In recent research, we wanted to examine how various asset classes have performed during periods of controlled inflation.

This analysis becomes particularly relevant in light of the Federal Reserve’s recent decision to cut interest rates by 50 basis points in September. The move was driven by easing inflation and a desire to foster maximum employment at a time when the unemployment rate was climbing.

The Federal Reserve targets a Personal Consumption Expenditures inflation range of 1.5% to 2.5% (2% target “midpoint”). In our analysis, we observed an approximate difference of 0.4 percentage points between the average Consumer Price Index and the PCE.

Since July 1996, the Fed has informally used this 2% marker to determine whether inflation was under control. As such, we exported CPI data from YCharts from July 31, 1996, to the present to identify periods where the forward 12-month average CPI fell within the 1.9% to 2.9% range—effectively aligning with the Fed’s 1.5%-2.5% PCE target range.

The analysis also included two-month “transition” periods when the CPI initially exceeded 2.9%, fell below this threshold the following month, and then maintained an average CPI within the target range for the subsequent year.

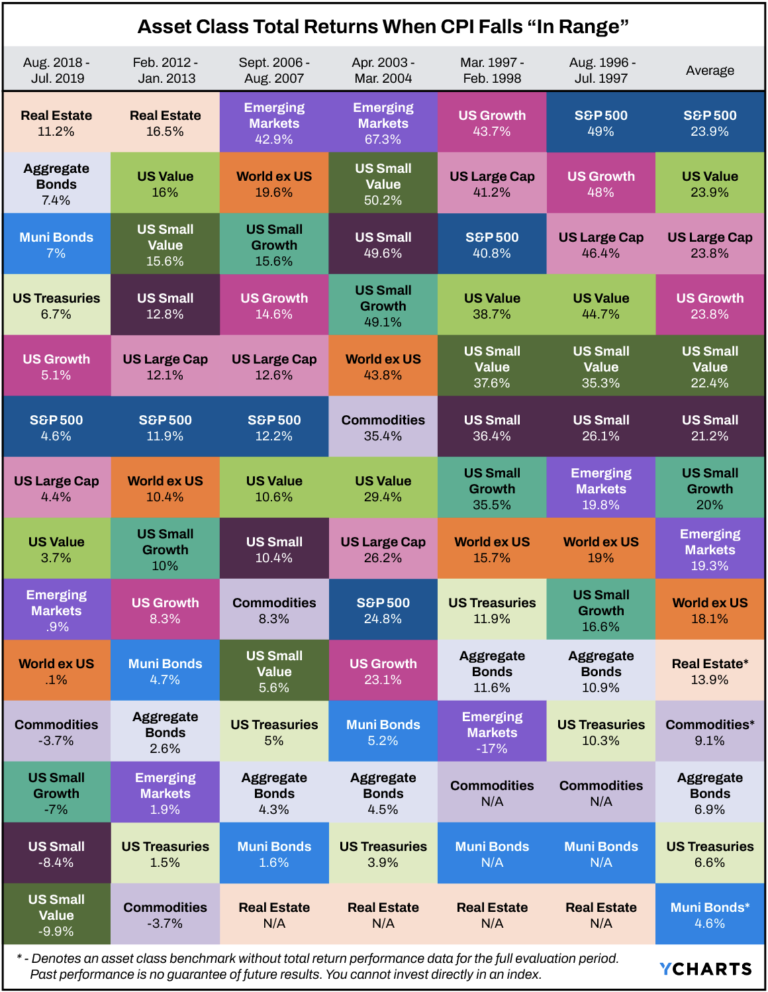

This approach revealed six periods where the CPI was “in range” and sustained for a year. These periods included August 2018 – July 2019, February 2012—January 2013, September 2006—August 2007, April 2003—March 2004, March 1997—February 1998, August 1996 – July 1997.

The findings demonstrate that controlled inflation over a year tends to mean good things for portfolios. Equities, in particular, have historically shown robust performance during these intervals of stable inflation. Specifically, the S&P 500 stood out with the highest average return at 23.88%, closely followed by large cap value stocks at 23.85%. The Russell 1000 rounded out the top three with returns of 23.82%, with large cap growth stocks not far behind, delivering an average return of 23.8%.

If the Fed’s latest cut was an insurance cut and price stability is sustained, historically, that tends to lead to positive returns across the portfolio.

Jerome Taylor is a senior marketing analyst at YCharts