What were the employment trends in April?

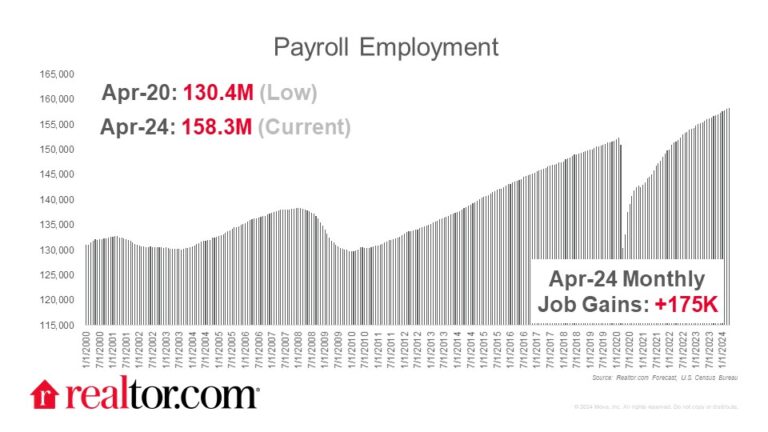

The April jobs report came in at a healthy level, but much more in line with the cooling that the Fed is looking for, consistent with the idea that their monetary policy is working to rein in economic growth and ease inflation. The U.S. added 175,000 jobs in April, a notable step down from the March addition of 315,000 jobs (an upward revision from the 303,000 originally published), and also lower than the average 242,000 monthly job additions over the previous 12 months.

April job gains were most notable in the health care (+56,000), social assistance (+31,000), and transportation & warehousing (+22,000) sectors. The unemployment rate ticked up slightly, to 3.9%. The unemployment rate has hovered between 3.7% and 3.9% since August 2023, in line with an economy at or above full employment. This month’s data shows that the labor market remains relatively healthy, even as it indicates that momentum is slowing, falling more in line with what is expected at this point in the monetary policy cycle.

What else do we know about today’s job market?

Other recent job market data showed that job openings eased somewhat further in March to 8.5 million, down from 8.8 million in February and 9.6 million openings one year prior. The job openings rate also dipped, to 5.1% following several months at 5.3%.

Job quits slipped somewhat to 3.3 million from 3.5 million the prior month, and the rate dropped to 2.1% after several consecutive 2.2% readings. These changes are not statistically significant, but they are directionally what is needed–signaling a still healthy, but cooling, labor market.

What does today’s data mean for earnings?

Average hourly earnings increased 3.9% annually in April, down from recent readings, but still enough to outpace the most recent inflation level of 3.5% and boost actual consumer buying power. However, measured shelter inflation outpaced wage growth, growing 5.7% in March, and the cost of buying the typical home for sale rose 6.9% in April according to Realtor.com data, bringing the income required to finance the purchase to $116,000.

What does today’s data mean for homebuyers and sellers and the housing market?

With mortgage rates continuing above 7%, buyers and sellers are again feeling the pinch of higher homebuying costs. Today’s cooler labor market data is a sign that mortgage rate relief could be on the horizon, but that will be dependent on inflation. In the May Fed meeting earlier this week, Chair Powell noted that the risks to the economy have moved into better balance, which means that the Fed is closer to achieving both the inflation component and the full employment component of its dual mandate. However, because inflation is further off-target it likely remains the chief concern. As a result, improvement in inflation is the key we need to see in order to get lasting mortgage rate relief.

Today’s job market data suggests that slower price growth may be on the horizon, but we’ll know for sure when the CPI data is released in mid-May. For now, homebuyers and sellers are likely to see a cooler spring, with fewer transactions, as mortgage rates hold back some households from acting on housing plans, but we may see an unseasonably active summer and fall if inflation improves and mortgage rates drop, as I’m currently anticipating

Subscribe to our mailing list to receive updates on the latest data and research.