.

On the commercial side, look for a continued pullback in getting new deals closed. With cap rates rising, values are not matching rents yet. There will be a need for a rapid repricing of commercial assets that could put the next round of financial institutions under stress. Residential is not totally immune. As banks fail and/or get nervous, underwriting will continue increasing, making it harder to get a loan funded.

As the easy money over the last decade quickly comes to an end, things will begin “breaking” in the economy. The two recent failures are just the beginning and not isolated events. They are indicative of systematic risk in the financial system that has yet to be identified.

Signature Bank, a New York-based bank known for its involvement in the cryptocurrency industry also failed in 2023. Regulators shut down the bank on March 12, 2023, two days after the collapse of Silicon Valley Bank. The sudden failure was reportedly caused by a run on deposits after Signature Bank customers were spooked by the collapse of Silicon Valley Bank, which prompted panicked withdrawals totaling more than $10 billion.

The run on deposits was triggered by Signature Bank’s involvement in the cryptocurrency industry, which was also linked to the collapse of FTX in December 2022. Signature Bank’s involvement in cryptocurrency, which accounted for 15-20% of the bank’s deposits, was seen as a major contributing factor to its failure.

The bank had reportedly planned to shed as much as $10 billion in deposits from digital-asset clients to reduce its exposure to the volatile cryptocurrency market. However, the collapse of Silicon Valley Bank and the subsequent run-on deposits made it impossible for Signature Bank to continue operating.

Signature Bank’s failure was the third-largest bank failure in U.S. history, with nominal assets at the time of failure of $210 billion. The collapse of Signature Bank and Silicon Valley Bank has raised concerns about the stability of the banking system and the impact of bank failures on the housing market and other sectors of the economy.

In terms of the impact on the real estate industry, the failure of these banks has had a limited effect, as the real estate market is not directly tied to the cryptocurrency market. However, there are some indirect impacts that are worth considering.

One potential impact is on the availability of financing for real estate transactions. SVB and Silvergate were both lenders that provided financing to many businesses, including those in the real estate industry. With their failures, there is now less lending capacity in the market, which could make it harder for some real estate developers and investors to secure financing.

However, this is unlikely to lead to a crash in the real estate market. The real estate market is a large and diverse market, with many different types of buyers, sellers, and investors. While the availability of financing can have an impact on certain segments of the market, it is unlikely to cause a widespread collapse.

Furthermore, the failure of SVB, Silvergate, and Signature is not indicative of a broader trend in the banking industry. While some banks may have exposure to the cryptocurrency market, most banks are well-capitalized and well-regulated and are not at risk of failure.

There are several reasons why the recent events, such as the failures of Silicon Valley Bank and Silvergate, are unlikely to cause a crash like the one that occurred in the 2008 financial crisis.

Firstly, the current real estate market is fundamentally different from the market in 2008. Prior to the 2008 crash, there was an oversupply of homes and an increasing number of homeowners who were unable to make their mortgage payments. This led to a large number of foreclosures, which further exacerbated the oversupply issue.

Today, the market is characterized by a shortage of homes, which has resulted in increasing prices and competition among buyers. Additionally, mortgage lending standards have become stricter since the financial crisis, which has resulted in fewer risky loans being issued.

Secondly, the financial system has also undergone significant reforms since the 2008 crisis. Regulators have implemented new rules and regulations that have made the banking system more resilient and less prone to collapse. For example, banks are now required to hold more capital as a cushion against potential losses, and the Federal Reserve has established mechanisms to provide liquidity to the market during times of stress.

Lastly, recent events, such as the failures of Silicon Valley Bank and Silvergate, are relatively isolated incidents that are unlikely to have a significant impact on the broader real estate market. While these events may result in some short-term disruptions or market volatility, they are unlikely to trigger a broader collapse.

Overall, while there are always risks and uncertainties in any market, the current real estate market is fundamentally different from the market that existed prior to the 2008 financial crisis, and the financial system has become more resilient and better equipped to weather potential shocks. Therefore, it is unlikely that the recent events, such as the failures of Silicon Valley Bank and Silvergate, will cause a crash like the one that occurred in 2008.

Recent First Republic Bank Failure in May 2023

First Republic Bank, which catered to a wealthy clientele and grew rapidly through deposits, has become the second large regional bank with assets over $200 billion to fail in just a few weeks, following Silicon Valley Bank. What caused First Republic Bank to fail? According to analysts, the bank’s business model left it susceptible to a sudden rise in interest rates, which eroded the value of its large loans, including jumbo mortgages and led to withdrawals of deposits from fearful clients.

As a result, the bank had to sell off unprofitable assets and lay off up to a quarter of its workforce, but these measures were seen as too little, too late. Eventually, the bank had to be seized by the government and sold to JPMorgan Chase, with its stockholders wiped out.

While the depositors are protected by the FDIC’s insurance fund, which could take a $13 billion estimated loss as a result of First Republic’s failure, the stockholders are at the very end of the line and are likely to lose their investments. This outcome was deemed acceptable by President Joe Biden, who noted that taxpayers were not on the hook for the bank seizure. However, for those who invested in First Republic Bank, the collapse is a painful reminder of the risks and uncertainties of the financial market.

A Sunday bank failure is an extremely rare occurrence. Signature Bank failed on Sunday, marking only the sixth time a Federal Deposit Insurance Corp. (FDIC) bank failed on a Sunday, according to Bankrate’s analysis of FDIC data. It was also the first Sunday bank failure since 1991.

First Republic Bank, a regional bank with assets over $200 billion, recently failed, becoming the second large regional bank to do so in just a few weeks. The bank, which catered to a wealthy clientele, grew deposits rapidly but was susceptible to a sudden rise in interest rates.

After the collapse of Silicon Valley Bank and Signature Bank, investors have been wondering who’s next. In this blog post, we will discuss the collapse of First Republic Bank, its causes, and what the future might hold for other banks.

| Failed banks | Date closed |

|---|---|

| First Republic Bank | 05/01/2023 |

| Signature Bank, New York | 03/12/2023 |

| Silicon Valley Bank, Santa Clara, Calif. | 03/10/2023 |

| Failed banks | Date closed |

|---|---|

| Almena State Bank, Almena, Kan. | 10/23/2020 |

| First City Bank of Florida, Fort Walton Beach, Fla. | 10/16/2020 |

| The First State Bank, Barboursville, W.Va. | 04/03/2020 |

| Ericson State Bank, Ericson, Neb. | 02/14/2020 |

| Failed banks | Date closed |

|---|---|

| City National Bank of New Jersey, Newark | 11/1/2019 |

| Resolute Bank, Maumee, Ohio | 10/25/2019 |

| Louisa Community Bank, Louisa, Ky. | 10/25/2019 |

| The Enloe State Bank, Cooper, Texas | 05/31/2019 |

Impact of Bank Collapse on the Housing Market

The recent failures of Silicon Valley Bank, Silvergate, and Signature Bank have raised concerns about the stability of the real estate industry, particularly in terms of lending. While individual bank failures are unlikely to cause a widespread crash, they can have a significant impact on the housing market, and the wider economy.

One of the primary ways that banks influence the housing market is through their role in real estate lending. Banks provide loans to individuals and businesses for property purchases, which fuels the housing market. When banks fail, there is often a reduction in lending, which can slow down the housing market.

The collapse of banks can also have a broader impact on the economy. Banks are an essential part of the financial system, and when they fail, it can lead to a reduction in lending across the board. This can slow down business investment, which can lead to a recession. The failure of banks can also cause a loss of confidence in the financial system. When people lose faith in the banking system, they may withdraw their savings, causing a run on the bank. This can further exacerbate the bank’s financial problems and lead to more failures.

The failures of Silicon Valley Bank and Silvergate were due to different reasons. Silvergate failed due to taking deposits and investing in cryptocurrencies, and SVB invested in US Treasuries with maturities that mismatched their deposits. The failures of these banks were avoidable, and regulators should have caught them. Unfortunately, many more “failures” of banks and other financial institutions are expected to occur due to rising interest rates, which will lead to more stress in the economy and on financial institutions.

Signature Bank’s involvement in the cryptocurrency industry, which accounted for 15-20% of the bank’s deposits, was seen as a major contributing factor to its failure. Signature Bank’s collapse and Silicon Valley Bank’s failure raised concerns about the stability of the banking system, which could lead to a loss of confidence in the system.

The impact of bank failures on the housing market can be seen in the 2008 financial crisis. Many banks failed, and there was a significant reduction in lending. This caused the housing market to crash, and many homeowners found themselves underwater on their mortgages. The resulting foreclosures caused a glut of homes on the market, further depressing prices. As the easy money over the last decade quickly comes to an end, things will begin “breaking” in the economy. The recent failures are just the beginning and not isolated events. They are indicative of systematic risk in the financial system that has yet to be identified.

Therefore, bank failures can have a significant impact on the housing market and the wider economy. The failures of Silicon Valley Bank, Silvergate, and Signature Bank have raised concerns about the stability of the banking system and could lead to a loss of confidence in the system. It is essential that regulators identify and address systematic risks in the financial system to avoid future bank failures and prevent the adverse effects they can have on the economy.