What happened

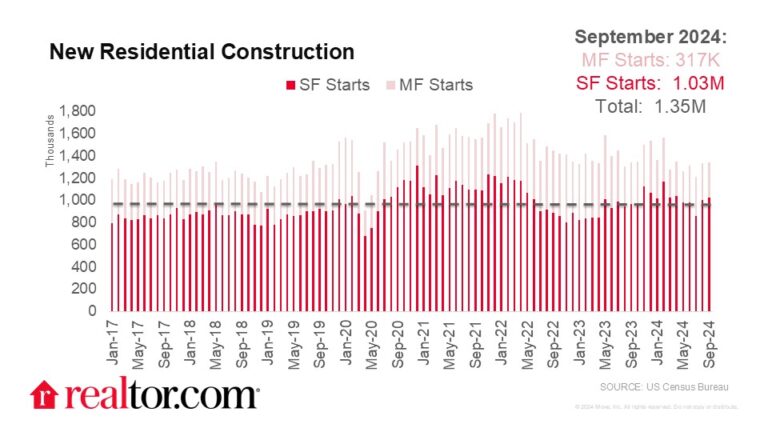

New residential construction retreated slightly in September following a strong August. The number of units permitted for construction fell to 1,428,000 on a seasonally adjusted annual basis, a decrease of 2.9% from the previous month and 5.7% from the previous year. Housing starts slowed as well, falling 0.5% from August 2024 and 0.7% from September 2023. Completions dipped by 2.7% month-over-month, but remain up by 14.6% year-over-year. After leading the surge in August, multi-family projects dragged in September. Permits fell 10.8% month-over-month and 17.4% year-over-year, starts fell 4.5% month-over-month and 15.7% year-over-year, and completions fell 8.7% month-over-month though they remain elevated from 2023 figures. After 14 months of consecutive declines in median asking rent, builders seem to be responding to the market and shifting their focus to single-family construction.

Where it happened

This month’s data contains some eye-popping regional splits, mostly in the Northeast, which this team of economists suggests should be taken with a grain of salt. Housing starts in the Northeast are up 57.9% month-over-month and 109.3% year-over-year for September, the same month in which the region’s first snowfall occurred. Completions too were up 55.6% month-over-month and 92.2% year-over-year on a seasonally adjusted annual basis. Blips in the raw data during off-peak months of the year in regions with a high degree of seasonality, like the Northeast, can skew the adjusted figures that are primarily reported. We will be interested to see how next month’s revisions of the September data come in.

Meanwhile, the majority (51.0%) of newly-built homes hitting the market are still in the South, where September completions fell 21.6% from the spike month in August, but still exceed September of last year by 3.1%. The West region had a strong month in terms of housing completions, beating August by 22.1% and last September by 25.3%. On a permitting basis, the South also dominates in terms of future construction, constituting 53.6% of permits issued nationally. Southern states make up most of the top 10 states for new construction highlighted in our New Construction Insights Report, and it appears that trend will continue.

What does this mean for homebuyers, sellers, homeowners, and the housing market

Prospective homebuyers are facing major affordability challenges, with mortgage rates ticking back up into the mid-6% range and listing prices remaining stubbornly high. Though the bottom-line new construction figures for September 2024 are somewhat disappointing, single-family projects specifically had a more promising month. Single-family permits and starts were up from even a strong August, and single-family completions still exceeded September 2023. Builders are increasingly bringing smaller, more affordable homes to the market, so buyers may find more newly-built homes that fit their budget in the coming years if the pace of new construction continues.