The companies that can afford to, including Zillow, are aggressively growing MLO headcount in order to capture future market share, Mike DelPrete writes.

This article was shared here with permission from Mike DelPrete for Inman Intel, a data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

Even in a depressed market, people are still getting loans and buying houses — and some companies are positioning themselves to capture a larger share of the mortgage market.

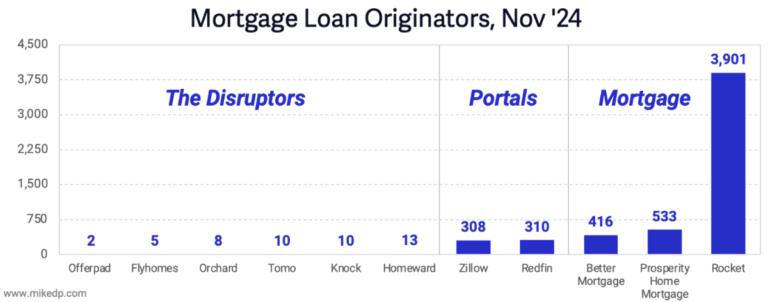

Why it matters: Tracking MLO (mortgage loan originator) headcount is a corollary to the size of a company’s mortgage business, and tracking headcount over time reveals who is investing for future growth.

- Three interesting examples are Zillow, Redfin and Better Mortgage.

- Over the past 15 months, there has been slow and steady headcount growth at Zillow, an equally slow decline at Redfin, and a rapid rise at Better (a classic hockey stick curve).

Broadening the field of companies and looking at the past three years provides helpful context in terms of growth, decline and relative size.

- The small disruptors pale in comparison to the portals and established mortgage companies.

- Better has been on a wild ride.

As a percentage, Better has grown the most over the past year.

- Tomo earns a noteworthy mention as the only disruptor to materially grow MLO headcount (but off a small base).

Mortgage origination volumes typically align closely with MLO headcount.

- Zillow’s origination growth has remained steady as it continues to invest in and grow its mortgage business.

- Redfin and Better appear to be riding more of a seasonal wave. (Note: Better’s origination volumes also include a growing refinance business, while Zillow and Redfin are primarily purchase volume.)

The closest metric to measuring overall efficiency would be origination volume per MLO.

- Zillow’s has been flat while Redfin experienced a recent uptick in the previous two quarters, the result of a seasonal uplift in volume with a corresponding drop in MLO headcount.

- Better’s metrics were materially better, but have been sliding, likely a result of exponential headcount growth outpacing origination volumes (i.e. investing for future growth).

Revenue per MLO is another efficiency metric, and in that category, Zillow is winning.

- In Q3 2024, Zillow’s mortgage revenue per MLO was $130,000 compared to $114,000 at Redfin and $89,000 at Better.

The bottom line: The companies that can afford to are aggressively growing MLO headcount in order to capture future market share.

- The mortgage businesses of the disruptors, primarily power buyers, remain at a much smaller scale as they’ve navigated the slow market and pivoted their business models.

- The portals are the ones to watch — having acquired mortgage businesses of significant scale — and with Zillow continuing to grow its MLO headcount.

- The pure-play mortgage companies are larger, especially Rocket, and well-positioned to execute on growth opportunities in their own adjacent spaces.

Mike DelPrete is a strategic advisor and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.