Welcome to the Reno housing market report for 2023. In this report, we will take a look at the current state of the housing market in Reno, Nevada, including trends and forecasts for the coming year. With Reno’s reputation as a popular destination for outdoor enthusiasts, retirees, and tech industry workers, we’ll explore what impact these factors have on the local real estate market. So, if you’re interested in buying or selling property in the area, keep reading to learn more about the Reno real estate market.

Reno/Sparks Housing Market Trends for 2023

The following residential housing market data covers the cities of Reno, Nevada, and Sparks, Nevada. The Reno and Sparks, Nevada real estate market witnessed a notable shift in September 2023, with various key indicators showing changes. The data provided by the Northern Nevada Regional MLS on October 3, 2023, gives insights into the evolving market conditions. Here are the highlights of the market report:

Home Prices and Unit Sales Pullback

Similar to the cooling temperatures of fall, the Reno and Sparks real estate market appears to be cooling as well. The key metrics demonstrate this trend:

- Median Sales Price: In September 2023, the median sales price for single-family homes (SFRs) was $562,500, marking a 2.2% decrease from August. However, it’s important to note that this figure is still up by 5.8% year-over-year, highlighting the long-term resilience of the market.

- Median Sold Price Per Square Foot (PPSF): The median PPSF also fell in September 2023, coming in at $307.40 per square foot, which is a 1.1% decrease from August. Nevertheless, it has increased by 2.0% over the same period last year, indicating continued growth.

- Unit Sales: As predicted in the previous month’s market report, the number of homes sold in September 2023 experienced a sharp decline. A total of 390 homes were sold, representing a 14.0% decrease from August and a significant 22.3% decrease from the same period last year. The impact of 23-year record high mortgage interest rates is evident in these reduced sales figures.

Market Dynamics and Inventory

Market dynamics and inventory levels also provide important context:

- Available Inventory: The current available inventory of homes listed for purchase is 809, reflecting a 1.3% decrease from the previous month and a significant 35.6% decrease from the same time last year. Homeowners seem reluctant to sell their homes with a 3% mortgage rate when facing the prospect of buying a new home with an 8% mortgage rate.

- Pending Sales: The number of current pending sales is 459, showing an 8.4% decrease from the previous month and an 11.7% decrease from the same period last year. These trends indicate that October sales are likely to be weaker.

- Months’ Supply of Inventory (MSI): September’s MSI was 2.2 months of supply, signaling a seller’s market. This figure is calculated by dividing the available inventory by the number of homes sold in the previous month. A balanced market typically falls between four and six months of supply.

- Days on Market (DOM): The median days on market for September was 54 days, marking a decrease of 1 day from August’s median DOM. Year-over-year, September’s DOM is 15 days less than the figure for September 2022.

Condo/Townhomes Market

The market for condo/townhomes also experienced changes in September 2023:

- Median Sales Price: The median sales price for condo/townhomes in September was $332,500, reflecting a 2.1% decrease from August and a 4.3% decrease from the same period last year.

September brought a significant shift in the Reno and Sparks real estate market. Home prices saw a slight retreat, while unit sales experienced a notable pullback, likely influenced by rising mortgage interest rates. Nevertheless, the year-over-year gains in median prices indicate the market’s resilience.

Reno Housing Market Forecast 2023-2024

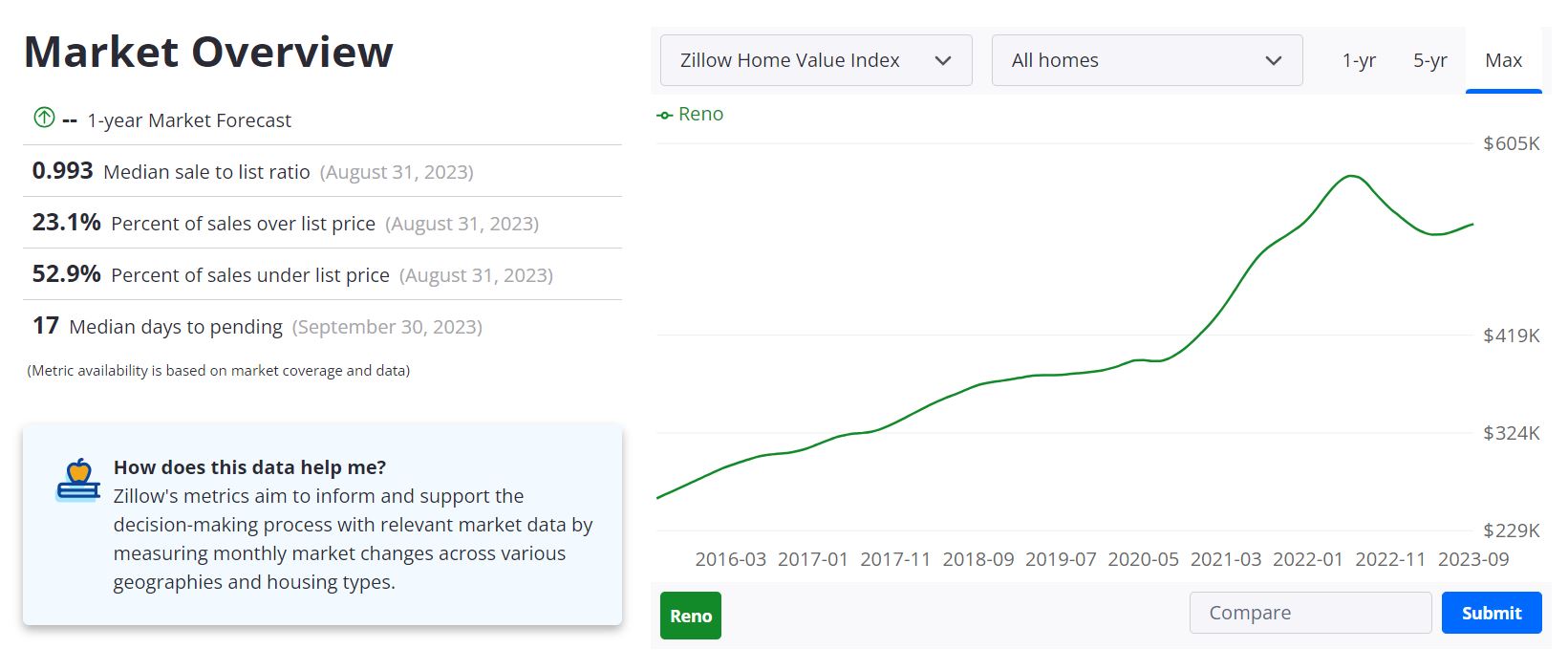

The Reno, Nevada housing market is experiencing dynamic shifts, and Zillow’s latest data provides insights into the evolving conditions. As of September 30, 2023, here’s an overview of key statistics and the market forecast:

- Average Home Value: The average home value in Reno stands at $527,713. However, over the past year, there has been a 5.5% decrease in home values, reflecting changes in the market’s performance.

- Pending Time: Homes in Reno typically go to pending status in approximately 17 days, indicating a relatively fast-moving market.

- Median Sale to List Ratio: As of August 31, 2023, the median sale-to-list ratio in Reno is 0.993, suggesting that, on average, homes are selling slightly below their list prices.

- Sales Over and Under List Price: On August 31, 2023, about 23.1% of home sales in Reno were over the list price, while 52.9% were under the list price. These figures indicate a diverse pricing dynamic, with opportunities for both buyers and sellers.

- Median Days to Pending: As of September 30, 2023, the median time it takes for a home to go pending in Reno is 17 days, indicating a market that moves efficiently.

Reno MSA Housing Market Forecast

The Reno, NV MSA (Metropolitan Statistical Area) housing market forecast provides a glimpse into the region’s expected performance in the coming months:

Based on the data, the Reno MSA is anticipated to experience a slight positive shift in housing market conditions. Here are the forecasted changes for the coming months:

- As of September 30, 2023, the market is expected to show a 0.2% increase by October 31, 2023.

- By December 31, 2023, there is a forecasted decrease of 0.2% in the housing market.

- Looking further ahead, the data suggests a 0.3% increase in the market by September 30, 2024.

These forecasted changes indicate some level of stability and potential growth in the Reno MSA housing market, albeit with fluctuations in the short term. The market’s performance is influenced by various factors, including economic conditions, local developments, and national trends.

Market Overview

The Reno housing market is currently experiencing a decrease in average home values over the past year, which can be attributed to various market dynamics. However, the market’s efficiency is evident in the relatively short time it takes for homes to go pending, highlighting the competitiveness of the area.

The diversity in sales dynamics, with both homes selling over and under the list price, offers opportunities for different types of buyers and sellers. Additionally, the median sale-to-list ratio is below 1, indicating potential room for negotiation for buyers.

Despite the recent decrease in home values, the forecast suggests the potential for a positive shift in the Reno MSA housing market in the coming months. As with any real estate market, it’s essential for buyers and sellers to stay informed, monitor changes, and adapt their strategies to the evolving conditions. Local economic factors, interest rates, and regional development can play crucial roles in shaping the future of the Reno housing market.

It’s advisable for those considering real estate transactions in Reno to consult with local experts and stay up-to-date with market data to make informed decisions.

Will the Reno Housing Market Crash?

The speculation about a potential housing market crash in Reno has prompted discussions and concerns. However, predicting market crashes can be complex and challenging. It’s important to consider several factors before arriving at any conclusions. The current real estate market climate is influenced by a combination of local and national economic conditions, mortgage interest rates, employment rates, and housing demand.

Historically, real estate markets experience cycles of ups and downs. While a significant crash cannot be ruled out entirely, it’s essential to assess the overall market conditions and consult with experts before making assumptions.

Is It a Good Time to Buy a House in Reno, Nevada?

The decision to buy a house in Reno, Nevada depends on a variety of individual factors. While the current market might seem uncertain due to price fluctuations and speculations, there are aspects that could make it a favorable time for buyers.

- Interest Rates: Mortgage interest rates are a crucial consideration for buyers. If rates are low, it could translate into more affordable monthly payments.

- Personal Finances: Assessing your financial situation, job stability, and ability to afford homeownership is essential.

- Long-Term Goals: Consider your long-term plans. If you plan to stay in the area for several years, buying could be a prudent investment.

Ultimately, the decision to buy a house should be based on careful consideration of your financial readiness, life circumstances, and thorough research into the local market.

The Reno housing market presents a mix of price trends, market stability questions, and buying opportunities. While the average home value has decreased over the past year, it’s essential to look beyond the short-term figures and consider the broader context of the market. Predicting market crashes is challenging, and individual decisions to buy a house should be based on personal financial readiness and long-term goals. Consulting with real estate professionals and staying informed about market trends will guide you in making the right choices for your housing needs in Reno, Nevada.

Reno Real Estate Investment Overview

Reno, Nevada is a popular destination for real estate investors due to its strong economy, growing population, and affordable housing market. The city offers a range of recreational opportunities and attractions, including nearby Lake Tahoe and the Sierra Nevada mountains, as well as a thriving business environment with a diverse range of industries, from technology to healthcare and logistics.

Investing in the Reno real estate market offers a dynamic landscape with both opportunities and considerations. While recent data indicates a 5.6% decrease in average home values over the past year, it’s important to recognize that real estate markets often exhibit short-term fluctuations.

In the context of Reno’s housing market, a median home value may not be considered affordable for everyone. However, compared to other popular real estate markets in the United States, such as San Francisco, New York City, or Los Angeles, Reno’s housing market may be relatively more affordable. It is important to note that affordability is also influenced by factors such as local median income levels, employment opportunities, and the overall cost of living. In addition, properties tend to go pending within an average of 49 days, making it a fast-moving market.

Investors have many reasons to consider Reno real estate, including the potential for rental income from the city’s growing population, the chance to take advantage of a strong economy with numerous job opportunities, and the possibility of diversifying their investment portfolios with a range of property types, from single-family homes to multi-unit apartment buildings. The city’s thriving tourism industry, with numerous entertainment options, including casinos and music festivals, also presents opportunities for investors to benefit from short-term rental income.

Here are the top reasons to consider investing in Reno real estate:

Strong Economic Growth:

Reno’s economy has seen a significant boost in recent years, with job growth outpacing the national average. The city’s diverse economy includes industries such as healthcare, technology, logistics, and manufacturing, which have all seen growth in recent years. This economic growth has resulted in increased demand for housing, making it an attractive market for real estate investors. Moreover, the city is a hub for tech startups and small businesses, which are continually looking to expand and hire.

Affordable Housing Market:

Despite the average home value in Reno being over $500,000, it is still relatively affordable compared to other western cities such as San Francisco and Seattle. This affordability has made Reno an attractive destination for people looking to relocate from more expensive areas, increasing demand for housing and presenting opportunities for real estate investors. Additionally, the city has a wide range of housing options, from single-family homes to condos and townhouses, allowing investors to diversify their portfolios.

Favorable Tax Environment:

Nevada has a business-friendly tax environment, with no state income tax and relatively low property taxes. This favorable tax environment can be beneficial for real estate investors, as it can increase potential returns on investment. Moreover, the state’s tax structure is favorable to businesses, making it an attractive location for corporations, which can result in increased demand for housing.

Tourist Destination:

Reno is a popular tourist destination, attracting visitors to its many attractions, such as Lake Tahoe and the Reno Air Races. This tourism industry can provide a stable source of income for real estate investors through short-term rentals and vacation homes. Furthermore, the city hosts several events and festivals throughout the year, such as the Reno Rodeo, Hot August Nights, and the Great Reno Balloon Race, which can boost the demand for short-term rentals.

Growing Rental Market:

As home prices continue to rise, more people are turning to rent as a more affordable housing option. This has resulted in a growing rental market in Reno, making it an attractive market for real estate investors looking to generate passive income. The city’s growing economy and population growth also contribute to this trend, providing a stable demand for rental properties.

Proximity to Major Cities:

Reno’s proximity to major cities such as San Francisco, Sacramento, and Las Vegas makes it an attractive location for businesses and residents alike. This proximity can drive economic growth and increase demand for housing, making it an attractive market for real estate investors. Furthermore, the city’s location near Lake Tahoe and the Sierra Nevada mountains makes it an ideal destination for outdoor enthusiasts, contributing to its overall appeal.

Growing Population:

Reno’s population has been steadily growing in recent years, with an expected growth rate of 2.7% by 2025. This population growth can increase demand for housing, presenting opportunities for real estate investors to capitalize on this trend. Additionally, the city’s population growth is driven by both domestic and international migration, providing a diverse pool of potential renters and buyers for real estate investors.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Reno.

Not just limited to Reno or Nevada but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Las Vegas is another hot real estate market in the state of Nevada. Las Vegas is a hot spot for real estate investment due to its strong economy, growing population, low taxes, and tourism industry. The city’s affordable housing market and proximity to major cities like Los Angeles also make it an attractive destination for investors. Additionally, Las Vegas is home to a variety of entertainment options, including casinos, music festivals, and sporting events, which can provide a stable source of income for real estate investors through short-term rentals and vacation homes.

On the east of Nevada lies the state of Utah, where you can consider investing in Salt Lake City. Salt Lake City is emerging as a hot spot for real estate investment due to its growing population, strong job market, and relatively affordable housing market. The city’s diverse economy, which includes industries such as healthcare, education, and technology, has resulted in job growth outpacing the national average.

This economic growth, combined with the city’s stunning natural beauty and recreational opportunities, has attracted people from across the country, driving demand for housing. Salt Lake City’s favorable tax environment, with no state income tax and relatively low property taxes, also make it an attractive market for real estate investors looking to maximize their returns. Additionally, the city’s growing rental market and proximity to major cities such as Denver and Las Vegas provide further opportunities for investors.

Let us know which real estate markets in the United States you consider best for real estate investing!

References

- https://snr.realtor/market-reports/

- https://www.zillow.com/reno-nv/home-values

- https://realestate.usnews.com/places/nevada/reno

- https://www.realtor.com/realestateandhomes-search/Reno_NV/overviww