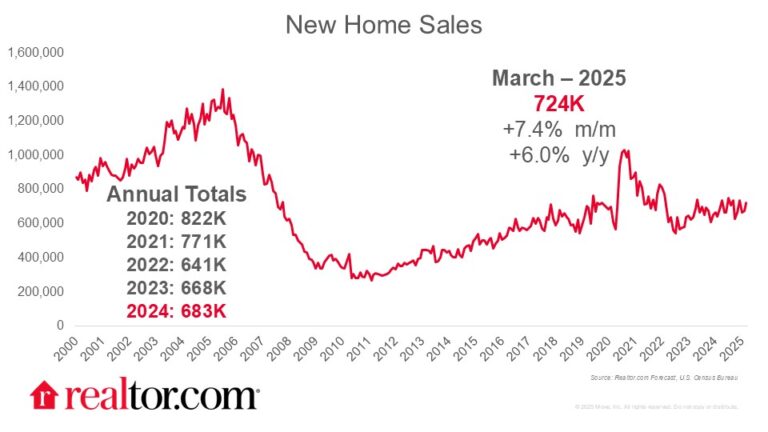

March 2025 New Home Sales

What Happened This Month:

New home sales jumped in March despite still-high mortgage rates and the beginning of a decline in consumer confidence stemming from tariff fallout that is slowing the existing home market. The number of new single-family homes sold in March reached 724,000 on a seasonally adjusted annual basis, a figure 7.4% higher than February’s and 6.0% above March 2024. This result is a bit surprising, given the doom and gloom statistics currently surrounding most of the housing market, but it is also a continuation of the trend we have seen in new home sales in recent months in which less expensive homes are driving sales activity. The median sales price fell to $403,600 from $411,500 in February and $436,400 last March, and the shares of homes sold for under $300,000 and from $300,000 to $399,999 both increased this month. Affordable new builds are the catalyst for growth in the new home segment.

Regionally, the South continued its dominance, being home to about two-thirds of all new homes sold in March. Southern new home sales increased 13.6% month over month and 22.3% year over year, and the South was the only region that saw sales increase from March 2024. The biggest declines in sales (-22.2% month over month and -33.3% year over year) were in the region with the least sales activity, the Northeast, so the data is a bit volatile. We know that the supply gap is most pronounced in the Northeast, so the slowdown in new home sales there is unwelcome news. The Midwest saw modest growth from February (+3.0%), but both that region (-15.9%) and the West region (-12.2%) posted year over year losses.

More Not-Yet-Started New Homes are on the Market:

The increased sales pace drove down the months of supply for new homes to 8.3 from 8.9 in February. This is roughly back to its level from last March, but an acceleration from the past several months. There were 503,000 newly built homes on the market as March came to an end, up slightly from February which was itself the highest number in at least a year. Interestingly, more of these new homes for sale have yet to be started. That share rose to 22.3%, nearly matching the share of new homes on the market that are completed. During the peak of the post-pandemic buying frenzy, fewer completed homes were for sale than ones yet to be started, but this reversed in 2024 as the pace of sales slowed down. This month’s elevated activity has shifted the makeup of homes on the market back toward how it was from 2021 to 2023.

What does this mean for buyers and builders?

This month’s new home sales data is a bit surprising given the headwinds for buyers nationwide, and it comes in direct opposition to trends in the existing home market, where the luxury segment has been outperforming more affordable inventory and many of the slowest local markets are in the South. In the new home space, low-priced and Southern inventory are chugging right along, with plenty of options available to prospective buyers.