What happened this month

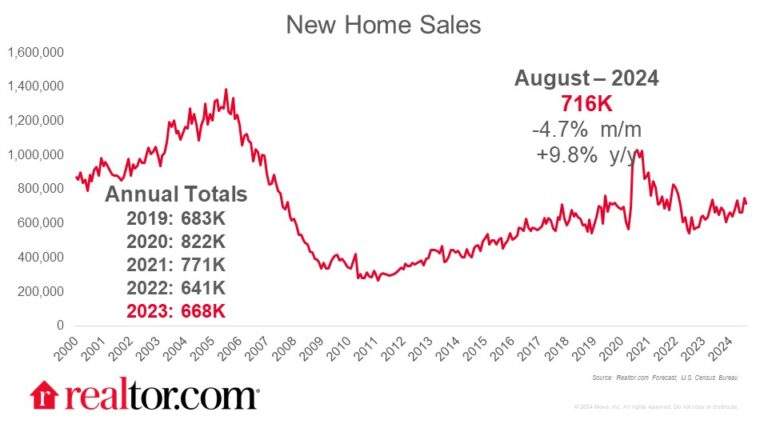

New-home sales fell by 4.7% in August, following an uptick in July, to a seasonally adjusted annual rate of 716,000. Despite mortgage rates diminishing throughout the month and new-construction activity picking up, buyers purchased newly built homes at a slower pace in August than they did in July as a bit of apprehension remains in the market.

Compared with August 2023, however, the nationwide rate of new-home sales increased by 9.8%. Fortunately for buyers, the median sales price of new homes in August fell to $420,600 from $429,000 in July, a 2% decrease month over month and a 4.6% decrease from August 2023’s median new-home sales price of $440,900.

We’ve shown that builders are putting smaller and more affordable homes on the market, and August’s sales data proves that this encouraging development is helping buyers’ bottom lines.

Regionally, the exception to the new-home sales slowdown is found in the South, where the seasonally adjusted annual rate of sales actually increased by 2.7% month over month, as Sun Belt states continue to be the focal point of new-home building and transactions. The national trend is driven instead by the least active region in terms of new-home sales activity, the Northeast, which is down 27.3% from the previous month and 33.3% from the previous year. New-home sales in the West were down 17.8% month over month and down 6.7% year over year, while the Midwest trailed July 2024 by 5.8% but led August 2023 by 26.6%.

Further evidence to support the finding that builders are prioritizing affordability can be found in the distribution of new-home sales prices. The share of new homes sold for under $300,000 jumped to 18% for August 2024 from 17% in July 2024 and just 12% in August 2023. New-home sales for $300,000 to $399,999 increased to 29% from 27% in July 2024 and 25% in August 2023, and new-home sales for $400,000 to $499,999 increased to 22% from 18% in July 2024 and 21% in August 2023. Builders are filling the gap created by trends in the existing-home market, where sales are slowing and prices are rising.

New-home share of inventory falling

With the pace of new-home sales slipping and new-home construction remaining strong, new-home inventory picked up slightly, to 7.8 months of supply compared with 7.3 in July. As existing-home inventory increases, though, the new-home share of all homes for sale dipped slightly, to 25.8%.

New homes are more likely to be move-in ready

More completed new homes were sold in August (372,000) than in July (352,000) on a seasonally adjusted annual basis, while sales of unstarted and under-construction homes fell. As the busy summer building season comes to a close, more projects are being wrapped up and buyers have more ready-for-move-in options available. The number of completed new homes still for sale also increased, from 102,000 to 105,000.

New-home sales activity is expected to pick up

The weaker August new-home sales figures come as a bit of a surprise given the favorable buying conditions resulting from falling prices and mortgage rates as well as increased new-construction activity. Some potential buyers remain on the sidelines, so the goal of builders will be to flaunt the affordability and amenities of their newly built homes for sale, especially as the market for existing homes remains sticky in terms of lower sales volumes and higher sales prices.