The insurer asked the California Department of Insurance to raise rates by an average of 22 percent “to help avert a dire situation” as the company pays thousands of claims related to the fires.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain powerful insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

State Farm says it has been struggling to handle insurance payouts from the Los Angeles wildfires, which devastated the city last month.

The insurer asked the California Department of Insurance on Monday to increase rates in the state by an average of 22 percent “to help avert a dire situation” as the company works to pay the thousands of claims it has received in the wake of the disaster.

State Farm has paid out more than $1 billion to California policyholders and has received more than 8,700 claims since Feb. 1, a press release from the company said.

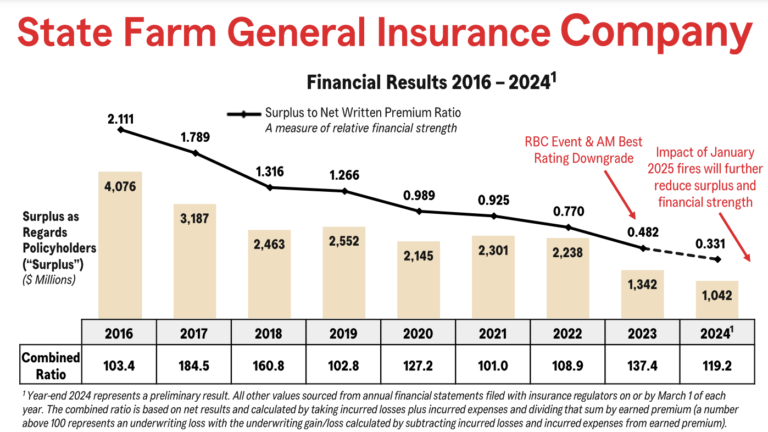

The insurer added that over the last nine years, the company’s rates in the state have not matched the growing risk in the area, meaning that for every $1.00 the company has collected in premiums, State Farm General has spent $1.26, which has led to move than $5 billion in underwriting losses.

“Insurance will cost more for customers in California going forward because the risk is greater in California,” the company said. “Immediate emergency interim approval of additional rate is essential to more closely align cost and risk and enable State Farm General to rebuild capital. We must appropriately match price to risk. That is foundational to how insurance works. We must match price to risk.”

In March 2024, the insurer noted, credit rating agency AM Best downgraded State Farm General’s Financial Strength Rating to Fair and its Long-Term Issuer Credit Rating to Fair, calling its balance sheet strength “weak.”

Credit: State Farm General

In May 2023, State Farm also announced that it would stop accepting new applications for homeowners insurance in California due to growing construction costs, wildfire risks and a “challenging” reinsurance market. Less than a year later, the company also announced that it would not renew coverage for 72,000 houses and apartments in the state.

Despite State Farm’s claims of growing deeper into a financial hard spot, some consumer advocates say the insurer’s financials are well in order.

Director of Insurance for the Consumer Federation of America Doug Heller told USA Today that the company “has been quite profitable in California over the last several years.”

“They have built up an incredible fortune in order to deal with crisis,” Heller continued. “If they feel that they are going to need rate hikes in the future they have a right to go through the process, but to be putting on the emergency siren seems more like trying to bully the state into handing over cash while we’re trying to recover from disaster.”

Heller added that as of 2023, State Farm’s losses in California (its second largest state by premium dollars) were lower than industry averages, according to industry trade publication data. He said the company’s surplus (remaining funds after claims and administrative overhead) is equivalent to more than 10 percent of the surplus held by the entire property and casualty insurance industry.

State Farm was also accused last fall of funneling its excess profits to parent company State Farm Mutual Automobile Insurance Co. while claiming it was in financial distress and needed a 30 percent rate hike, The LA Times reported.

In June 2024, the insurer also made three requests for extraordinary “relief” from the typical process used to set rates in California. State Farm at that time argued for a legal maneuver called “variance,” which insurance companies employ when they think their solvency is threatened. As part of that process, State Farm requested a 30 percent hike on homeowners insurance.

“State Farm General’s rate filings raise serious questions about its financial condition,” press secretary for the California Department of Insurance Gabriel Sanchez told USA Today. “To protect millions of California consumers and the integrity of our residential property insurance market, the Department will respond with urgency and transparency to recommend a course of action for Commissioner Lara.”

As of Jan. 30, $4.2 billion in claims have been paid out to California residents in relation to the LA County wildfires, according to the California Department of Insurance.