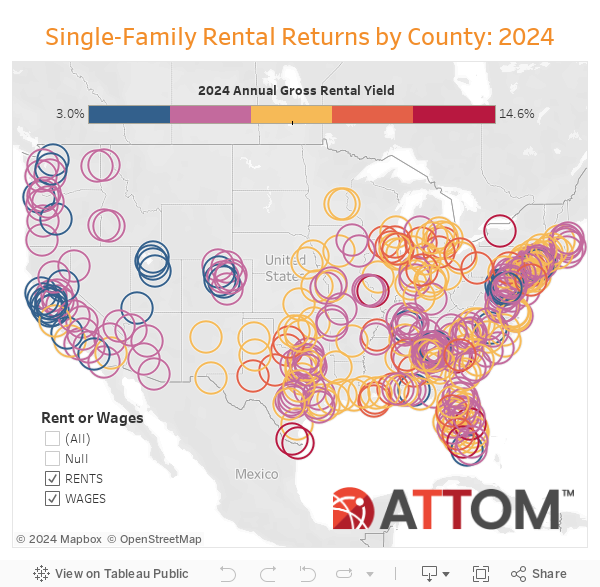

According to ATTOM Data’s latest Q1 2024 Single-Family Rental Market report, average gross rental yields on three-bedroom single-family homes are projected to rise by 7.55% this year. As ever, though, the devil is in the regional details. While some markets are offering landlords great rental margins—over 10% in some areas—others offer lackluster and/or declining returns.

Let’s dive a little deeper into which markets the report identifies as hot—and which ones should give investors pause, based on their projected 2024 performance.

The Midwest and South Lead Again

There’s no stopping the rise of the Midwest and South as top destinations for investors. The report data show that almost all the counties offering the highest potential gross annual rental yields are in these two regions. They include:

- Indian River County, Florida, in the Sebastian-Vero Beach metro area (14.6%)

- St. Louis City, Missouri (14.6%)

- Cameron County, Texas, in the Brownsville-Harlingen metro area (13.2%)

- Richmond County, Georgia, in the Augusta-Richmond County metro area (12.7%)

Larger metro areas (population over 1 million) are also concentrated in these regions. These metro areas include:

- Wayne County (Detroit), Michigan (12%)

- Allegheny County (Pittsburgh), Pennsylvania (11.2%)

- Cuyahoga County (Cleveland), Ohio (10.2%)

- Cook County (Chicago), Illinois (10.1%)

The exceptions are Monroe County, New York, in the Rochester metro area, where projected rental yields are 12.8%, and Riverside County, California (9.7%).

And what about the markets where rental yields are less than impressive for a three-bedroom rental? The vast majority of them are in California. They include:

- Santa Clara County, in the San Jose metro area (3%)

- San Mateo County, in the San Francisco metro area (3.4%)

- San Francisco County (3.9%)

- Alameda County (Oakland) (4.4%)

This contrast will surprise no one, given how expensive real estate prices are in the West. The rental yield looks so good in the Midwest and South because home prices there are still comparatively affordable, while rents are comparatively high and steadily rising.

What The Data Tell Investors

This data set offers useful direction for investors looking for hot rental markets. But, of course, it doesn’t let you off the hook in terms of doing thorough research on each property. Gross rental yields are a general indication of what’s possible in a given location—but they’re not a guarantee of high net rental yields. Property taxes, maintenance costs, and other expenses will vary greatly from state to state, county to county, and property to property.

In fact, a higher gross rental yield can represent a higher risk—for example, if the property value is low due to the home needing repairs or being in a less desirable neighborhood. A lower gross yield doesn’t always indicate a housing market in trouble. Sometimes, it can simply indicate a prosperous, in-demand neighborhood where both home values and rents reflect the demand.

If you’re a beginner investor, going for a more expensive property that doesn’t require repairs in a popular neighborhood may well be worth the smaller return. But if you have more of an appetite for risk, the high-yield zones identified in the ATTOM report are useful as a starting point for researching properties that have great rental investment potential.

Just bear in mind that in the vast majority of the high-yield counties identified in the report, rent growth is outpacing wage growth. Detroit and Chicago are notable exceptions. Investing in areas where wages are outpacing rent growth is less risky from the tenant retention point of view, as people are more likely to be able to afford their rents longer.

From this perspective, even investing in the San Francisco metro area is not such a bad idea. Yes, your profit will be modest, but wages are growing faster than rents in this area (7.2% wage growth versus 2% rent price growth in 2023). There’s no denying that right now, many Californian locations are less attractive as investment propositions than booming Midwestern and Southern cities. But the main culprit here is sky-high home sale values, not the rental market.

In fact, if we look at what the rental market is doing independently of home prices in some of the high-yield areas, things are looking more volatile. Rents declined 6% in Chicago’s Cook County and 4% in Detroit. Things are still looking excellent in these locations; we just don’t know how long they’ll stay that way with this trajectory.

Final Thoughts

Think of these options as choosing between the good-and-steady versus the great-though-riskier. Neither is necessarily superior—it all depends on how hands-on an investor you’re prepared to be and how much experience you already have in choosing the right opportunities.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.