What happened this month

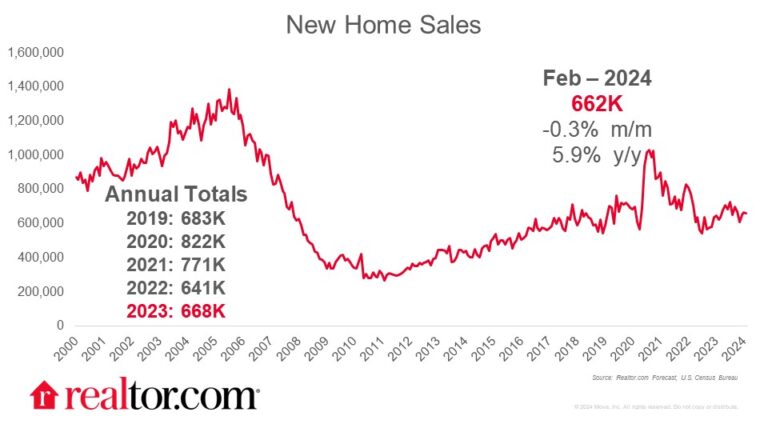

New-home sales remained relatively flat in February 2024 relative to January, falling just 0.3% monthly, to a rate of 662,000 new-home sales, 5.9% higher annually. New construction continued to be a popular option for buyers amid low existing-home inventory. However, as mortgage rates climbed back toward 7% in February, some buyers decided to put their homebuying plans on hold.

New-home sales picked up monthly in the South (+3.7%) and the West (+1.3%), but fell in the Midwest (-2.4%) and the Northeast (-31.5%). On an annual basis, the Northeast (+60.9%), West (+43.4%), and Midwest (+15.3%) all saw new-home sales growth, but the South saw a 10% annual decline.

New homes are a more common option for home shoppers

For-sale inventory picked up 14.8% annually in February as new listing activity saw an 11.3% annual increase. New-home inventory has remained steady amid falling existing inventory, and increased only 1.3% monthly and 5.9% annually in February, continuing to offer a steady stream of in-demand inventory.

But new homes are less likely to be move-in ready

Roughly one-third of homes available for sale today are newly built, a significant shift from pre-pandemic norms as builders offer home supply in an undersupplied market. Of the available new homes in February, roughly 23% were not started, 57% were under construction, and 20% were completed. Months supply bumped up slightly to 8.4 months, and median months held at 2.7 months.

Builders heed affordability concerns and benefit from limited existing homes

The median sale price for a new home fell to $400,500 in February, 7.5% lower than one year earlier as builders adjust to the market’s needs by building smaller, lower-priced homes. Furthermore, the share of homes sold for less than $400,000 increased to half of all new homes sold, an 8 percentage point increase from one year prior.

New-home sales remain higher on an annual basis and claim a larger chunk of the market than before the COVID-19 pandemic. Existing-home sales saw an impressive 9.5% monthly increase in February, landing just 3.3% lower than one year prior. New construction activity surged in February, signaling that builders are preparing for incoming buyer demand once mortgage rates let off the gas and settle to a more desirable level.

Buyer and sellers are gearing up for the spring season and the Best Time To Sell is approaching, but the spring’s frenzy will likely be dependent on how mortgage rates move in the coming months. Mortgage rates continue to be dependent on inflation, which has not eased in earnest quite yet.