In the world of advisor technology, there is tremendous diversity and increasingly, a solution for almost any need. That’s partially why many advisors make the decision to go independent—for access to tools that better align with their practices and client needs.

If you think of that world as a spectrum, one extreme would be what you see at a wirehouse; a highly integr ated tech environment but limited in choice. On the opposite end, a firm stitches together a fragmented techstack from various vendors and software providers.

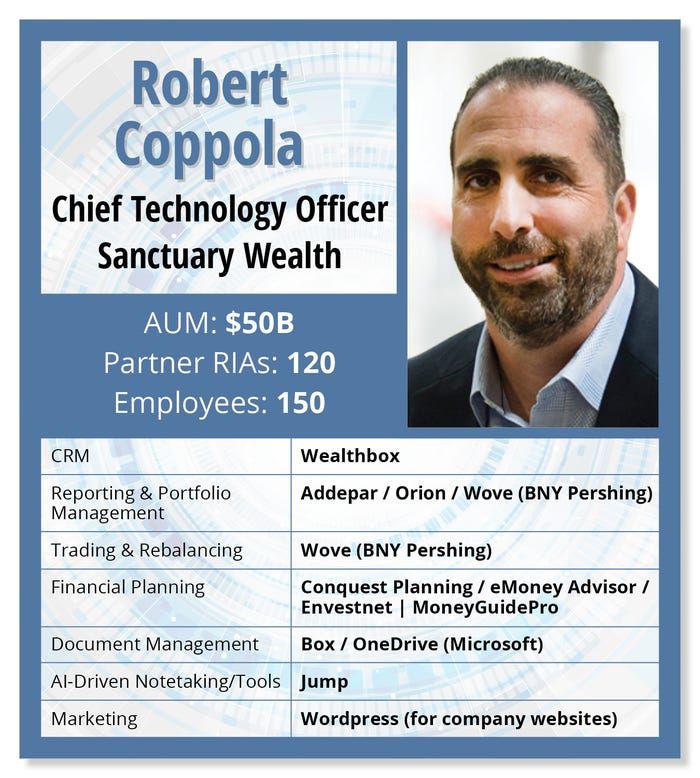

At Sanctuary, we start with what we call Sanctuary One, a proprietary solution that we offer to our partner firms. (Sanctuary has some 120 partner firms, and 495 licensed professionals overseeing $48 billion on the platform). Sanctuary One is made up of a number of intentionally pre-integrated solutions in various areas, with the knowledge that one size doesn’t cover everything. We have about 125-plus fintech wealth and practice management tools that are add-ons to Sanctuary One, and that list constantly grows.

With our shared ADV model, we try to provide a significant amount of integration in the most important areas of the tool set, like planning, CRM, managed account, trading and rebalancing, custodial selection, billing, wealth reporting, compliance and risk management, and an investor portal. And then we complement that with some other add-ons that are substantially integrated.

CRM: Wealthbox

We selected Wealthbox based on a number of factors, including the flexibility, number of integration options, and a strategic partnership that we have been able to establish and grow. We work very closely with Wealthbox and have initiated a number of initiatives with them to create a better experience for our advisors working with them.

Reporting & Portfolio Management: Addepar / Orion / Wove (BNY Pershing)

Sanctuary One leverages the Wove operating system. We’re an early adopter of the multi-custodial version of Wove, leveraging that for a good chunk of what I just described.

Then we have some additional things that we’ve done where we use a vendor called Dispatch for digital account opening for not only Pershing, but also for Schwab and for other custodians to make that process easier for our advisors. We cater to multi-custodial needs.

For some of the real-time market data, we use iCapital for some offerings. We use Subscribe for alternative investments. We’re highly integrated with Office, or M365, Zoom, and Telepathy. So everybody gets those, and then you can add from there.

Financial Planning: Conquest Planning / eMoney Advisor / Envestnet | MoneyGuide Pro

Money Guide Pro and eMoney are by far the biggest footprint in the space, and they have a lot of pieces and functionality.

Conquest is an up-and-comer and is doing some interesting things, and it’s a strategic partner from a wealth standpoint.

We have half a dozen other niche players that we work with to address very specific things like tax planning or other more nuanced strategic planning activities. This doesn’t mean that eMoney and MoneyGuide Pro offers aren’t sufficient for most. But there are some things that are evolving in the space. But it’s the typical story—it’s a fragmented space right now.

AI-Driven Notetaking/Tools: Jump

We’re leaning cautiously into the application of AI to help make our people more effective and efficient. Our current focus, where we’re burning most of the calories, is in the middle to back office to help everybody scale.

We use Jump AI in the meeting recording, transcription, and meeting preparation space. We see a lot of value and a huge uptick with our advisor community in a very short period.

We all know that in 10 years, there’s going to be fewer advisors and more investors. We know the average number of accounts and households per advisor is going to constantly go up. And you have what everybody’s been talking about for decades now: fee compression. Which advisors combat by expanding services.

Marketing: WordPress

We use this tool in the context of the marketing sites we host and maintain for our partner firms. We also provide a hardened WordPress environment for them to provide a safe, flexible, and cost-effective solution to the their online presence. We also provide a range of additional tools in the marketing space, including lead generation, SEO, marketing automation, and compliance.

Selection Process

If an advisor brings up an idea, we take it very seriously and do the due diligence. Most of the time, we can say, “Yes, that makes sense.” But every once in a while, we’ll look and say, “This doesn’t make sense for the following reasons, and here’s a better solution for you.”

For example, we’ve had fairly young startups that didn’t have their act together from a security standpoint. Or, I’ve had scenarios where the vendor wanted an enterprise deal. But we didn’t have enough interest to do one and it didn’t make commercial sense.

Then there’s always that piece that can come into play where we get our subject matter experts together and we look at it and say, “hey, this one just doesn’t cover as much as one of the other things that’s already an alternative.” For the most part, when we are saying no, it’s with the advisor in agreement.

Behavioral Finance Potential

I think behavioral finance goals are another place that we’re starting to lean into, and that I think are interesting. Particularly in terms of figuring out how good of a job the advisor is doing communicating to customers and things like that to help advise and provide insights.

I think it’s coming in more from the startup space. There are firms out there that have been around for a long time, from the practice management side. What we’re starting to see are AI-based behavioral finance tools that are starting to get a bit of a foothold.

As told to senior reporter Alex Ortolani and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Alex Ortolani at [email protected].