What were the employment trends in March?

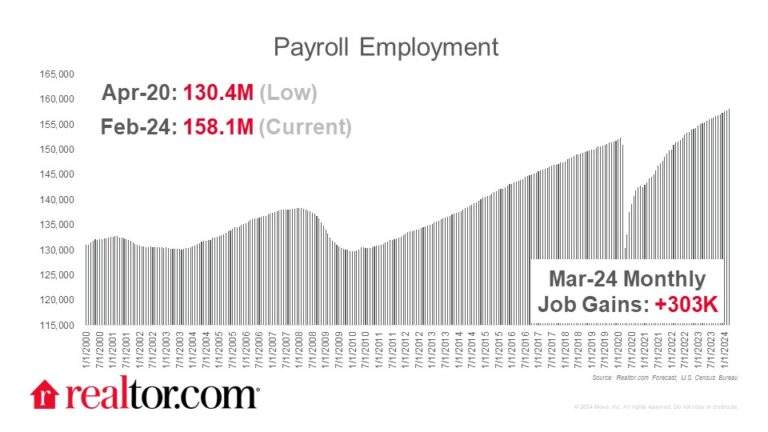

The March jobs report came in stronger than expected, improving on February’s slightly downwardly revised level. The U.S. added 303,000 jobs in March, outpacing February’s rate of 270,000 jobs, and coming in significantly higher than the average 231,000 monthly job additions over the previous 12 months.

March’s job gains were most notably in the health care (+72,000), government (+71,000), and construction (+39,000) sectors. The unemployment rate fell slightly to 3.8%. The unemployment rate has hovered between 3.7% and 3.9% since August 2023. This month’s data points to a robust and strong labor market.

What else do we know about today’s job market?

Other recent job market data showed that job openings remained steady at 8.8 million jobs in February, down from 9.8 million openings one year prior. The job openings rate was steady at 5.3% for the third month in a row.

Job quits also held steady in the month at 3.5 million and a rate of 2.2% for the fourth consecutive month. March jobs data followed suit and showed a strong labor market.

What does today’s data mean for the monetary policy?

The March jobs data and upcoming inflation data will be important inputs for the FOMC ahead of the committee’s May interest rate decision. For now, the market expects the first interest rate cut to come in the June meeting, but unexpectedly hot or cool economic data in the coming month could alter the expected timeline.

This month’s hotter-than-expected jobs growth could adjust rate-cut expectations, especially if March inflation data comes in on the high side.

What does today’s data mean for homebuyers and sellers and the housing market?

Average hourly earnings increased 4.1% annually in March, outpacing the most recent inflation level of 3.2%, meaning consumers have seen their spending power improve. However, shelter costs outpaced wage growth, growing 5.4% in February.

The housing market is eager to see mortgage rates ease as rates have spent nearly a year above 6.5%, and have most recently been hovering above 6.7%. However, mortgage rate relief is dependent on falling inflation and cooling employment growth. Though mortgage rates will likely ease by the end of the year, housing will remain relatively expensive and present a challenge to many buyers. Nevertheless, falling mortgage rates can also help ignite seller activity, which would relieve some of the upward pressure on home prices.

Subscribe to our mailing list to receive updates on the latest data and research.