The San Diego housing market has seen dynamic changes in prices, sales, and trends. While the median sold prices have seen fluctuations, the year-over-year gains are indicative of a robust real estate market. However, the significant decrease in sales may be a result of the challenges posed by rising interest rates.

The median sold price of existing single-family homes in San Diego stood at $973,100 in September 2023. While this represents a 2.7% decrease compared to the previous month, it marks an impressive 8.2% year-over-year increase. However, it’s worth noting that sales have seen a significant month-to-month and year-over-year decrease, dropping by 19.4% and 25.3%, respectively.

For existing condos and townhomes, San Diego reported a median sold price of $665,000 in September 2023. This reflects a 2.2% decline compared to the previous month, but a substantial 11.8% increase compared to September 2022. However, sales in this category also experienced a notable month-to-month and year-over-year decline, with drops of 22.2% and 23.2%, respectively.

Median Sold Price of Existing Single-Family Homes in San Diego

- September 2023: $973,100

- August 2023: $1,000,000

- September 2022: $899,000

Median Sold Price of Existing Condos and Townhomes in San Diego

- September 2023: $665,000

- August 2023: $680,000

- September 2022: $595,000

Are Housing Prices Dropping in San Diego?

In September 2023, the San Diego housing market saw a 2.7% decrease in the median sold price of existing single-family homes compared to the previous month. This might indicate a short-term downward trend.

However, when looking at the year-over-year data, there is an impressive 8.2% increase in prices, demonstrating the market’s resilience and growth over a more extended period.

For existing condos and townhomes, there was a 2.2% decrease in prices month-to-month but an 11.8% increase year-over-year. This suggests that while there may be some fluctuations in the short term, San Diego’s housing market has shown consistent long-term growth.

Is It Wise to Buy a House in San Diego Right Now?

Deciding whether to buy a house in San Diego right now depends on your individual circumstances and long-term financial goals. While short-term fluctuations in prices may occur, the long-term trend in San Diego has been one of growth.

If you’re planning to make San Diego your long-term home and can secure a mortgage with favorable terms, now may be a good time to buy, especially if you can take advantage of the 8.2% year-over-year increase in single-family home prices. It’s essential to work with a real estate expert who can provide guidance tailored to your specific situation.

Is San Diego a Seller’s Market Right Now?

San Diego’s housing market has shown characteristics of a seller’s market, especially in the single-family home segment. The year-over-year increase of 8.2% in median sold prices suggests strong demand and limited supply, which is typical of a seller’s market. However, the month-to-month data shows a 2.7% price decrease, which could be seen as a temporary shift.

When considering buying in a seller’s market, be prepared for potentially competitive conditions, and it’s advisable to work with a real estate agent who can help you navigate the market and make informed decisions.

It’s important to note that real estate markets can change over time, so it’s crucial to stay informed about the latest developments and work with professionals who have a deep understanding of the San Diego market to make the best choice for your specific situation.

San Diego Housing Market Forecast 2023-2024

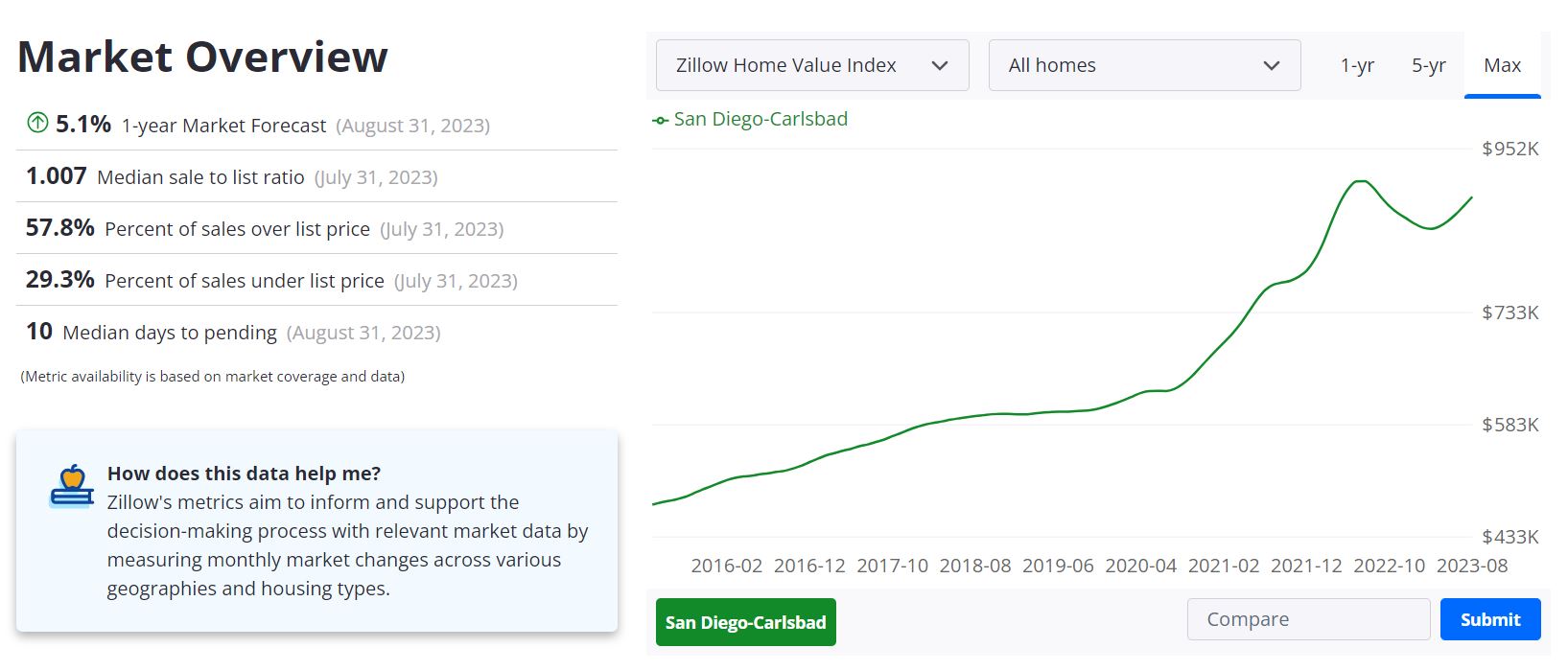

Zillow, a prominent real estate marketplace, provides valuable insights into the San Diego-Carlsbad housing market. This analysis delves into the key data points and trends that Zillow offers, shedding light on the market forecast and its significance in the real estate landscape.

San Diego-Carlsbad Area: An Overview

The San Diego-Carlsbad area, situated in Southern California, encompasses San Diego County, including the city of Carlsbad. San Diego is known for its beautiful beaches, favorable climate, and diverse economy that includes a strong emphasis on defense, tourism, international trade, and research. It’s a thriving region attracting individuals and families seeking a high quality of life.

Now, let’s focus on the housing market within this area.

Housing Market Size and Average Home Value

The San Diego-Carlsbad area constitutes a significant portion of California’s real estate landscape. The average home value in this region stands at $887,962. Over the past year, there has been a slight decline of 1.4%, indicating a modest adjustment in home values.

Zillow’s 1-Year Market Forecast

Zillow’s 1-year market forecast as of August 31, 2023, predicts a growth rate of 5.1% in the San Diego-Carlsbad housing market. This projection suggests a positive trajectory, potentially presenting opportunities for homeowners and investors alike.

Market Trends and Key Indicators

Examining market trends and indicators is vital for understanding the dynamics of the real estate environment. As of July 31, 2023, the median sale-to-list ratio in the area was 1.007, indicating homes were selling slightly above the listed price on average.

Furthermore, data from the same period reveals that 57.8% of sales were transacted over the list price, underscoring a competitive market. Conversely, 29.3% of sales were below the list price, showcasing a range of options for buyers.

The median days to pending, a crucial indicator of market speed, was 10 days as of August 31, 2023. This rapid transition from listing to pending underlines the active and dynamic nature of the San Diego-Carlsbad housing market.

Hence, the San Diego-Carlsbad area presents a diverse and active real estate market. The Zillow forecast of a 5.1% growth in the coming year reflects optimism and potential for homeowners and investors. With a competitive market, homes transacting above the list price, and a relatively quick sale process, this region holds promise for those looking to engage in the real estate market.

Greater San Diego Area Housing Market Report

The Greater San Diego Association of REALTORS® provides valuable insights into the housing market in the San Diego area through their comprehensive report. While there has been a decrease in closed and pending sales in the Greater San Diego housing market, the median sales prices have appreciated significantly, and properties are spending less time on the market.

Additionally, the increase in inventory and supply, especially for attached homes, may offer more options for buyers. Let’s analyze the latest data to gain a clear understanding of the trends and dynamics shaping the real estate landscape in this region.

Closed Sales and Pending Sales

In the San Diego area housing market, there have been significant changes in closed and pending sales for both detached and attached homes:

- Detached Homes: Closed sales decreased by a notable 30.4 percent, indicating a decrease in completed home sales. Pending sales also decreased by 14.3 percent, reflecting a decrease in homes under contract and awaiting closure.

- Attached Homes: Closed sales for attached homes decreased by 24.2 percent, while pending sales decreased by 6.0 percent, showing a decline in both completed and upcoming transactions.

Inventory and Supply

The San Diego housing market also experienced changes in inventory and supply:

- Detached Homes: Inventory for detached homes increased by 7.0 percent, indicating a growth in the number of available homes for sale. Supply, which is the number of months it would take to sell the current inventory at the current sales pace, increased by 45.0 percent.

- Attached Homes: Inventory for attached homes saw a significant 17.3 percent increase, suggesting a rise in the availability of these properties. Supply for attached homes increased by 56.3 percent, indicating a notable increase in the time it would take to sell the existing inventory.

Median Sales Price and Days on Market

Changes in median sales prices and the time properties spend on the market:

- Detached Homes: The median sales price for detached homes increased by 10.1 percent, reaching $999,000, showing strong price appreciation. Days on the market decreased by 18.8 percent, indicating that these homes are selling faster.

- Attached Homes: The median sales price for attached homes increased by 10.0 percent, reaching $660,000. Days on market for attached homes decreased by 20.7 percent, suggesting a faster sales pace for these properties.

San Diego Rental Property Market

The San Diego real estate market has been ranked among the ten most expensive real estate markets in the country, though it ranks below several other West Coast cities. This creates massive demand for San Diego rental properties by those who simply cannot afford to buy homes.

The rental market will continue to grow as the city grows an estimated 500,000 population by 2050, adding tens of thousands each year. The median rent in San Diego is $2700. The rent you’d receive on single-family San Diego rental properties would, of course, be much higher.

Renters vs. Owners in San Diego

San Diego’s property rental market is influenced by several factors, including the local economy, job opportunities, and the overall demand for housing. It’s a city known for its mix of urban and suburban neighborhoods, each with its own rental and ownership dynamics.

San Diego had a diverse housing landscape with a mix of renters and property owners.

- Renters: San Diego has a significant population of renters, comprising individuals and families who lease residential properties. This includes apartments, condominiums, townhouses, and single-family homes. The exact percentage of renters relative to property owners can vary by neighborhood and demographic factors.

- Owners: San Diego also has a substantial number of property owners. These are individuals or entities who own residential properties and may either live in their properties or lease them out to renters. Property owners contribute to the diversity of the city’s housing options.

Size of the Rental Market

The size of the San Diego property rental market is substantial, with a wide range of rental properties available to residents. This market includes apartments, houses, and various types of housing units. The exact size of the rental market can fluctuate based on factors like population growth, economic conditions, and housing development trends.

Real estate agencies, rental platforms, and government agencies often track and report on the status of the rental market, offering detailed insights into its size and dynamics.

For the most up-to-date and specific information regarding the current state of the San Diego property rental market, including the number of renters and property owners, it’s recommended to refer to the latest reports and data from sources like local real estate associations, government housing agencies, and real estate websites.

San Diego’s property rental market is an essential component of the city’s real estate landscape, offering a wide range of housing options to its diverse population.

San Diego County shows it has a Median Gross Rent of $1,842 which is the third most of all other counties in the greater region. Comparing rental rates to the United States average of $1,163, San Diego County is 58.4% larger. Also, measured against the state of California, rental rates of $1,698, San Diego County is 8.5% larger.

San Diego Apartment Rent Prices

As of October 2023, the rental market in San Diego, California exhibits some notable trends and changes:

Average Rent Prices

The average rent for different types of apartments in San Diego is as follows:

- 1-Bedroom Apartment: The average rent for a 1-bedroom apartment is $2,444. This represents a 2% decrease compared to the previous year, indicating a slight drop in rental prices.

- Studio Apartment: Over the past month, the average rent for a studio apartment decreased by -5% to $2,015.

- 2-Bedroom Apartment: The average rent for a 2-bedroom apartment decreased by -3% to $3,200 over the past month.

Housing Units and Occupancy

In terms of occupied housing units, San Diego has the following distribution:

- Renter-occupied Households: Renter-occupied households make up 53% of the housing units in San Diego, indicating a significant presence of renters in the city.

- Owner-occupied Households: Owner-occupied households account for 48% of the housing units, highlighting a balanced mix of homeowners in the area.

Affordable and Expensive Neighborhoods

San Diego’s neighborhoods offer a range of rental prices, making it accessible for various budgets:

The Most Affordable Neighborhoods:

- Bay Park: The average rent in Bay Park is $2,135 per month.

- University Heights: In University Heights, the average rent is around $2,200 per month.

- North Park: North Park offers an average rent of approximately $2,273 per month.

The Most Expensive Neighborhoods:

- Carmel Valley: Carmel Valley is one of the more expensive neighborhoods, with an average rent of $2,942 per month.

- Mission Valley East: In Mission Valley East, the average rent can go for $2,894 per month.

- Mission Beach: Mission Beach has an average rent of $2,850 per month.

Popular Neighborhoods

Some neighborhoods in San Diego are particularly popular among renters:

- Mission Beach: Mission Beach tops the list with 1,115 listings, making it a sought-after area for renters.

- Pacific Beach: Pacific Beach is also a popular choice, offering 760 listings for prospective renters.

- Ocean Beach: Ocean Beach features 295 places for rent, making it a vibrant neighborhood for renters.

These insights provide a snapshot of the current rental market in San Diego. Rental prices have seen some fluctuations in recent months, with variations in different apartment types. The city offers a range of neighborhoods to suit different budgets and preferences, with a balanced mix of renters and homeowners.

References

- https://www.car.org/

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.sdar.com/press-releases.html

- https://www.zillow.com/SanDiego-ca/home-values

- https://www.zumper.com/rent-research/san-diego-ca