Whether it’s refining your business model, mastering new technologies, or discovering strategies to capitalize on the next market surge, Inman Connect New York will prepare you to take bold steps forward. The Next Chapter is about to begin. Be part of it. Join us and thousands of real estate leaders Jan. 22-24, 2025.

Demand for homes remains above long-term averages, but scarce inventory means sales aren’t likely to pick up until mortgage rates move closer to 5 percent, analysts at Fitch Ratings said Thursday.

And because investors who fund most mortgages had already priced in Wednesday’s Fed rate cut, they may have to get less skittish about the risks involved in funding home loans if mortgage rates are to come down much more than they already have, Fitch analysts warned.

TAKE THE INMAN INTEL INDEX SURVEY FOR SEPTEMBER

“Housing demand, as measured by homes sold above list price and the average sale-to-list price, has softened since August 2023 but remains above long-term averages,” Fitch analysts said. “A further decline in mortgage rates will help improve affordability and support demand, but low inventory will likely constrain home sales until rates move closer to 5 percent.”

For those keeping close tabs on mortgage rates, this week’s highly anticipated Fed rate cut might have seemed anticlimactic.

After the central bank brought short-term interest rates down for the first time in 4 years — starting out what’s expected to be a protracted rate-cutting campaign with a dramatic 50 basis-point cut — rates for FHA and conforming mortgages actually went up a bit Wednesday.

One reason mortgage rates went up is that Fed policymakers had been telegraphing their intention to cut rates for months. Since hitting a 2024 high in April, rates on 30-year fixed-rate conforming mortgage rates had already come down by more than a percentage point this summer.

The monetary policy tools at the Fed’s disposal allow it to make precise adjustments to short-term interest rates, keeping the federal funds rate within a quarter percentage point of policymakers’ desired target.

But the central bank doesn’t have direct control over long-term interest rates like Treasury yields and mortgages, which are determined largely by supply and demand. If investors — who weigh factors including inflation expectations, economic growth and monetary policy — decide that it would be smart to buy government bonds and mortgage-backed securities, that can push long-term interest rates down.

When Fed Chair Jerome Powell was asked Wednesday how much he thought mortgage rates might drop over the next year, he suggested that he was the wrong person to ask.

Powell’s press conference

“It’s very hard for me to say,” Powell told Elizabeth Schulze of ABC News. “From our standpoint, I can’t really speak to mortgage rates. I will say … that’ll depend on how the economy evolves.”

Powell pointed Schulze to the Fed’s latest Summary of Economic Projections (SEP), which shows what Federal Reserve Board members and Federal Reserve Bank presidents expect to happen with growth, unemployment and inflation in the months and years ahead — and how they think short-term interest rates might need to be adjusted.

To fight inflation during the pandemic, Fed policymakers raised the federal funds rate 11 times between March 2022 and July 2023, bringing it to a target of between 5.25 and 5.5 percent — the highest level since 2001. Wednesday’s cut dropped the target to 4.75 to 5 percent.

The “SEP” — and its associated “dot plot” — show that the median expectation of Fed policymakers is that by the end of next year, the federal funds rate will be about 2 percent lower than it was before Wednesday’s rate cut.

“If things work out according to that forecast, other rates in the economy will come down as well,” Powell said. “However, the rate at which those things happen will really depend on how the economy performs. We can’t look a year ahead and know what the economy’s going to be doing.”

Fed cut priced in to mortgage rates

Rate-lock data tracked by Optimal Blue shows that rates on 30-year fixed-rate conforming mortgages hit a new 2024 low of 6.03 percent Tuesday, but bounced back 5 basis points after Wednesday’s Fed meeting.

A weekly survey of lenders by the Mortgage Bankers Association showed applications for purchase loans were up by a seasonally adjusted 5 percent last week when compared to week before, but slightly lower (0.4 percent) than a year ago. Requests to refinance were up 24 percent week over week and 127 percent from a year ago.

Demand for conventional purchase mortgages meeting Fannie Mae and Freddie Mac’s requirements is up from a year ago, as homebuyers are seeing improving affordability conditions, sparked by lower rates and slower home-price growth, MBA Deputy Chief Economist Joel Kan said, in a statement.

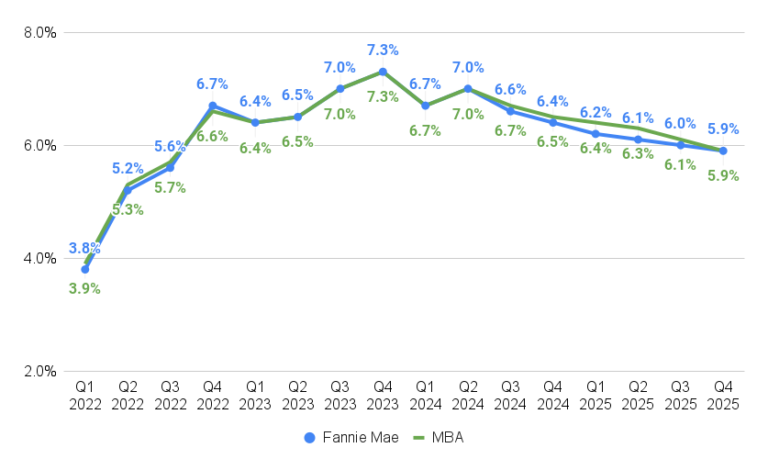

Rates on conforming mortgages have already come down more than a full percentage point from a 2024 high of 7.27 percent registered April 25 — nearly to where economists at Fannie Mae and the Mortgage Bankers Association (MBA) forecast in August they would be at the end of next year.

Mortgage rate forecast

Source: Fannie Mae and Mortgage Bankers Association forecasts, August 2024.

Taking an even longer view, analysts at Fitch Ratings said Thursday they expect 10-year Treasury yields, a barometer for mortgage rates, to still be at 3.5 percent at the end of 2026 — just a quarter percentage point lower than Thursday’s close of 3.74 percent.

In order for mortgage rates to come down more dramatically, the “spread” between 10-year Treasurys and 30-year mortgage rates will need to come down, Fitch analysts said.

The 30-10 spread — which Fitch calculates averaged 1.8 percentage points during the decade before the pandemic — widened to 3 percent at times last year.

Fed trimming its mortgage holdings

Investors have been demanding higher returns on mortgage-backed securities (MBS) due to “prepayment risk” — the fear that borrowers who take out loans when mortgage rates are elevated will refinance them when they drop.

In addition to prepayment risk, demand for MBS has weakened as the Fed trims its massive holdings of MBS and government debt — a process known as “quantitative tightening.”

As mortgage rates come down, so does prepayment risk. Fitch analysts think mortgage rates say the 30-10 spread has already narrowed to 2.6 percentage points this year, but that trend will probably have to continue to help get mortgage rates below 6 percent.

If the 10-year Treasury yield drops to 3.5 percent and the 30-10 spread returns to 1.8 percentage points, that would translate into 5.2 percent mortgage rates, Fitch analysts said.

In releasing their latest economic and housing forecasts in August, economists at Fannie Mae said it will take time for falling rates to translate into sales.

Part of the problem is that in addition to making homes less affordable to buyers, elevated mortgage rates have created a “lock-in effect” for would-be sellers who are reluctant to give up the low rate on their existing mortgage.

Asked whether lower mortgage rates might reignite demand for housing and push prices up, Powell said lower rates should also help generate more supply, by alleviating the lock-in effect and bringing more listings onto the market.

“The housing market is in part frozen because of lock-in with low rates,” Powell said. “People don’t want to sell their homes because they have a very low mortgage [rate and] it would be quite expensive to refinance. As rates come down people will start to move more, and that’s probably beginning to happen already.”

When that happens, “You’ve got a seller, but you’ve also got a new buyer in many cases,” Powell said. “So it’s not obvious how much additional demand that would make.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.