What happened to mortgage rates this week

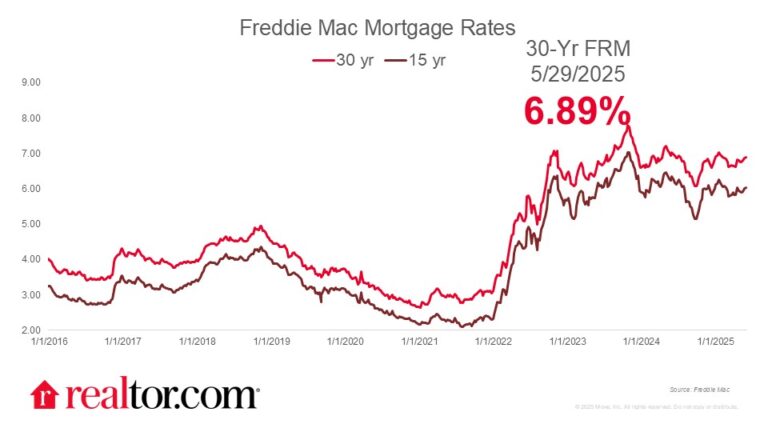

The Freddie Mac 30-year mortgage rate rose 3 basis points, to 6.89% this week, the highest level since Feb. 6, 2025. The increase tracks modest gains in the 10-year Treasury yield and comes amid President Donald Trump’s calls to end the federal government’s conservatorship over Fannie Mae and Freddie Mac. Mortgage rates have now climbed for three straight weeks, up 13 basis points since early May and a full 25 basis points since early April.

What it means for the housing market

High mortgage rates will continue to pose significant challenges for homebuyers. With rates threatening to cross 7% for the first time since January, the “lock-in effect”—where current homeowners are reluctant to sell and give up their lower mortgage rates—shows no signs of easing. According to a recent Realtor.com® survey, just 2% of respondents said they would be willing to buy with rates above 6%.

Despite persistently high rates, there are growing signs the market is coming into better balance for prospective buyers. Springtime is usually when the market starts heating up, but this year, seasonally adjusted home prices fell month over month. While overall inventory remains below pre-pandemic norms, both new listings and total homes for sale continued to rise last month. Furthermore, homes are staying on the market for longer, and nearly 1 in 5 listings saw a price cut last month, suggesting buyers might be regaining some bargaining power despite rising interest rates.