Introduction

Though the summer housing market is in full swing, buyer enthusiasm has been tempered by still-high housing costs. New, existing and pending home sales all fell in May as buyers remained on the sidelines, hoping for more affordable conditions later in the year. Mortgage rates ranged from 6.86% to 7.22% in the second quarter, which, coupled with high home prices, meant that home shoppers in many markets simply could not afford to participate. However, mortgage rates have since fallen to 6.77%, the lowest level since mid-March, upon June’s cooler jobs report and easing CPI data. Though mortgage rates have fallen more slowly than many had hoped, the recent trend is good news for hopeful homebuyers.

Seller activity continued to pick up through the second quarter, and active inventory grew 36.7% year-over-year in June, the eighth consecutive month of annual inventory growth. Moreover, affordable inventory surged 50% in the same period, driven by greater availability of smaller and more affordable homes in the South. Overall, affordable housing markets in the South, Midwest and Northeast continue to thrive in today’s housing environment. Buyer demand in these areas has kept inventory levels relatively low and time on market snappy.

Summer 2024 Housing Market Ranking

Today’s home shoppers are faced with still-scarce, though improving, home inventory, elevated home prices, and mortgage rates near 7%. Housing affordability has not improved substantially over the last year, even with rising inventory levels, which means it is still relatively challenging to purchase a home. The Wall Street Journal/Realtor.com Housing Market Ranking highlights housing markets that offer shoppers a lower cost of living, including for homes, and thriving local economies that are attractive, but not too crowded. This quarter’s top market is affordable, priced more than $100,000 lower than the national median in June. In fact, only five of the top 20 markets were priced higher than the U.S. median in June, underscoring the importance of affordability to today’s buyers. The ranking identifies markets that those considering a home purchase should add to their shortlist–whether the goal is to live in it or rent it as a home to others.

We reviewed data for the largest 200 metropolitan areas in the United States. The Summer 2024 ranking surfaced the following top areas:

| Rank | Metro | Population | Unemployment Rate (%) | Median Home Listing Price June 2024 |

| 1 | Fort Wayne, Ind. | Midwest | 3.3% | $335,000 |

| 2 | Canton-Massillon, Ohio | Midwest | 4.1% | $255,000 |

| 3 | Akron, Ohio | Midwest | 4.0% | $265,000 |

| 4 | Manchester-Nashua, N.H. | Northeast | 2.5% | $598,000 |

| 5 | South Bend-Mishawaka, Ind.-Mich | Midwest | 4.2% | $320,000 |

| 6 | Burlington-South Burlington, Vt. | Northeast | 1.7% | $559,000 |

| 7 | Kingsport-Bristol-Bristol, Tenn.-Va. | South | 3.2% | $325,000 |

| 8 | Rockford, Ill. | Midwest | 6.2% | $220,000 |

| 9 | Ann Arbor, Mich | Midwest | 3.2% | $545,000 |

| 10 | Appleton, Wis. | Midwest | 2.5% | $425,000 |

| 11 | Hickory-Lenoir-Morganton, N.C. | South | 3.5% | $375,000 |

| 12 | Columbus, Ohio | Midwest | 3.6% | $400,000 |

| 13 | Toledo, Ohio | Midwest | 4.4% | $275,000 |

| 14 | Kalamazoo-Portage, Mich | Midwest | 3.7% | $375,000 |

| 15 | Springfield, Mo. | Midwest | 2.9% | $345,000 |

| 16 | Roanoke, Va. | South | 2.7% | $380,000 |

| 17 | Worcester, Mass.-Conn. | Northeast | 3.5% | $550,000 |

| 18 | Dayton, Ohio | Midwest | 4.0% | $260,000 |

| 19 | Portland-South Portland, Maine | Northeast | 2.6% | $675,000 |

| 20 | Springfield, Mass. | Northeast | 3.8% | $412,000 |

The Midwest Boasts Climate-Resilient Housing Markets

Twelve of the top 20 housing markets are in the Midwest, a region that offers affordability and also tends to fare better in terms of climate risk. In last quarter’s ranking, we introduced climate data to the ranking parameters, leveraging data provided by First Street that is currently part of the Realtor.com experience. This data captures the share of properties in a given metro that are affected by severe or extreme exposure to any combination of 5 climate risks– extreme heat, wind, air quality, flood and wildfire– over the next 30 years. Nationwide, more than 2 in 5 homes confront at least severe or extreme exposure to at least one of these climate risks.

Areas in the Midwest tend to be less impacted by these risks, giving buyers some peace of mind when taking on a home purchase. In the top ranked market, Fort Wayne, Indiana, just 2.3% of properties are at severe or extreme risk of experiencing one of the 5 risks considered, over the next 30 years. The top 20 markets saw an average of just 4.7% of properties at risk of damage from climate-related incidence. Akron, OH and Appleton, WI boast the most favorable risk share (1.8% of properties) among the top 20 markets, while Kingsport-Bristol, TN has the least favorable risk share (13.9% of properties), followed by Roanoke, VA (12.1% of properties).

Affordable Hotspots see Significant Price Growth

Just 5 of the top 20 markets were priced higher than the U.S. median home for sale in June. Relatively low-priced metros have thrived relative to higher-priced areas over the last couple of years as buyers sought out affordable areas that offered appealing lifestyle amenities.

The popularity of these approachable markets, however, has pushed prices higher, hurting their affordability somewhat. On average, the top 20 markets saw prices climb an average 6.0% year-over-year in June, compared to flat price growth nationally. Even with climbing prices, the average listing price among the top 20 markets was roughly $50,000 lower than the national median in June. The lowest priced market on the list is Rockford, Illinois, where the median listing price was just $220,000 in June, less than half the national median. Interestingly, affordability is a trend we see even among the luxury market with the relatively lower prices in Nashville, TN, driving it to the top of the Wall Street Journal/Realtor.com Summer 2024 Luxury Housing Market Ranking.

Though these areas are largely lower-priced, they boast almost 50% more amenities per capita than the 200 largest metro average. Amenities are measured as the average number of stores per specific “everyday splurge” category (coffee, upscale/specialty grocery, home improvement, fitness) per capita in an area. Buyers are looking to save without compromising on comforts, and this quarter’s housing markets deliver.

Improving Inventory Levels Pale in Comparison to Pre-Pandemic

Many of the top-ranked markets have gained significant attention because they offer buyers affordable housing options in desirable areas. That is, these markets have the amenities many buyers are looking for, but at an approachable price. The rapid rise in popularity taxed inventory levels in many of these metros and despite recent improvement, the number of homes for sale is still well below pre-pandemic levels.

On an annual basis, inventory grew in all of the top 20 markets in June. Nationally, there were 36.7% more homes for sale in June 2024 compared to one year earlier. Just 7 of the top 20 markets saw inventory climb faster than the national rate in June. Though some markets have seen substantial inventory gains on an annual basis, all 20 markets have significantly fewer homes for sale than pre-pandemic. On average, for-sale inventory was 51.8% lower than pre-pandemic in the top-ranked markets, while inventory was roughly 32.4% lower nationally.

Limited inventory drove competition higher, which put upward pressure on prices across the country. In-demand, affordable markets, such as those on the Wall Street Journal/Realtor.com Housing Market Ranking list, have seen prices climb, especially high relative to pre-pandemic prices. On average, home prices in the top 20 markets were 45.4% higher than pre-pandemic (2019) in June compared to 39.1% price growth nationally in the same timeframe.

High demand for these affordable locales meant that homes did not spend very long on the market. In June, homes spent an average 45 days on the market at the national level. The top 20 markets saw homes spend roughly two weeks less time on the market than the typical U.S. home as the pace of sale remained quick despite climbing prices. Homes in the top-ranked markets also sold faster than pre-pandemic, spending more than two weeks less time on market in June 2024 compared to pre-pandemic.

Mid-sized Markets with Stable Economies

This quarter’s top markets are bringing in buyers due not only to their affordability, but also their short commute times, manageable metro sizes and healthy job markets.

The 200 largest US metros have an average unemployment rate of 3.8%. However, the best-ranked 20 markets boast stronger-than-average labor markets, with an average unemployment rate of 3.5%. These markets also out-perform the national labor market, which saw an unemployment rate climbing from 4.0% in May to 4.1% in June. All but 3 of the top-ranked markets had an equal or lower unemployment rate than the national rate, including Burlington-South Burlington, Vt. (1.7%), Manchester-Nashua, N.H. (2.5%) and Appleton, WI (2.5%), areas that saw the best employment conditions.

High mortgage rates and home prices meant that the required household income to purchase a median-priced home was more than $100,000 in 34 of the 50 largest U.S. metros in April, with most of the metros below this threshold located in the Midwest. Updating the analysis for June data shows that the required income to purchase a home was below $100,000 in 15 of the 20 top-ranked housing markets in June. On average, the required income to purchase in these markets, assuming 20% down and the June average mortgage rate, was roughly $83,000, more than $10,000 below the recommended household income to purchase a home priced at the U.S. median. Though the best-ranked 20 markets saw wages 5.5% lower than the 200 metro average, home prices were 16.3% lower than the 200 metro average in June, making up for the wage difference.

Buyers in these areas also saw shorter commute times and a lower cost of living than the large metro average. Commutes were 6.2% lower, on average, in the top markets compared to the 200 largest markets. Appleton, WI boasted the snappiest commute, with residents spending just an average 20 minutes commuting to work.

Quick commute times are likely due, in part, to the smaller size of this quarter’s top areas. Just one market at the top of the list boasted more than 1 million residents. Columbus, OH is the largest market on the list with a population of 2.2 million. However, the 20-metro average population is just 536,000 people, 59.2% lower than the 200-metro average. The smallest metro on this quarter’s list was Burlington-South Burlington, Vt. with just 228,000 residents.

City Spotlight: Kalamazoo-Portage, MI

Kalamazoo-Portage, Mich climbed 46 spots since last year to rank as the 14th housing market in this quarter’s index. Located a couple hours north of our top ranking market Fort Wayne, IN, and 90 miles west of 9th-ranked Ann Arbor, MI, Kalamazoo is poised to grow with the Midwest’s hot markets. This well-located hub is also just 40 miles East of Lake Michigan, making summertime day trips to the lake an easy feat.

Kalamazoo punched well above its weight this quarter. With roughly 262,000 residents, the metro was the 15th smallest market out of the 200 areas analyzed. However, this small, affordable metro saw significant buyer demand and climbing home prices. The median listing price in Kalamazoo was $375,000 in June, up 13.1% higher than one year prior but still roughly $70,000 below the national average. Homes spent 38 days on the market in June, a few days more than the previous year, but one week faster than the national median.

Active inventory was 36.3% lower than pre-pandemic in the 2nd quarter of 2024. This scarcity drove price growth in the area and home prices climbed 41.1% versus pre-pandemic in the same time period.

Buyers in Kalamazoo may be drawn to the area’s strong economy, which revolves around healthcare and healthcare-adjacent technologies and education. The medical technology company, Stryker, is headquartered in the area and serves as a major employer. Other important employers include Western Michigan University, Bronson Healthcare, and Pfizer.

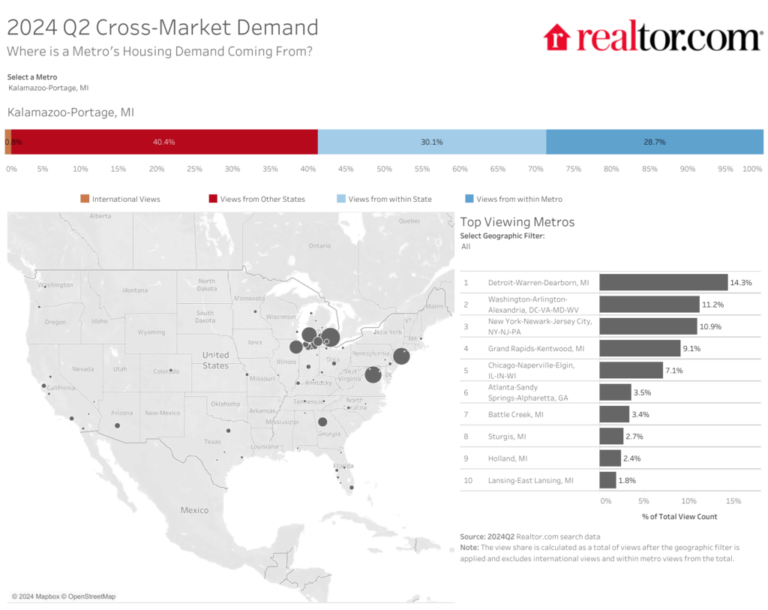

Almost three-quarters (71.3%) of views to properties in Kalamazoo came from outside of the metro in the second quarter, with the highest out-of-metro attention from the Detroit (14.3%), Washington D.C. (11.2%) and New York City (10.9%) areas. This share increased by 1.6 percentage points in Q2 of 2024 compared to the previous year, indicating a pick up in demand from non-locals.

Kalamazoo, MI Housing Highlights

| Realtor.com – Kalamazoo, MI: June 2024 Inventory Metrics | ||

| YoY % Change | ||

| Median List Price | $ 375,000 | 13.1% |

| Active Listings | 376 | +27.0% |

| Days on Market | 38 | +5 days |

| New Listings | 304 | -5.6% |

Out-of-Metro Home Shoppers Drive Demand

The recently revamped Wall Street Journal/Realtor.com Housing Market Ranking utilizes new metrics, such as climate risk data, and a reconfigured weighting system. To account for these changes, we ran the numbers from one year ago with the updated methodology to understand how the market is shifting.

Returning Markets

There are familiar places on the list of the top 20 markets: 13 members of this spring’s list would have been on the list one year ago, and 17 were on last quarter’s list. Among the markets that have remained on our list is the ever-popular Southern locale of Kingsport-Bristol, Tenn., as well as the Midwestern hotspot of Columbus, Ohio, and various small- to mid-sized Midwestern cities that offer affordable housing and low cost of living. Notably, the popular and fast-moving Northeastern metro of Manchester-Nashua, N.H. also remained on the list, continuing the reign of Boston-adjacent locales.

| Market | Summer 2024 Rank | Summer 2023 Rank | Rank Change |

| Fort Wayne, Ind. | 1 | 1 | 0 spots |

| Akron, Ohio | 3 | 12 | 9 spots higher |

| Manchester-Nashua, N.H. | 4 | 10 | 6 spots higher |

| South Bend-Mishawaka, Ind.-Mich | 5 | 3 | 2 spots lower |

| Burlington-South Burlington, Vt. | 6 | 15 | 9 spots higher |

| Kingsport-Bristol-Bristol, Tenn.-Va. | 7 | 4 | 3 spots lower |

| Appleton, Wis. | 10 | 17 | 7 spots higher |

| Hickory-Lenoir-Morganton, N.C. | 11 | 20 | 9 spots higher |

| Columbus, Ohio | 12 | 2 | 10 spots lower |

| Springfield, Mo. | 15 | 7 | 8 spots lower |

| Roanoke, Va. | 16 | 13 | 3 spots lower |

| Dayton, Ohio | 17 | 18 | 1 spots higher |

| Portland-South Portland, Maine | 19 | 8 | 11 spots lower |

Markets Falling Out of the Top 20

Seven markets fell off of the list between the last year and this year, but all remained within the top 60 markets. The biggest mover was last year’s 11th-ranked market, Evansville, Ind.-Ky., which fell 33 spots to rank 44th this summer. Relatively high-price Boulder, CO also fell off the list this spring as no West region markets ranked in the top 20.

New Markets

Taking the places of the 7 descended markets are five Midwestern locales, and two Boston-adjacent Northeast metros. All of the markets ascended from within the top 65. Much like the markets that stayed in the top 20, most of the Midwest new markets, as well as one of the two Northeast new markets were more affordable than the national market. Ann Arbor, Mich, and Worcester, Mass.-Conn. were higher priced than the national median in June.

Methodology

The ranking evaluates the 200 most populous core-based statistical areas, as measured by the U.S. Census Bureau, and defined by March 2020 delineation standards for eight indicators across two broad categories: real estate market (60%) and economic health and quality of life (40%). Each market is ranked on a scale of 0 to 100 according to the category indicators, and the overall index is based on the weighted sum of these rankings. The real estate market category indicators are: real estate demand (15%), based on average pageviews per property; real estate supply (15%), based on median days on market for real estate listings, median listing price trend (15%), based on annual price growth over the quarter, property taxes (10%) and climate risk to properties (10%). The economic and quality of life category indicators are: unemployment (5%); wages (5%); regional price parities (5%); the share of foreign born (5%); small businesses (5%); amenities (10%), measured as the average number of stores per specific “everyday splurge” category (coffee, upscale/specialty grocery, home improvement, fitness) per capita in an area; and commute time (5%).