(Bloomberg) — Optimism is building that a game-changing fund design that will help asset managers shrink clients’ tax bills and grow their ETF businesses will soon be approved by the US securities regulator.

This week, at least seven firms including JPMorgan and Pacific Investment Management Co. filed amendments to their applications to create funds that have both ETF and mutual fund share classes. The filings update initial applications — some of which sat idle for months — with more details about the fund structure, and suggest the US Securities and Exchange Commission has engaged in constructive discussions with a growing number of applicants, according to industry lawyers.

“The SEC signaling is clear. These amendments really constitute the SEC prioritizing ETF share class relief,” said Aisha Hunt, a principal at Kelley Hunt law firm, which is working with F/m Investments on its application.

The latest round of filings, which also include Charles Schwab and T. Rowe Price, are serving as yet another sign that the SEC is fast-tracking its decision process on multi-share class funds, after F/m Investments and Dimensional Fund Advisors filed amendments earlier in April.

Brian Murphy, a partner at Stradley Ronon and lawyer on DFA’s filing, said other fund managers are receiving feedback and amending applications.

“We understand that the SEC staff is telling other asset managers to follow the DFA model as well,” said Murphy, who is also a former Vanguard lawyer and SEC counsel.

At stake is a novel fund model where one share class of a mutual fund would be exchange-traded. It was patented by Vanguard over two decades ago, and helped the money manager save its clients billions on taxes. The blueprint ports the tax advantages of the ETF onto the mutual fund, and is a tantalizing prospect for asset managers that are seeing outflows and looking to break into the growing ETF industry.

After Vanguard’s patent on the design expired in 2023, over 50 other asset managers asked the SEC for so-called “exemptive relief” to use the fund design. But it wasn’t until earlier this year, when SEC acting chair Mark Uyeda said the regulator should prioritize the applications, that it was clear the SEC would be interested in allowing other fund firms to use the model.

According to Hunt, the regulator has signaled that it will first approve a small subset of the applicants.

‘Work to be Done’

To be sure, an approval doesn’t mean that an issuer will be able to immediately begin using the fund blueprint. Because ETFs trade during market hours, they require different infrastructure than mutual funds, so firms that currently only have the latter structure will need to hire staff and form relationships with ETF market makers before they implement the dual-share class model.

“Dimensional has sort of set the template for what that language looks like in the context of these filings. And by extension cleared the way for approval, which feels imminent now,” said Morningstar Inc.’s Ben Johnson. “But then once we arrive at approval, there’s still going to be work to be done.”

Mutual fund firms will need to prepare for shareholders who want to convert, tax-free, into the ETF share class, which would require some “plumbing” and structural changes, said Johnson.

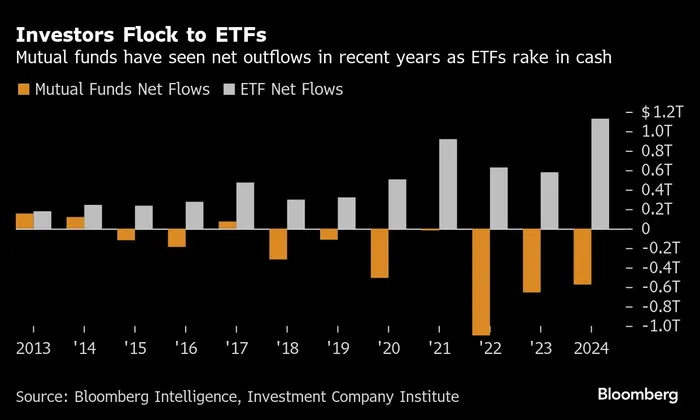

Another point to consider is that mutual funds that have significant outflows may not be ripe for ETF share classes, as that could result in a tax hit, according to research from Bloomberg Intelligence. In 2009, a Vanguard multi-share class fund was hit with a 14% capital-gains distribution after a massive shareholder redeemed its shares in the fund. Fund outflows can bring about a tax event when a mutual fund has to sell underlying holdings to meet redemptions.

Mutual funds have largely bled assets in recent years as ETFs have grown in popularity. As a result, legacy asset managers have found themselves battling for a slice of the increasingly saturated ETF market, which now boasts over 4,000 US-listed ETFs. SEC approval of the dual-share design could open the floodgates to thousands more funds.