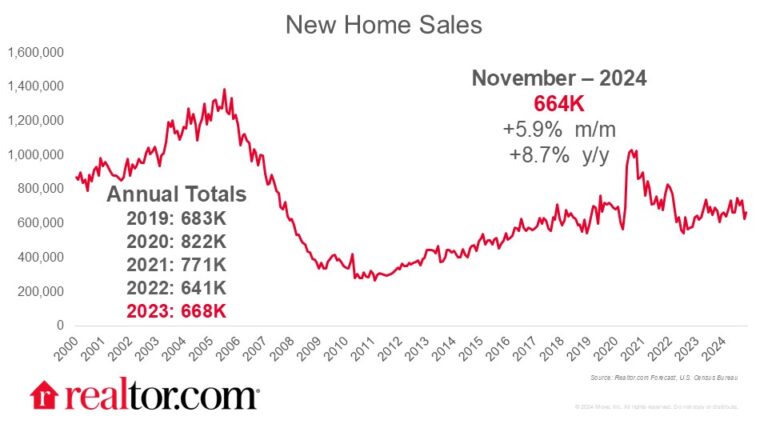

November 2024 New Home Sales

What Happened This Month:

New home sales picked back up in November after a weaker October, growing 5.9% month-over-month and 8.7% year-over-year to a seasonally adjusted annual rate of 664,000 homes. This comes as existing home sales also improved in November, providing the market a bit of holiday spirit to close out 2024. Despite mortgage rates failing to gain much negative momentum lately, home sales volume nationwide is gradually picking up as time slowly chips away at the lock-in effect that has sidelined many prospective home buyers with ultra-low mortgage rates on their current homes in recent years. Also pulling more buyers into the fray for newly-built homes are the attractive prices. The median sales price for a new home in November was $402,600, down 6.3% from last year.

Some of the regional oddities from the October new home sales data seem to have settled back into place. Northeastern sales–which skyrocketed in October–fell 41.0% in November, back to a level 11.5% below November of 2023. Southern sales, which dragged down the national numbers last month as the region with the highest concentration of new construction and the poorest sales performance in October, rebounded nicely and saw 13.9% month-over-month and 13.6% year-over-year gains. In the West, despite being the region with the second highest number of new homes sold, sales volume was down 7.5% month-over-month and 1.4% year-over-year. The Midwest will almost certainly be the region that has the best 2024 in terms of new home sales, with a 17.6% year-to-date edge over 2023 already.

New Home Share of Inventory Rising:

The number of newly-built homes for sale increased again in November, to a seasonally adjusted annual level of 490,000, marking four consecutive months without a retreat. New homes now make up 26.9% of all for-sale inventory, continuing to be a major piece of the market even as the number of existing homes for sale grows. The pace of sales growth slightly overtook inventory growth this month, and the months’ supply of inventory for new homes dipped a bit from 9.2 to 8.9. This is still a strong signal of a well-supplied buyer’s market in the new home segment.

More Completed New Homes are on the Market than Non-Started Ones:

A result of this healthy supply growth is that more move-in-ready new homes are on the market for buyers to actually take a look at. The share of new homes for sale that are completed has reached 25.3%, the highest since 2016. This is a positive development for buyers, who can take their time, see a finished home, and make an informed decision more than they have been able to for years.

What Does this Mean for Buyers and Builders?

This month’s new home sales data is a holly-decked, tinsel-strung, light-flashing holiday billboard for potential home buyers, inviting them to look at new construction to find their next home. The market is well-stocked, moving at a comfortable pace, and offers many low-cost options that the existing home market simply does not have right now. In fact, 25% of new home sales in November were for $300,000 or less, by far the highest share of 2024. It’s a common misconception that new builds are out of the price range of prospective buyers, when the reality is that new construction is often offering better prices, better financing, and a better product than the existing home segment is now.