The U.S. housing market, despite some slowdown, remains a race for eager buyers keen on sealing property deals. A blend of soaring mortgage rates, historic lows in available homes, and determined buyers striving for homeownership has quickened homebuying across the nation.

The Rush to Beat the Competition

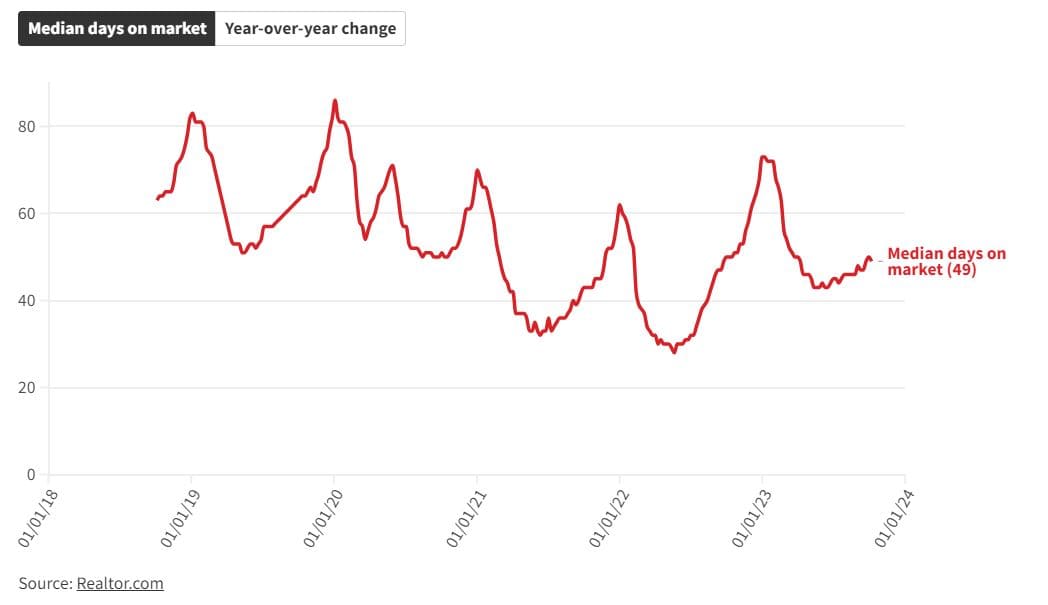

Nationally, the median home listing is spending 49 days on the market as of the first week of October, as per a comprehensive analysis by Realtor.com. This is only slightly less than the same period last year. However, specific regions are witnessing homes selling at a significantly accelerated pace compared to the previous year, where buyers lack the luxury of time, and sellers can expect swift transactions.

Eager Homebuyers in Diverse Markets

Realtor.com identified a mix of markets, spanning from the Northeast to the Southwest, where homes are changing hands swiftly. These include both affordable and high-priced markets, such as Buffalo, NY, and Oxnard, CA. Despite affordability challenges affecting demand, a pool of eager homebuyers is actively seeking opportunities despite the low inventory of available homes.

The Impact of Climbing Mortgage Rates

Climbing mortgage rates have stirred concerns among potential buyers and sellers. Despite this, appropriately priced homes in desirable locations continue to sell briskly. The uncertainty surrounding mortgage rates has urged buyers to act swiftly to secure homes and lock in rates before potential increases.

Top 10 Housing Markets Where Homes Are Selling Faster in 2023

1. Buffalo, NY: Leading the Speed Race

At the forefront of this trend is Buffalo, NY, where the median days on the market stand at 50. This represents a remarkable 13-day decrease from the previous year, indicating a surge in the housing market. Homebuyers in Buffalo are acting swiftly, fearing further rate hikes and aiming to secure a deal promptly.

Key Metrics for Buffalo, NY:

- Median list price: $239,900

- Median days on the market: 50

- Year-over-year change in median days: 13 days faster

With home prices considerably below the national average and tight inventory, the Buffalo market is witnessing a significant rise in demand.

2. Phoenix, AZ: A Hotspot for Homebuyers

Phoenix, despite enduring scorching desert temperatures for a significant part of the year, remains a hotbed for homebuyers. The metro has witnessed accelerated home sales, with properties selling almost two weeks faster than the previous year. Factors like minimal natural disasters and a robust real estate market contribute to this demand.

Key Metrics for Phoenix, AZ:

- Median list price: $475,000

- Median days on the market: 78

- Year-over-year change in median days: 13 days faster

Luxury homes are particularly in demand, selling faster than those below $1 million. Cash buyers dominate this segment, less affected by mortgage rate hikes, thereby keeping this part of the market active.

3. Oxnard, CA: Coastal Appeal and Rapid Sales

Situated along the Pacific coast, the Oxnard metro, including Thousand Oaks and Ventura, is known for its beautiful beaches and a thriving agricultural industry. Homes are selling swiftly, with a 7% increase in the median list price compared to the previous year.

Key Metrics for Oxnard, CA:

- Median list price: $875,000

- Median days on the market: 57

- Year-over-year change in median days: 11 days faster

Despite the higher median prices, the appeal of this coastal region attracts buyers seeking waterfront views and a pleasant lifestyle.

4. Boise, ID: A Market Rebounding

Boise, Idaho, known for its outdoor recreation and favorable climate, saw a surge in demand during the COVID-19 pandemic as urban residents sought a change. While rising interest rates caused a temporary slowdown, the market has rebounded.

Key Metrics for Boise, ID:

- Median list price: $519,900

- Median days on the market: 72

- Year-over-year change in median days: 9.5 days faster

The median home sale in this growing metro is almost 10 days faster than the previous year, reflecting a supply-demand imbalance and declining inventory, ultimately driving faster sales and rising prices.

5. Las Vegas, NV: Entertainment and Accelerated Sales

Las Vegas, a city known for its entertainment and low taxes, has long attracted retirees and individuals seeking an escape from harsh winters. Despite a history of real estate market fluctuations, Las Vegas is currently experiencing a surge in housing demand.

Key Metrics for Las Vegas, NV:

- Median list price: $449,999

- Median days on the market: 56

- Year-over-year change in median days: 9 days faster

After the housing crash of 2008 and a slowdown due to rising interest rates in 2022, the market has rebounded. Homes are now selling about a week faster than the national median, reflecting renewed demand and improved market conditions.

6. Bridgeport, CT: Affluent Living and Swift Sales

The Bridgeport metro, located near New York City, is renowned for its affluent living and attractive real estate market. Despite higher median prices, homes in this area are selling over a week faster than the previous year, indicating sustained demand amidst limited supply.

Key Metrics for Bridgeport, CT:

- Median list price: $795,000

- Median days on the market: 74

- Year-over-year change in median days: 8 days faster

Offering a mix of attractive properties, including four-bedroom homes, this metro remains appealing, especially with the rise of hybrid work models and increased flexibility.

7. Harrisburg, PA: Rapid Sales in Central Pennsylvania

Harrisburg, located in Central Pennsylvania, boasts the quickest average time-on-market among the listed places. The market here is fueled by limited inventory and high demand, resulting in homes being sold swiftly, attracting both buyers and sellers.

Key Metrics for Harrisburg, PA:

- Median list price: $309,900

- Median days on the market: 46

- Year-over-year change in median days: 8 days faster

The record low number of homes for sale in Harrisburg has intensified competition among buyers, making it an opportune time for sellers to list their properties and facilitate quicker sales.

8. Springfield, MA: Historical Charm and Affordable Homes

Springfield, located along the Connecticut River, is a city steeped in history, known as the “Birthplace of Basketball.” With a rich industrial heritage and the influence of the Springfield Armory, this city offers attractive home prices, about 25% below the national average.

Key Metrics for Springfield, MA:

- Median list price: $319,000

- Median days on the market: 53

- Year-over-year change in median days: 7 days faster

Despite rising mortgage rates, demand remains high due to these affordable home prices, making it an appealing option for potential buyers.

9. Cleveland, OH: Affordable Homes and Cultural Richness

Cleveland, situated against the southern shore of Lake Erie, is renowned for its affordability, making it the most budget-friendly metro on this list. The city offers a multitude of homes priced below $200,000, attracting a diverse range of buyers.

Key Metrics for Cleveland, OH:

- Median list price: $199,000

- Median days on the market: 48

- Year-over-year change in median days: 6 days faster

The city’s economic diversification and urban revitalization initiatives have bolstered demand, further fueled by the attractive pricing of properties.

10. Portland, ME: Coastal Charm and High Demand

Portland, known for its rugged coastline and vibrant food scene, attracts buyers seeking quality living in a picturesque setting. Despite prices approximately 25% higher than the national average, homes in Portland are selling faster than the previous year, indicating sustained demand.

Key Metrics for Portland, ME:

- Median list price: $549,900

- Median days on the market: 51

- Year-over-year change in median days: 6 days faster

With a range of housing options, including waterfront properties, Portland offers a lifestyle that continues to entice both primary residence and vacation home buyers.

Looking Ahead

“Buyers are thinking, ‘I need to make an offer either the day a home goes on the market or soon after, so I can get my home and lock in a rate before it goes up,’” says Matthew Roland, assistant dean at the University of Buffalo’s Department of Urban and Regional Planning. He hopes for potential rate decreases to bolster inventory in the coming months.