After posting $33 million in profit in 2024, PHH Mortgage’s parent company said Thursday it will invest further in loan servicing and the originations technology that handles a majority of its customer inquires.

Turn up the volume on your real estate success at Inman On Tour: Nashville! Connect with industry trailblazers and top-tier speakers to gain insights, cutting-edge strategies, and invaluable connections. Elevate your business and achieve your boldest goals — all with Music City magic. Register now.

Loan servicer and reverse mortgage lender Onity Group Inc. says it will continue to invest in technology after restructuring its debt and posting its most profitable annual results in more than a decade.

Onity — formerly known as Ocwen Financial Corp., before rebranding in June 2024 — reported a $29 million fourth quarter loss Thursday, driven by $41 million in corporate debt restructuring charges the company says will pay off in the long run.

Onity’s $33 million in net earnings for the year made 2024 the company’s most profitable since 2013, as subsidiaries PHH Mortgage and Liberty Reverse Mortgage grew their respective businesses.

Glen Messina

“The year was marked by several significant milestones, including successfully completing a series of transactions to reduce our corporate debt, lower cost and extend maturities, rebranding to Onity, and expanding our digital capabilities,” Onity CEO, Chair and President Glen Messina said in a statement. “Fourth quarter results were consistent with the guidance we provided at the end of the third quarter, and even with the previously disclosed debt restructuring costs, we ended the year with book value per share at $56, up $4 from prior year-end.”

Shares in Onity, which in the last 12 months have traded for as little as $22.40 and as much as $41.27, fell 8 percent Thursday to close at $35.99.

Growing servicing portfolio

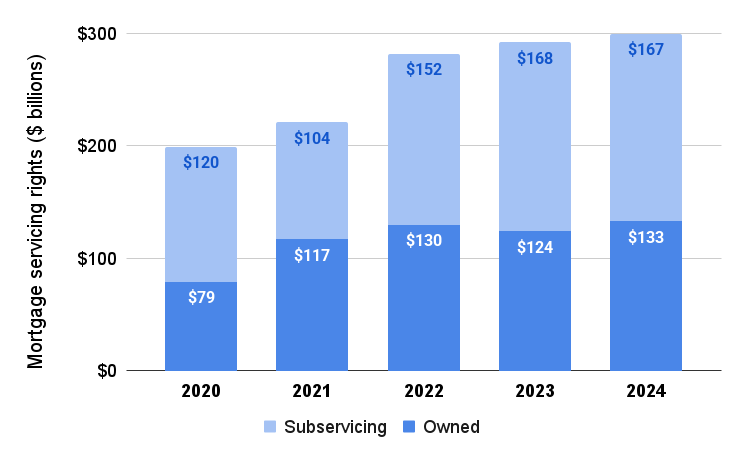

Source: Onity Group regulatory filings and investor presentations.

Onity’s PHH Mortgage subsidiary is among the largest U.S. mortgage loan servicers, collecting monthly payments or managing problems that come up with 1.4 million borrowers who owe more than $300 billion in mortgage debt on behalf of investors.

As a loan servicer, PHH Mortgage also has opportunities to originate mortgages by offering refinancing to borrowers it collects payments from, and is also one of the largest correspondent lenders in the U.S., with relationships to more than 700 correspondent sellers.

Mortgage originations grew by 33 percent in 2024, to $30 billion, with a third of that business ($10 billion) coming in the fourth quarter, a 72 percent jump from Q4 2023.

During Q4, PHH Mortgage’s investment in AI and other technology saved an estimated 50,000 hours of human labor per month, with 88 percent of customer inquiries resolved through digital interfaces like chat, Onity disclosed in an investor presentation.

PHH Mortgage last week announced the launch of an AI assistant available through its LoanSpan client reporting and analytics platform. LoanSpan’s AI assistant, LASI, can retrieve answers from client communications, policies and procedures manuals, presentations and educational videos.

Although based in West Palm Beach, Florida, most of Onity’s employees work overseas. Of the 4,300 employees on Onity’s payroll as of Sept. 30, 2024, 2,900 were located in India and 400 were based in the Philippines.

Onity back in the black

Source: Onity Group regulatory filings.

After posting a $64 million net loss in 2023, Onity was back in 2024, wrapping up the year by entering into several agreements with funds managed by Oaktree Capital Management in September to accelerate ongoing debt and capital restructuring efforts.

An Onity subsidiary in November issued $500 million in notes due in 2029 at 9.875 percent interest, paving the way for Onity to pay off $289 million in notes coming due in 2026 and $285 million in notes due in 2027.

In addition to giving Onity more time to pay off the notes, the effective yield on Onity’s new corporate debt structure is nearly 3 percentage points better, “which will enable our company to grow future earnings, capture upside potential in our share price, and provide greater financial flexibility to invest in the continued growth of our business,” Messina said at the time.

In conjunction with that agreement, Onity in December closed the sale of its 15 percent interest in MSR Asset Vehicle LLC (“MAV”) to Oaktree for $49.5 million. Under the terms of the sale, PHH Mortgage Corporation will continue as the exclusive subservicer of the MAV portfolio for an initial term of 5 years.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.