Key takeaways

- Nationally, listings with the phrase “priced to sell” or something similar in the description come with an average discount of 8.5%, or just under $38,000 off the median-priced home.

- The discount ranges from 23.1% in Little Rock, AR, to just 3.2% in Orlando, FL, across the 38 markets where there is a statistically meaningful discount.

- The share of listings with “priced to sell” in the description ranges from just 1.9% on Long Island, NY, to 6.7% in Sarasota, FL.

- Metros with a higher share of “priced to sell” homes on the market tend to have smaller discounts compared wit metros with a lower share, likely reflecting the need of sellers to offer a discount when other “priced to sell” homes are rare.

Nationally, value phrases are worth an 8.5% discount

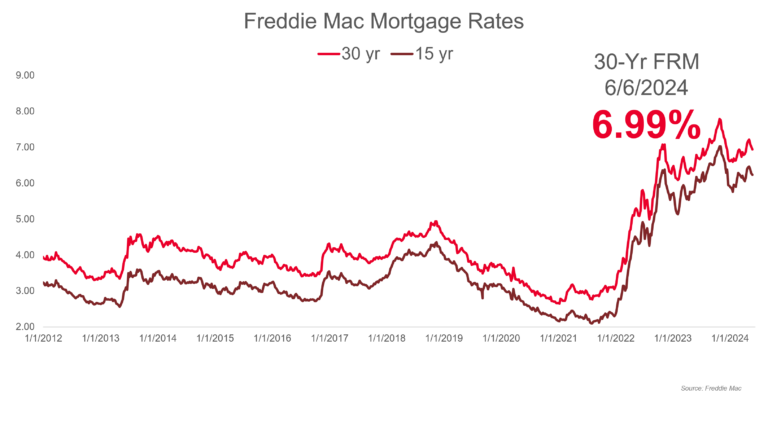

Homebuyers wanting to spend less on a home this fall have more than just falling mortgage rates to look forward to. That’s because we’ve found that certain “value”-based words used in listing descriptions are correlated with lower listing prices—and can be used to help homebuyers find true bargain properties.

At the national level, phrases such as “priced to sell,” “under valued,” “under priced,” and “bargain” are associated with listing prices that are 8.5% lower than similar homes with similar configurations in similar neighborhoods. What’s more, we’ve found substantial regional variation in the discount associated with such phrases as well as the density of listings with them, and that much of this variation can be explained by the share of listings with such listing terms. This suggests that buyers in markets with few listings that are “priced to sell” might be more sensitive to the characteristics that are associated with a lower than usual listing price, such as home condition, than buyers in markets where such listings are more common.

Discounts are largest in the South and East, smallest in Florida and the Southwest

Homebuyers in Southern and Midwestern markets can expect the largest discounts on properties with “priced to sell” in their listing description. Little Rock, AR, St. Louis, MO, and Charleston, SC, lead the pack, where, on average, bargain properties come with a 23.0%, 18.7%, and 15.9% discount, respectively.

On the median-priced home in these markets, this translates to a $57,494 discount in Little Rock, $49,476 in St. Louis, and $79,558 in Charleston. Memphis, TN, and Kenosha, WI, round out the top five, with discounts of 14.5% ($43,262) and 12.6% ($50,464), respectively.

Markets with the smallest discounts are almost exclusively in Florida and the U.S. West. Orlando, FL, Seattle, WA, and Salt Lake City, UT, come to the bottom of the list, where bargain properties will get you just a 3.2%, 3.7%, and 3.8% discount, respectively.

On the median-priced home, this translates to a discount of $13,497 in Orlando, $29,804 in Seattle, and $21,458 in Salt Lake City. Rounding out the bottom five are Austin, TX, and Denver, CO, with discounts of 4.0% ($20,200) and 4.3% ($26,125), respectively.

Fewer ‘priced to sell’ properties in your market? Expect larger discounts

In addition to the regional differences we find above, we also find a strong correlation between the share of listings in a market and the size of the discount offered by sellers of properties that are “priced to sell.” Why would fewer listings that are “priced to sell” be correlated with larger discounts? We can’t say definitively why there’s a correlation, but it likely has to do with what buyers are used to in a particular market.

For example, let’s compare two markets in the U.S., one with a large share of listings that are “priced to sell” and the other with a smaller share. On the one hand, markets like Long Island, NY, have just 1.9% of listings with such terms, and discounts are relatively large at 12.5%. Buyers on Long Island encounter such listings on a much less frequent basis than markets with a higher share, such as Sarasota, FL (6.7% of listings and just a 4.4% discount), and thus might expect a higher discount if such terms accurately represent characteristics of the property that would warrant a discount in the first place.

To put it more simply, if a lot of listings were priced to sell, then buyers might not expect a discount or might not be able to tease out whether those listings are actually priced to sell. In this case, the observed discount would be lower than if buyers can easily compare a “priced to sell” home with many other homes that aren’t.

Last, it could also be that the share of listings with such terms is correlated with market variation in property condition. With smaller variations may come the need for buyers to receive a greater discount because most other properties are in better condition. With larger variations, there may not be as much of a need because lower-than-average quality listings may be more accepted by buyers.

For example, consider a buyer in Phoenix, AZ, which has a lot of new or recently built homes. A property that is in less than average condition may need to be priced lower, with all else being equal, in order for that buyer to consider buying the property because there are a lot of other average or above-average quality homes on the market.

On the other hand, buyers in Washington, DC, may be accustomed to seeing homes in a variety of conditions and thus don’t require as large of a discount for buyers to be attracted to them.

Methodology

To determine whether for-sale listings being described as “priced to sell” are actually discounted, we tested whether there is an effect on listing prices with this and similar phrases using a hedonic pricing model. First, we looked at all the single-family homes listed for sale on Realtor.com in the U.S. on Aug. 10, 2024, and identified which ones were described with the words “priced to sell,” “bargain,” “under valued,” “fixer upper,” “contractor special,” “handyman special,” and “under priced.”

We then estimated a hedonic model to determine the effect of the bargain term on the home’s listing price while controlling for the number of bedrooms, number of bathrooms, square footage, lot size, age, and ZIP code of each property. This allowed us to estimate how much of a discount properties with such terms were listed for, on average, than similar properties within the same metro without a bargain term. We used a 5% level for statistical significance for interpreting the listing term coefficient.

Only metros where the listing term coefficient was significant were considered true “priced to sell” markets. Among the 100 largest U.S. metros that we examined, just 38 made the cut. We then calculated the average listing price discount for each of these metros. For demonstrative purposes, we use the median listing price from Aug. 10, 2024, to show, on average, the discount in dollars on the median-priced home.