What were the employment trends in June?

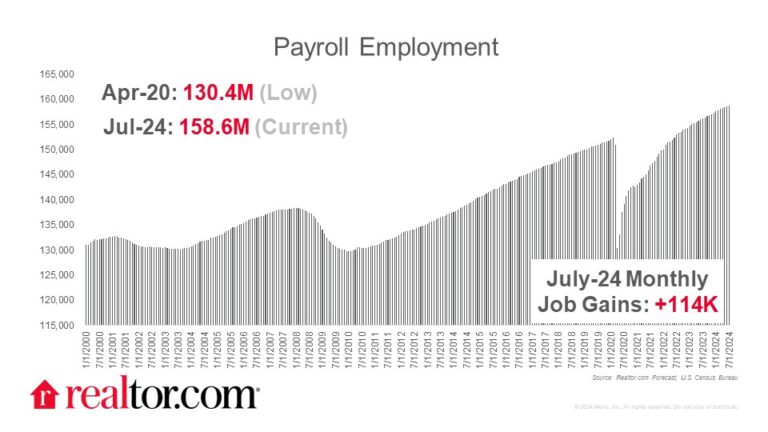

The July jobs report showed a significant slowdown in payroll growth with 114,000 job additions, well below the previous 12-months’ average gain of 215,000 jobs, and below June’s downwardly revised rate of 179,000 job additions. The unemployment rate grew for the fourth month in a row, reaching 4.3% in July, up 0.2 percentage points from June’s level and 0.8 percentage points higher than in July 2023. Employment trended higher in health care, construction, and in transportation and warehousing. The job market has slackened in recent months, inspiring confidence that the Fed’s contractionary policy is having the intended effect. In this week’s FOMC meeting, Chair Powell emphasized the committee’s commitment to achieving 2% inflation but acknowledged recent progress. It is too soon to tell whether a rate cut may be on the table in September’s meeting. The committee will continue to lean on incoming economic data and subsequent rate decisions will hinge on persistent cooling in both employment and inflation.

What else do we know about today’s job market?

Other recent job market data showed 8.2 million job openings in June, unchanged from an upwardly revised May reading, but still lower than the 9.1 million openings one year ago. The job openings rate held steady at 4.9%, but was down from 5.5% one year ago. Job quits, which reflect employees’ willingness to leave their job, were relatively unchanged in the month at 3.3 million, and the rate of 2.1% was relatively steady for an eighth month, and down from 2.4% in June 2023. The data show a somewhat elevated openings rate relative to pre-pandemic highs (4.8%), while the quits rate is on par with trends in 2017 and 2018. Together, these data suggest a still-robust labor market that offers job seekers enough options that workers may feel confident in leaving their job in search of a better opportunity.

What does this tell us about what’s ahead?

Mortgage rates fell to 6.73% this week, their lowest level since February, but remain in the 6.6%-7.2% range that they have occupied since November 2023. Because today’s job report showed a notable slowdown, it could result in further mortgage rate improvement. The uptick in unemployment could also help interest rates drift toward the lower end of the range.

What does today’s data mean for homebuyers, sellers, and the housing market?

Both buyers and sellers continue to weigh whether to get into the housing market as sticky home prices and high mortgage rates persist. As a result, the housing market eased in July, with stable prices, building inventory, and homes spending longer on the market than last year. However, the recent decline in mortgage rates may stoke market activity. Mortgage rates dropped to their lowest level in nearly six months this week. More significant mortgage rate progress will likely be necessary to see more dramatic shifts in the housing market as 86% of outstanding mortgage debt has a rate below 6%. Put differently, would-be buyers and sellers that currently hold a mortgage likely have a rate below today’s rate, and therefore may stay on the sidelines until mortgage rates fall further. Despite affordability challenges, the still-strong labor market means that workers are in a good position to make housing decisions.

Subscribe to our mailing list to receive updates on the latest data and research.