Redfin agents in areas affected by inclement weather report slow homebuying activity, but agents in warmer locales say buyers and sellers are active as mortgage rates stay in the high-6% range, down from 8% a few months ago.

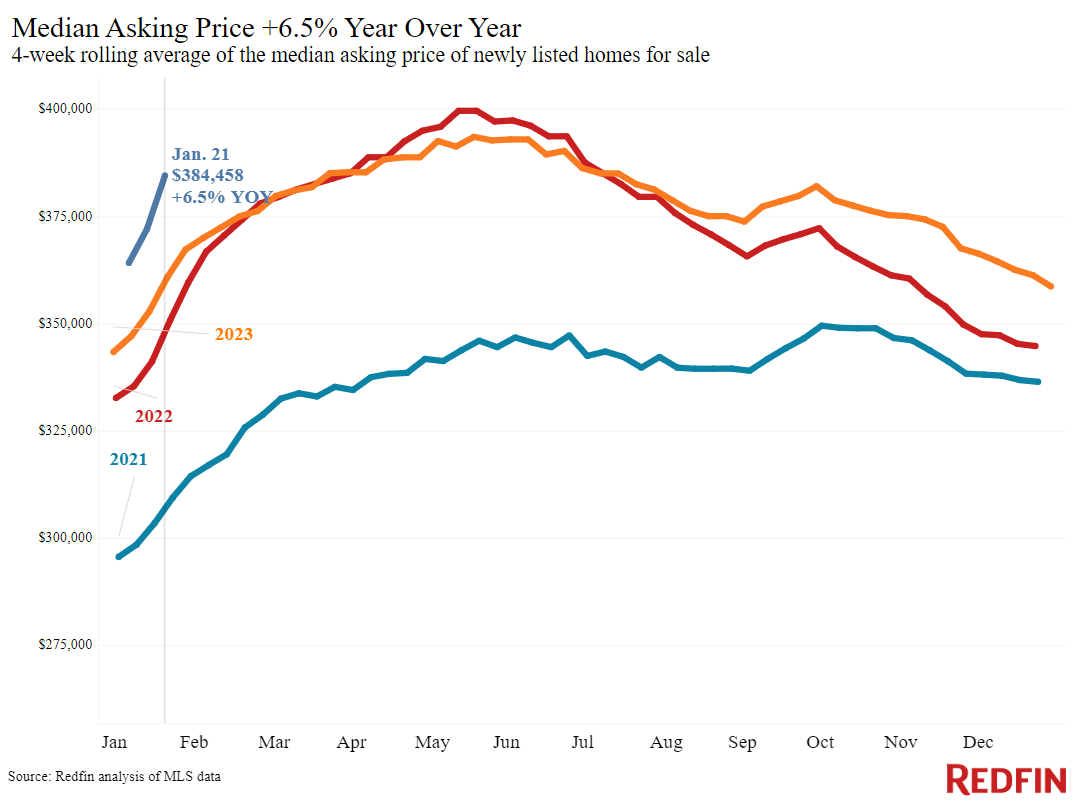

The median U.S. home-sale price rose 5.1% during the four weeks ending January 21, the biggest increase since October 2022. Asking prices rose 6.5%, also the biggest increase in more than a year.

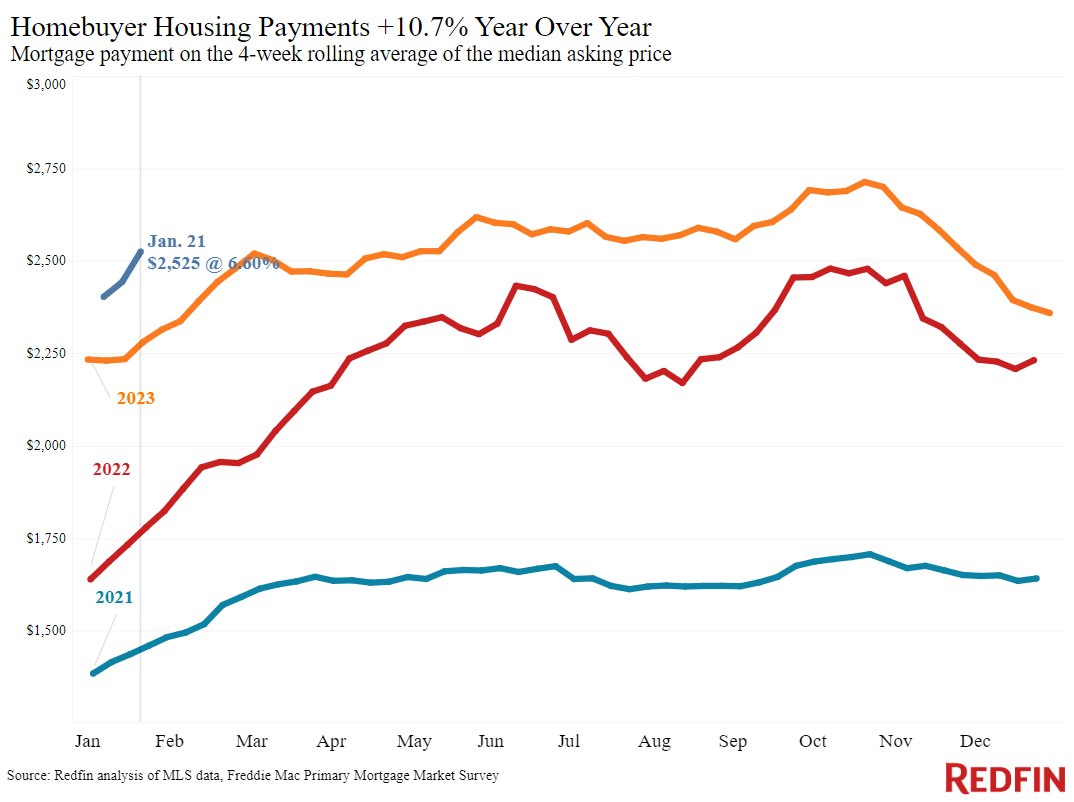

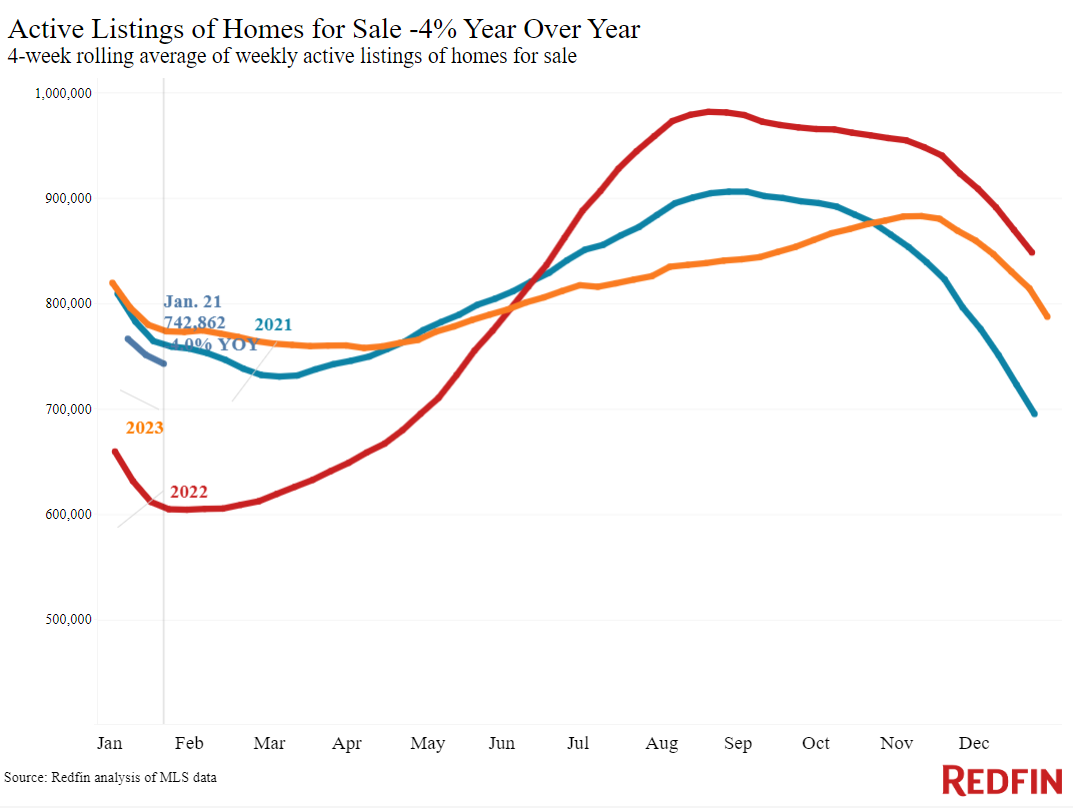

Prices are rising for a few reasons. One, inventory is still quite low. The total number of homes for sale is down 4% year over year. And while new listings are up 2%, that’s the smallest annual increase in about three months. Additionally, sellers can command higher prices because buyers have more purchasing power; mortgage rates are holding steady in the mid-to-high 6% range, down from 8% in October.

This week’s sales data shows sluggish activity as severe winter weather kept buyers and sellers on the sidelines in much of the country: Pending home sales are down 8% year over year, the biggest decline in four months. The big annual drop in pending sales can also be explained in part by the fact that they were improving at this time last year as mortgage rates fell.

While Redfin agents in places that are facing harsh weather report that would-be buyers are staying home (for now), mortgage-purchase applications are rising, and agents in warmer places say demand is picking up:

- “Real estate is usually slow in the Midwest in the winter, but this year it’s even slower than usual because the weather has been so extreme,” said Grand Rapids, MI Redfin Premier agent Christine Kooiker. “Casual house hunters are staying home to avoid the roads—but inventory is low enough that serious buyers are finding a way to see desirable homes. I also believe we’ll get busier as we approach spring. People are used to higher mortgage rates, and they know prices are likely to go up more if they wait.”

- “At the end of 2023, a lot of my clients said, ‘I’ll call you in January.’ And they did. This month has been nonstop,” said Shay Stein, a Redfin Premier agent in Las Vegas. “I wouldn’t say buyers are happy about 6.5% rates, but they’ll accept it because they’ll feel vindicated if rates rise back to 8%, and they can always refinance and avoid future bidding wars if rates drop further. And sellers are coming out of the woodwork, noticing the interest from buyers.”

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 6.95% (Jan. 24) | Up slightly from a week earlier | Up from 6.18% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.6% (week ending Jan. 18) | Lowest level since May | Up from 6.15% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Up 8% from a week earlier; up 17% from a month earlier (as of week ending Jan. 19) | Down 18% | Mortgage Bankers Association | |

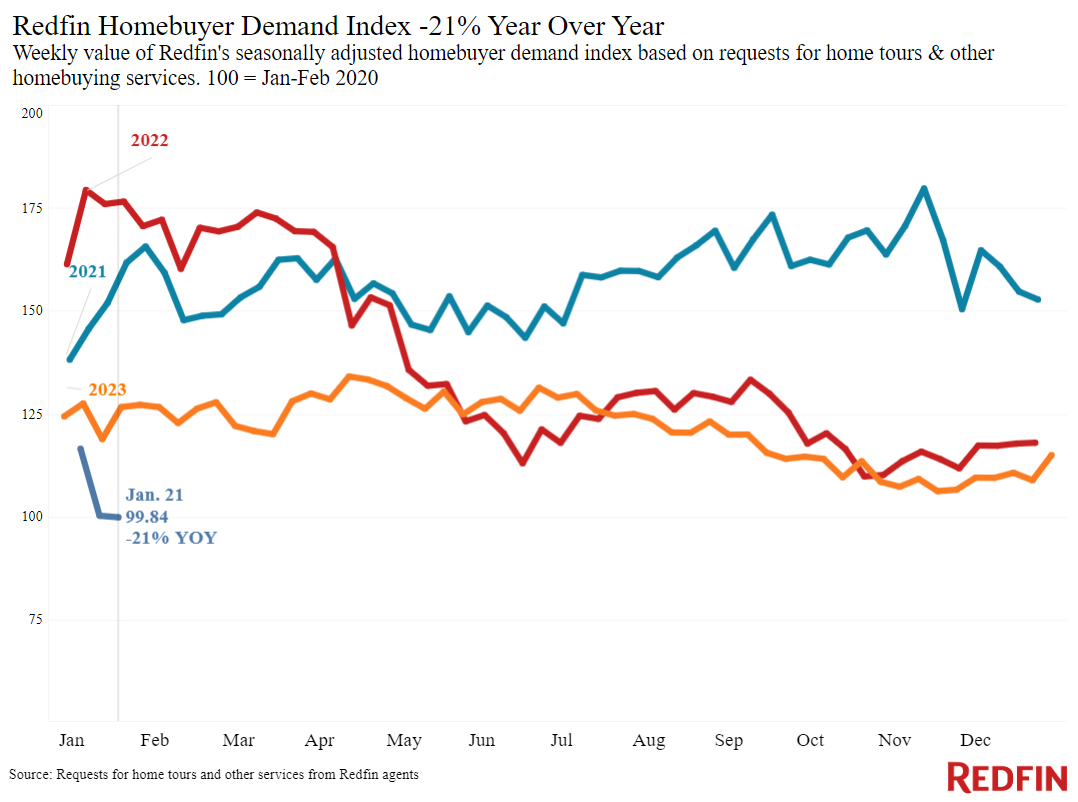

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down 8% from a month earlier (as of week ending Jan. 21) | Down 21% | Redfin Homebuyer Demand Index, a measure of requests for tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Up 18% from a month earlier (as of Jan. 20) | Down 15% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending January 21, 2023 Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. | |||

| Four weeks ending January 21, 2023 | Year-over-year change | Notes | |

| Median sale price | $362,225 | 5.1% | Biggest increase since Oct. 2022 |

| Median asking price | $384,458 | 6.5% | Biggest increase since Oct. 2022 |

| Median monthly mortgage payment | $2,525 at a 6.6% mortgage rate | 10.7% | Down roughly $200 from all-time high set during the four weeks ending Oct. 22, but up roughly $200 from the four weeks ending Dec. 31 |

| Pending sales | 54,331 | -8.2% | Biggest decline in 4 months |

| New listings | 54,796 | 2.2% | |

| Active listings | 742,862 | -4% | |

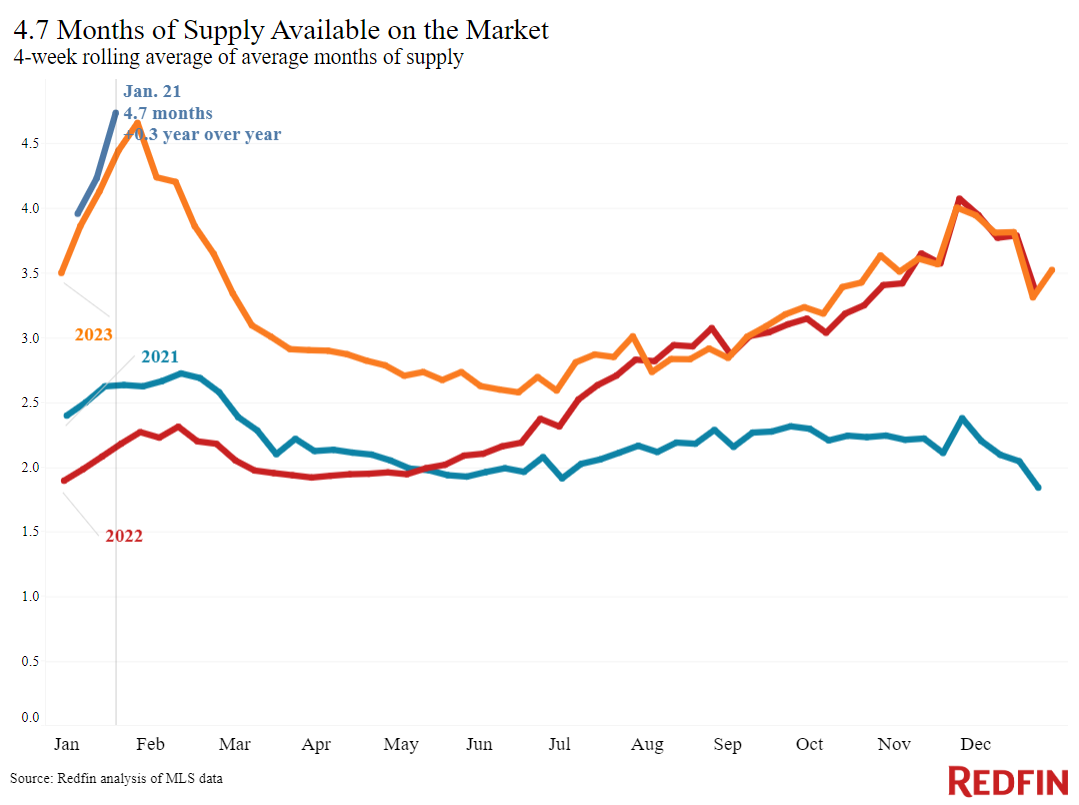

| Months of supply | 4.7 months | +0.3 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

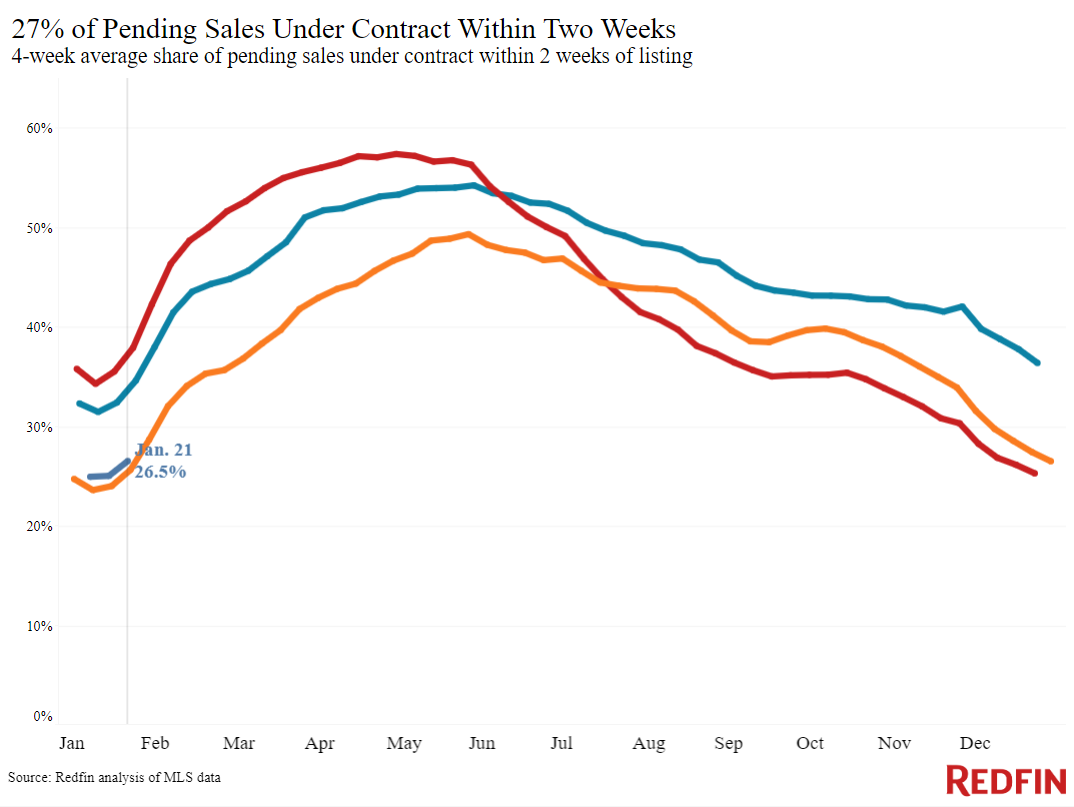

| Share of homes off market in two weeks | 26.5% | Essentially unchanged | |

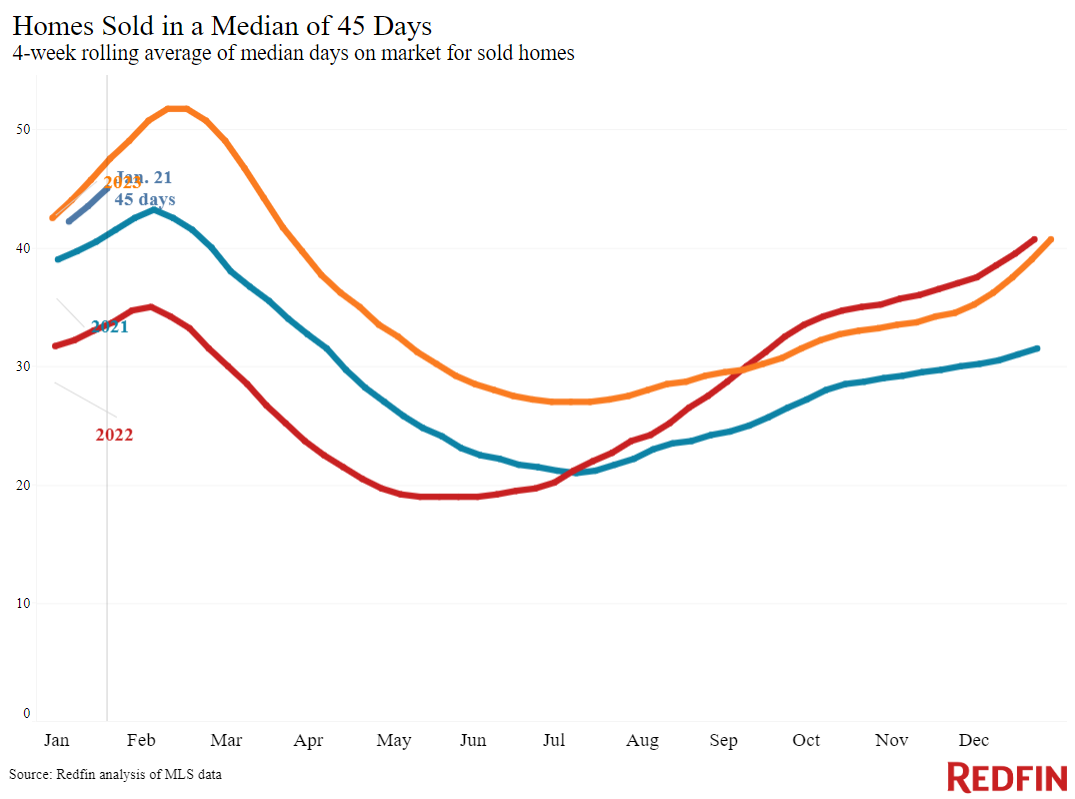

| Median days on market | 45 | -3 days | |

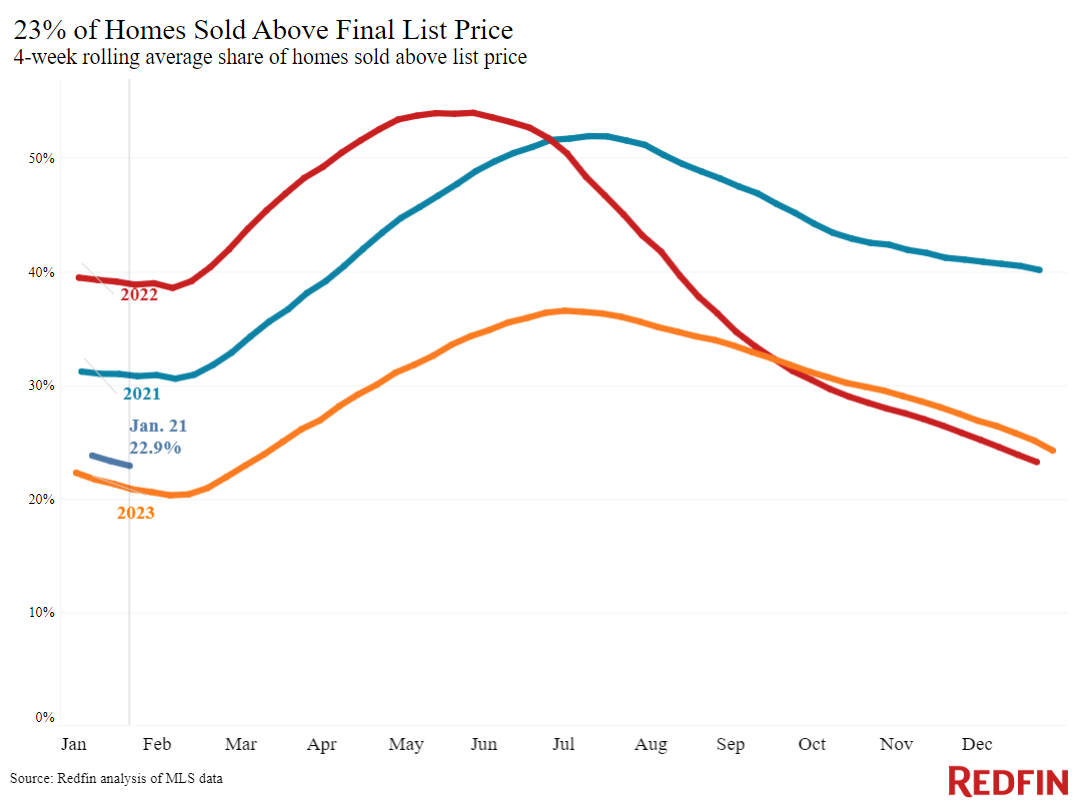

| Share of homes sold above list price | 22.9% | Up from 21% | |

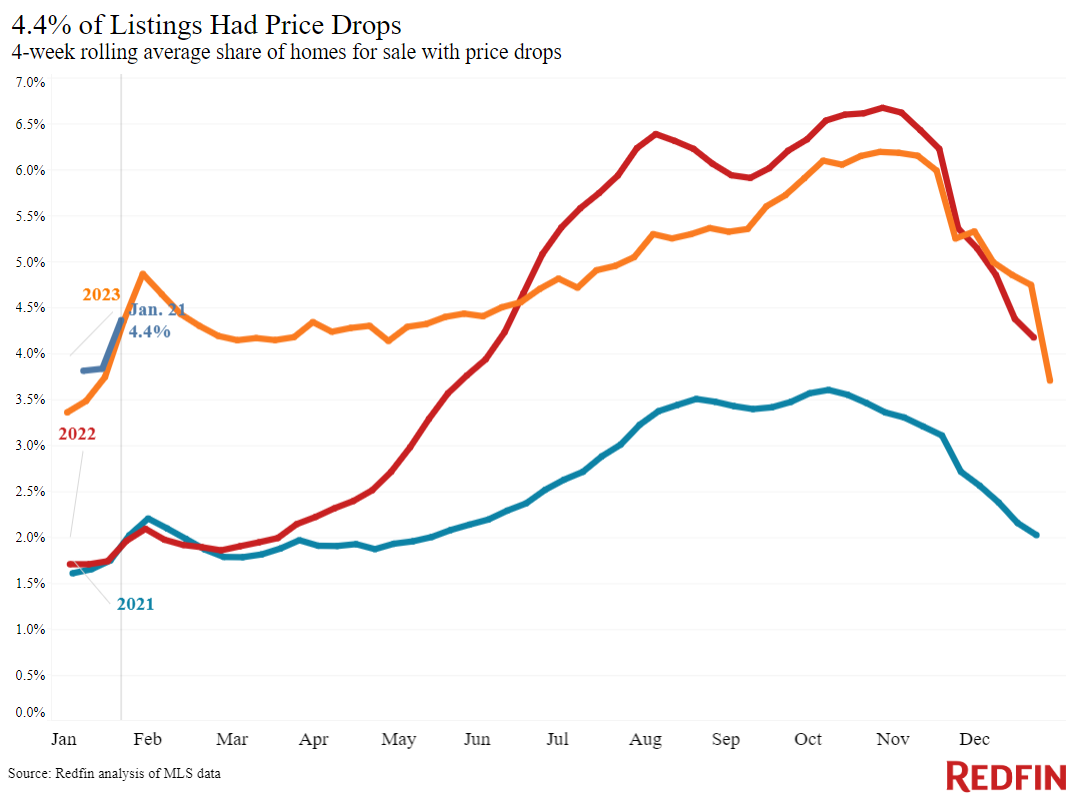

| Share of homes with a price drop | 4.4% | Essentially unchanged | |

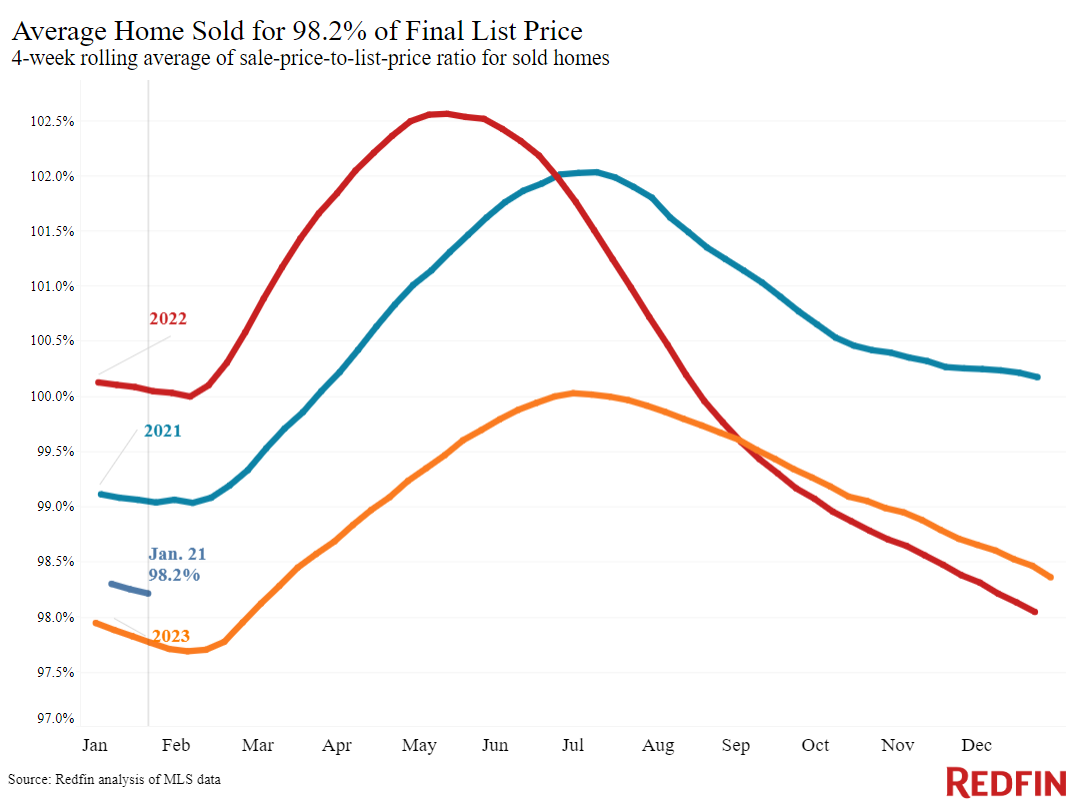

| Average sale-to-list price ratio | 98.2% | +0.4 pts. | |

Metro-level highlights: Four weeks ending January 21, 2023 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. | |||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases | Notes | |

| Median sale price | Anaheim, CA (13.6%) New Brunswick, NJ (13.5%) Miami (13.3%) Newark, NJ (12.6%) Providence, RI (11.8%) | Austin, TX (-3.7%) San Antonio, TX (-2.2%) Oakland, CA (-1.8%) Jacksonville, FL (-1%) | Declined in 4 metros |

| Pending sales | San Jose, CA (8.8%) Detroit (6.1%) Anaheim, CA (4.5%) Milwaukee, WI (2.6%) San Francisco (2.3%) | Portland, OR (-24.7%) New Brunswick, NJ (-21.9%) Newark, NJ (-18.9%) Houston (-18.3%) Atlanta (-17.3%) | Increased in 9 metros |

| New listings | San Diego, CA (22.3%) Phoenix (21.6%) Minneapolis, MN (20.4%) Miami (18.8%) Fort Lauderdale, FL (18.7%) | Chicago (-20.4%) Atlanta (-17.9%) Portland, OR (-16%) Fort Worth, TX (-11.2%) Nashville, TN (-8.6%) | Declined in 14 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.