Here are the latest trends in the NYC real estate market as well as the statewide market. In the ever-evolving realm of real estate, data-driven insights are the bedrock of informed decision-making. The New York State Association of REALTORS (NYSAR) has once again unveiled its monthly housing market report, offering a comprehensive snapshot of the current state of the New York housing market.

Let us delve into the latest housing report for September 2023 released by NYSAR and explore the key insights it offers.

- Pending Sales in New York State were down 8.1 percent to 9,232.

- They are considered a forward-looking indicator of home sales based on contract signings

- Closed Sales decreased 22.5 percent to 9,564.

- Home for sale declined by 24 percent to 28,943 units.

- The Median Sales Price was up 6.8 percent to $390,000.

- The average sales price was up 3.7 percent to $508,235.

- Sellers received, on average, 102.5% percent of their original list price at sale, a year-over-year gain of 1.1 percent.

- Days on the Market increased by 2.4 percent to 42 days.

- Months Supply of Inventory was down 8.8 percent to 3.1 months.

Inventory Dwindles

In September 2023, the inventory of homes for sale in New York State continued its downward trend, falling by 24 percent from the previous year. There were just 28,943 units available last month, marking the 47th consecutive month of year-over-year inventory reduction.

Mortgage Rates Surge

Mortgage rates in September reached their highest point in over two decades. According to Freddie Mac, the average interest rate on a 30-year fixed-rate mortgage was 7.31 percent. This level hasn’t been seen since the year 2000. The month saw an increase from the 7.07 percent average in August to 7.20 percent in September.

Sales Activity Declines

Closed sales in September 2023 declined significantly, with only 9,564 homes sold. This represents a 22.5 percent decrease from the 12,335 sales in the same month in the previous year. Pending sales also fell by 8.1 percent, with 9,232 units pending in September 2023. New listings decreased by 10.2 percent in year-over-year comparisons, dropping from 14,017 in September 2022 to 12,592 last month.

Rising Median Sales Price

The median sales price of homes in New York State saw a significant jump, rising by 6.8 percent from $365,000 in 2022 to $390,000 in 2023. This comprehensive analysis of the New York housing market for August 2023 offers crucial insights into the ongoing trends and dynamics.

NYC Real Estate Market Trends: Is it a Seller’s Market?

New York City, often referred to simply as New York, is a vibrant metropolis that captures the imagination of millions worldwide. Its iconic skyline, diverse neighborhoods, and cultural landmarks make it one of the most sought-after places to live, work, and invest in.

As we delve into the real estate market of New York City for October 2023, a critical question emerges: is it a seller’s market? To answer this, let’s dissect the latest housing statistics and trends to gauge the dynamics at play in the city that never sleeps. The following housing market trends are based on single-family, condo, and townhome properties listed for sale on Realtor.com. Land, multi-unit, and other property types are excluded.

The Numbers Speak: Housing Market Statistics

Let’s start by diving into the numbers that define the housing market in New York, NY in October 2023:

- Median Listing Home Price: $799K

- Year-over-Year Trend: Up 1.8%

- Median Listing Home Price Per Square Foot: $785

- Median Home Sold Price: $705K

These figures reveal a dynamic market with a median listing price of $799K, showing a positive year-over-year trend of 1.8%. The median price per square foot is $785, while the median sold price stands at $705K, indicating a vibrant real estate landscape in the city.

Sale-to-List Price Ratio

The sale-to-list price ratio is an essential metric in any housing market. In New York, NY, homes were sold for approximately 97.14% of their listing price on average in October 2023. This percentage reflects a slight negotiation factor, with buyers managing to secure homes at a price slightly below the initial asking price.

Market Dynamics: Buyer’s Advantage

New York, NY in October 2023 presents an interesting dynamic for buyers and sellers. The current market condition leans towards being a buyer’s market, meaning that the supply of homes outweighs the demand. This scenario gives buyers more room for negotiation and selection, making it a favorable time for those looking to enter the housing market in the city.

Median Days on Market

When considering the time it takes for homes to sell, the median days on the market is a crucial indicator:

- Median Days on Market: 73 Days

On average, homes in New York, NY sell after 73 days on the market. This statistic shows that properties are moving relatively quickly, especially considering the size and complexity of the market. Moreover, the trend for median days on the market has decreased since the previous month and is slightly down compared to the same period last year.

Neighborhood Variances

There are 234 neighborhoods in New York. Tribeca has a median listing home price of $4.9M, making it the most expensive neighborhood. Rego Park is the most affordable neighborhood, with a median listing home price of $362K.

NYC Housing Market Report for July 2023

In July, the New York City housing market experienced a seasonal slowdown as more New Yorkers continued their summer travels. However, StreetEasy® data indicates a rising trend in the number of listings entering contracts compared to the previous year. In July 2023, listings on StreetEasy entered contract, marking a 4.3% increase from the same period last year. This follows a 2.2% year-over-year increase in June.

Key Takeaways:

1. Despite Summer Slowdown, Luxury Sellers Maintain the Upper Hand

Despite the seasonal slowdown, the luxury market, defined as the top 10% of for-sale listings, remained strong. The starting price for luxury listings was $4.5M in July, a 12.5% increase from the previous year. In Q2 2023, 382 listings above this threshold entered contract, a solid increase of 29.9% from Q1 2023. Although slightly lower than the previous year, this signals a substantial recovery from the second half of 2022.

Discounts were rare in July, with only 5.2% of luxury listings lowering asking prices, suggesting sustained buyer interest. Luxury homes in July had a 94.8% sale-to-list price ratio, indicating that sellers still have the upper hand in the luxury market.

2. Luxury Buyers Are Shopping in Manhattan Again

Manhattan remains the primary market for luxury homes. Out of 89 luxury contracts signed in July, 81 were in Manhattan. The median asking price of the Manhattan luxury market rose 11.5% year-over-year to $7.75M. Wealthy buyers are particularly interested in condos in new construction buildings, primarily in Midtown, driving up overall luxury market prices.

The median asking price of all for-sale listings in Manhattan rose 11.9% from a year ago to $1.595M in July, reflecting the increasing overall expense of the Manhattan market. Low new listings are helping sellers maintain their advantage.

3. Brooklyn Joins the Million Dollar Club as Prices in the Borough Hit New Record

Brooklyn’s housing market remains competitive, with the borough’s median asking price reaching $1M in July, a record high. Rising asking prices reflect the borough’s continued popularity among buyers across various price tiers.

Limited inventory relative to demand is fueling competition in Brooklyn. The sale-to-list ratio is higher than in any other borough, indicating that sellers will likely maintain their advantage this year.

4. Queens Remains a More Affordable Destination for Buyers, But Inventory Is Tight

Queens continues to offer more affordable homes, with a median asking price of $648,000 in July. Although the increase in median asking price has been modest compared to Manhattan and Brooklyn, Queens remains a competitive market.

Low inventory is advantageous for sellers, allowing them to maintain their advantage in the market. Sellers who price their homes well are likely to attract strong interest from buyers.

5. Asking Prices Will Rise and Sellers Will Stay in the Driver’s Seat This Year

In the second half of the year, asking prices in NYC are expected to continue rising across all price tiers. The city will remain a seller’s market due to declining new listing inventory. Many homeowners, locked into low mortgage rates, are reluctant to put their homes on the market. This limited inventory will help sellers maintain their advantage this year.

Overall, the New York City housing market remains dynamic and varies from neighborhood to neighborhood, making it essential for buyers and sellers to stay informed.

NYC Real Estate Market Forecast 2023-2024

What are the New York City real estate market predictions for 2023 & 2024? New York City has a track record of being one of the best long-term real estate investments in the U.S. The New York real estate market has been booming year over year. NYC home prices nearly doubled over the last decade. With supply and demand continuing to favor sellers, prices continue to rise year over year.

According to NeighborhoodScout’s data, the cumulative appreciation rate over the ten years has been 80.72%, which ranks in the top 50% nationwide. This equates to an annual average real estate appreciation rate of 6.10%.

According to StreetEast’s forecast, due to the higher cost of renting and elevated inflation, renter demand will continue to cool in 2023, pushing down asking rents. This relief in rent prices, however, will be slow to come by due to a limited inventory of rental units. Priced-out buyers may stay in the rental market until 2023’s spring purchasing season, keeping rents high.

Despite record-high rates and possible annual savings of $14,500 from roommates, NYC renters are prepared to pay more to avoid having roommates, according to their research. All of this suggests the rental market may cool off more slowly, despite reduced affordability. NYC homeowners will be better prepared for a possible recession.

NYC will continue to see an influx of new residents. Despite high rents, StreetEasy search data suggests the city continues to draw interest from potential new residents wishing to move from other areas. The strong demand in NYC rentals from outside the city, despite lower affordability, coincides with the city’s impressive recovery, which had restored 97% of the employment lost during the epidemic by September of this year, according to an analysis by the NYC Office of the Comptroller.

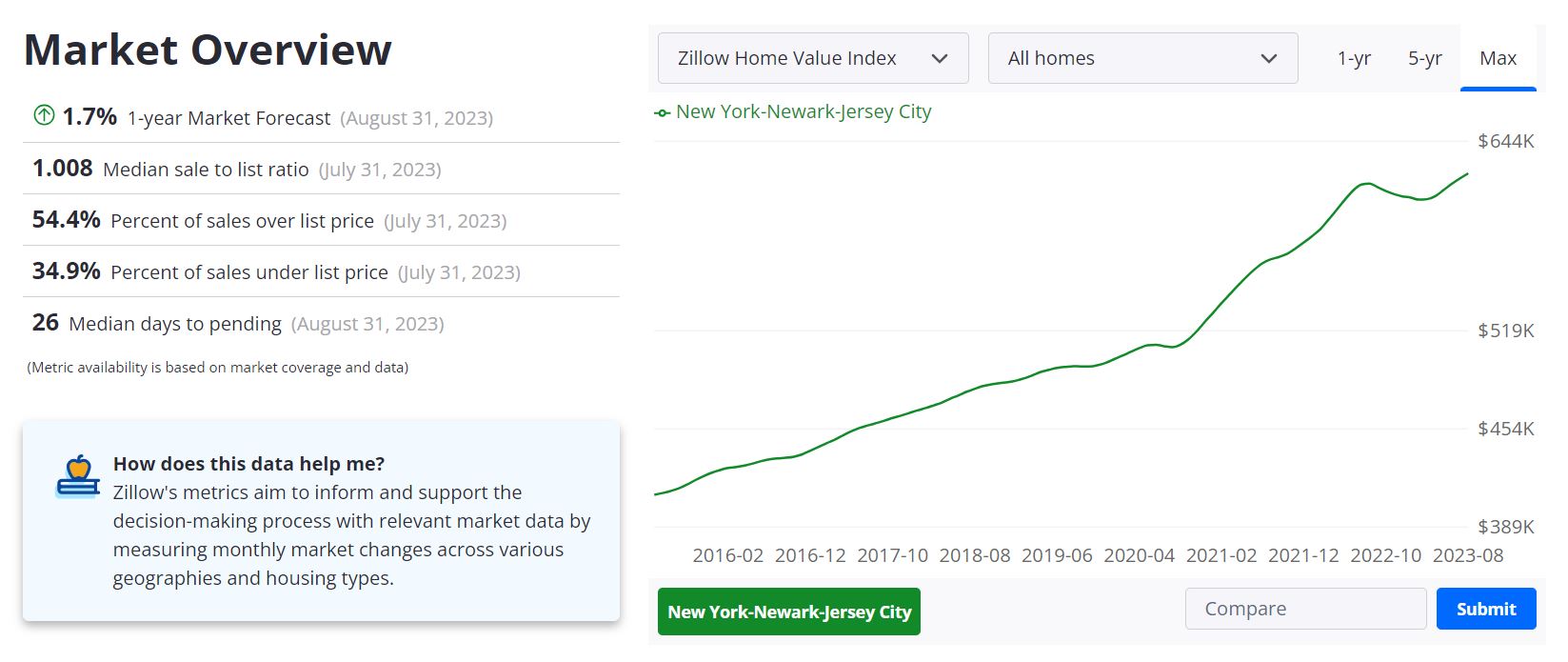

Zillow provides valuable insights into the current state and future projections of the real estate market in the New York-Newark-Jersey City area.

Current Real Estate Market Metrics (Data through August 31, 2023)

- Average Home Value: The average home value in the New York-Newark-Jersey City area is $623,405, reflecting a 1.1% increase over the past year.

- Median Days to Pending: Homes go to pending in around 26 days.

Key Metrics as of July 31, 2023

- Median Sale to List Ratio: The median sale to list ratio is 1.008, indicating a close alignment between sale and list prices.

- Percent of Sales Over List Price: 54.4% of sales were over the list price, suggesting a competitive market.

- Percent of Sales Under List Price: 34.9% of sales were under the list price, illustrating some room for negotiation.

NYC Real Estate Market Forecast (1-Year Projection from August 31, 2023)

Zillow predicts a 1.7% increase in the real estate market over the next year (by August 31, 2024).

Is NYC Real Estate Seeing a Price Drop?

Based on the data and forecast from Zillow, the NYC real estate market is not experiencing a drop in prices. The average home value has increased over the past year, and a further 1.7% increase is projected for the next year.

Is It a Good Time to Buy a House in NYC?

Considering the 1.7% projected increase in the market over the next year and the competitive nature of the current market with a significant percentage of sales going over the list price, it might be a good time to carefully consider buying a house in NYC. However, potential buyers should analyze their specific circumstances, market trends, and consult with real estate professionals for personalized advice.

New York’s Recovery From The Pandemic

Changes in house prices, rents, and mortgage interest rates can affect households’ income and wealth, as well as how much money they spend and on what. Housing costs and policies can also shape where people chose to live, work, and study, as well as their ability to move or change jobs. Rising house prices, by discouraging potential migrants, could significantly reduce the growth potential of the economy, shifting the balance of labor market growth from employment to wages, with a consequent deterioration in competitiveness.

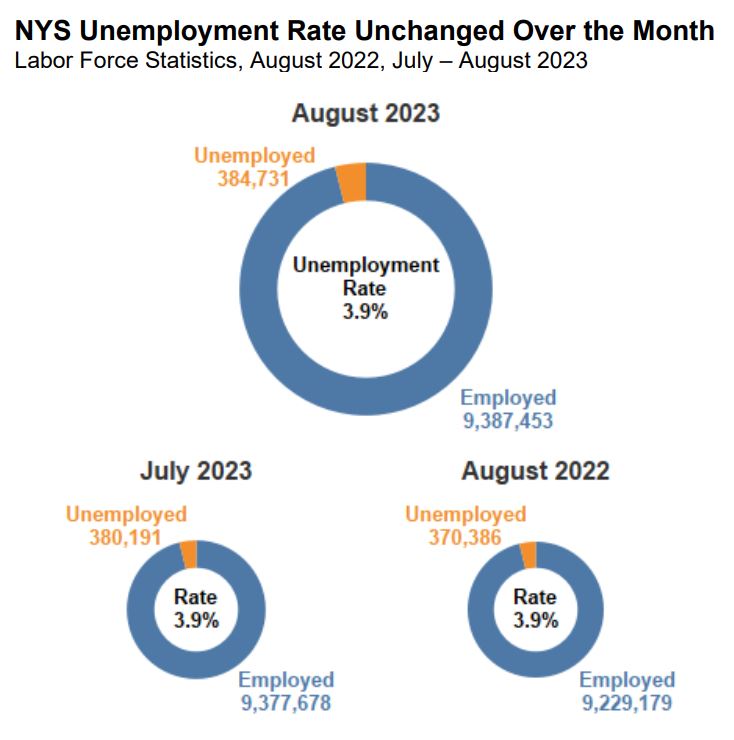

When it comes to the job market and real estate, the relationship is generally correlative: when one rises, so does the other, and when one falls, so does the other. According to preliminary figures released on September 14, 2023, by the New York State Department of Labor, the New York State’s seasonally adjusted unemployment rate held constant at 3.9% in August 2023.

At the same time, New York State’s labor force (seasonally adjusted) increased by 14,300. As a result, the labor force participation rate increased from 61.4% to 61.5% in August 2023, its highest level since September 2013.

The number of private sector jobs in New York State increased over the month by 4,900, or 0.1%, to 8,252,700 in August 2023. The number of private sector jobs in the U.S. also increased by 0.1% in August 2023. New York State’s private sector jobs (not seasonally adjusted) increased by 133,900, or 1.6%, over the year in August 2023, which was less than the 2.0% increase in the number of private sector jobs in the U.S.

On a net basis, the total number of nonfarm jobs in the state increased by 18,100 over the month, while private sector jobs increased by

4,900 in August 2023. At the same time, the total number of nonfarm jobs in the nation increased by 187,000, while private sector jobs increased by 179,000.

- New York City’s unemployment rate held constant at 5.3%.

- Outside of New York City, the unemployment rate increased from 2.9% in July to 3.0% in August 2023.

- The number of unemployed New Yorkers increased over the month by 4,500, from 380,200 in July to 384,700 in August 2023.

New York Rental Market Report

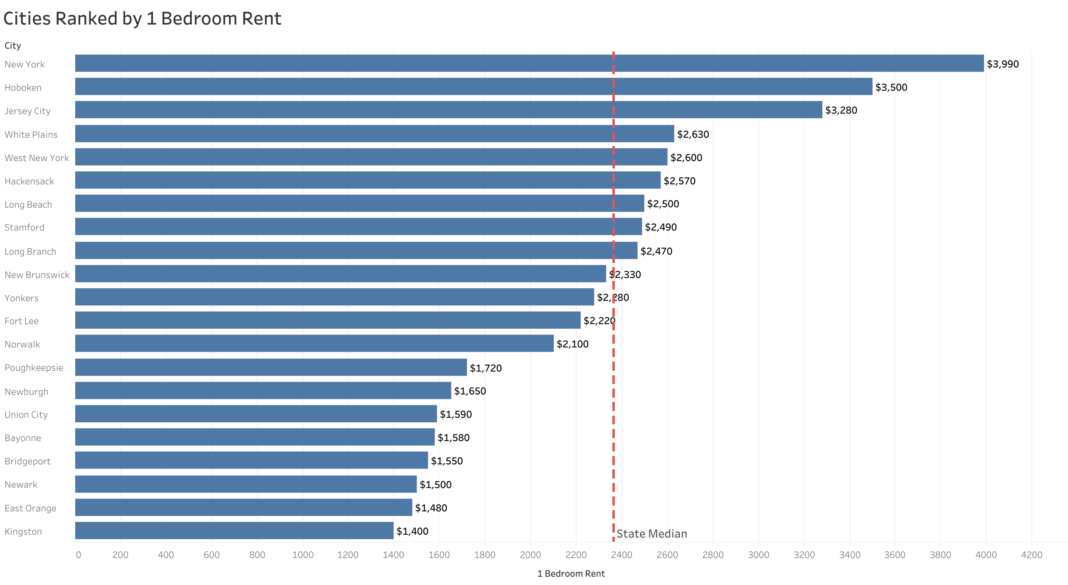

The Zumper New York City Metro Area Report analyzed active listings across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The New York one-bedroom median rent was $2,365 last month. New York City was the most expensive market with one-bedrooms priced at $3,990 whereas Kingston was the most affordable city with rent priced at $1,400.

Here are the places where it makes sense to invest in rental properties in the New York City Metro Area. These are the places where the demand for rentals is growing strong in 2023.

The Fastest Growing Cities For Rents in New York City Metro Area (Y/Y%)

- Hoboken had the fastest growing rent, up 25% since this time last year.

- Long Branch saw rent climb 23.5%, making it second.

- Yonkers rent was the third fastest growing, jumping 21.3%.

The Fastest Growing Cities For Rents in New York City Metro Area (M/M%)

- Fort Lee had the largest monthly rental growth rate, up 6.2%.

- Union City rent was the second fastest growing, climbing 6%.

- Yonkers was third with rent jumping 5.6%.

Where to Buy a House in NYC?

New York is dominated by renter-occupied one or two-bedroom apartments. 76.75% of New York’s dwellings are rentals. As per Neigborhoodscout.com, a real estate data provider, one and two-bedroom large apartment complexes are the most common housing units in NYC. Other housing types prevalent in NYC include single-family detached homes, duplexes, rowhouses, and homes converted to apartments.

The New York housing market has affordable townhomes. New York’s single-family homes account for just 1.15% of the city’s housing units. During the latest twelve months, the New York real estate did cool off. However, the cumulative appreciation rate over the ten years has been 38.81%, which ranks in the top 30% nationwide. Evaluate the specifics of the NYC housing market at the time you intend to purchase. Hiring a local property management company can help in finding tenants for your investment property in NYC.

New York City’s housing market is one of the most costly and competitive in the country. There are 237 neighborhoods in New York (as per Realtor.com). Tribeca has a median listing price of $3.9M, making it the most expensive neighborhood. Riverdale is the most affordable neighborhood, with a median listing price of $360K.

There are some buyer-friendly neighborhoods in New York City where buyers have a bit more negotiating power in neighborhoods as compared to sellers. Jackson Heights is one of New York City’s most buyer-friendly neighborhoods at the moment with home prices under $700,000. Other buyer-friendly markets with a median sales price below $700,000 include Rego Park, where the median sales price in Oct 2021 was $389K, trending down -by 8.9% year-over-year. The sale-to-list price ratio was 100 percent.

The median list price of homes in Sheepshead Bay was $499K in Oct 2021, trending down -by 5% year-over-year. The sale-to-list price ratio was 97.72 percent. The median list price of homes in East Flatbush was $650K, trending up 8.9% year-over-year. The sale-to-list price ratio was 100 percent. The median list price of homes in Brighton Beach was $569K, trending up 16.4% year-over-year. The sale-to-list price ratio was 97.03 percent.

Buyers have a bit more negotiating power in neighborhoods where the median home price falls between $700,000 and $1 million. In areas like Midtown East, where the median sales price is $872,500. Homes in Midtown East sold for approximately the asking price on average in Oct 2021. The other neighborhoods best for buyers looking to spend between $700,000 and $1 million are Bayside, where the median sales price in Oct 2021 was $720,000 and the sale-to-list price ratio was 99.37 percent; Gravesend ($684,500, 96.98 percent); Flushing ($838,000, 96.38 percent); and Bay Ridge ($499,000, 98.14 percent).

All of this could vary from time to time and can be checked on Realtor.com. Check out some of the best neighborhoods for investing in New York for the long term→ These neighborhoods have been selected from all five boroughs.

If you think of investing in NYC, you have decided on a long-term investment property. Here are the ten neighborhoods in NYC having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Inwood North

- Marble Hill

- Washington Heights Southeast

- Roosevelt Island

- W 115th St / Amsterdam Ave

- E 57th St / Madison Ave

- Madison Ave / E 52nd St

- W 58th St / Grand Army Plz

- Tribeca South

- W 70th St / Amsterdam Ave

Top Real Estate Estate Markets in New York

Buffalo real estate market

The Buffalo real estate investment offers a surprisingly good deal with low prices and relatively high rental rates. The Buffalo real estate market is dominated by older homes. A majority of homes in the Buffalo housing market were built before World War 2. Interestingly, this also means that many small apartment buildings are designed to serve a population that rented small units close to their jobs.

For example, roughly a third of homes are single-family detached homes, while almost half take the form of small apartment buildings. This creates an excellent opportunity for those in the market for Buffalo rental properties. You could buy a small apartment building with multiple tenants for the cost of a single rental property in a more expensive New York real estate market.

Syracuse real estate market

Syracuse’s real estate market offers cheaper property with a higher return on investment and a less hostile legal climate. It is one of the better choices if you want to invest in New York state. Another issue that factors into the equation is the job market. Lots of cities have a great quality of life but almost no one can afford to live there.

The Syracuse housing market ranked 6.3 out of 10 for its job market. That’s better than rural and much of upstate New York. And it is why there is a slow trickle of people moving in to replace those who leave. That’s why the Syracuse real estate market has a net migration of 5 or a stable population. This is in sharp contrast to the depopulation seen in most Rust Belt cities. It also means Syracuse’s real estate investment properties will hold their value for the foreseeable future if they don’t appreciate it.

Albany real estate market

Albany is a steadily appreciating real estate market. While it isn’t as famous or hot as NYC, it offers an affordable entry point and a massive pool of perpetual renters. Though it may not be somewhere you want to live, many locals are choosing to stay and make their homes here. And that will continue to drive demand for Albany real estate investment properties as long as they are priced right.

Rochester real estate market

You can also consider Rochester. The Rochester real estate market is stable, offering slow appreciation, affordable properties to outsiders, and good returns. It has strong, long-term potential that is only buoyed if NYC collapses. And this is one of the reasons why being everything the Big Apple isn’t is in your favor.

The Rochester real estate market enjoys a healthy population profile. Roughly a quarter of the population consists of children, and many are likely to remain due to the healthy job market. It also means that the Rochester housing market won’t crash if the job market weakens the way San Francisco collapses whenever the tech bubble bursts. Others choose to remain here because of the low cost of living.

Some of this article’s information came from referenced websites. Norada Real Estate Investments provides no explicit or implied claims, warranties, or guarantees that the material is accurate, trustworthy, or current. All information should be validated using the below references. Norada Real Estate Investments does not predict the future US housing market. Buying a rental property needs research, planning, and budgeting. Not all investments are good. Always do research and consult a real estate investment consultant.

References

- https://www.nysar.com/news/market-data/reports

- https://www.redfin.com/blog/data-center

- https://www.zillow.com/new-york-ny/home-values

- https://www.realtor.com/realestateandhomes-search/New-York_NY/overview

- https://streeteasy.com/blog/nyc-housing-market-data/

- https://www.redfin.com/city/30749/NY/New-York/housing-market

- https://www.elliman.com/corporate-resources/market-reports