What happened to mortgage rates this week

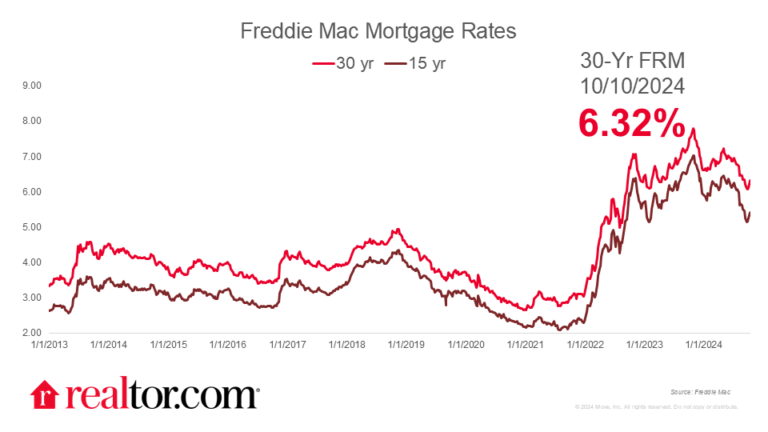

Mortgage rates climbed for the sixth consecutive week, rising by 7 basis points to 6.79%, the highest since July 11th on the heels of the 10-year treasury hitting nearly 4.5% yesterday – the highest level since April. Though much of the mortgage rate data that feeds into this week’s number was based on lower, but still rising, pre-election treasury yields, we should expect mortgage rates to continue to rise in the coming weeks based on the trend in post-election yields.

Why are 10-year yields, and thus mortgage rates, rising so quickly after the Trump and Republican election win? While it’s not always 100% clear what markets are thinking, they could be expecting a combination of stronger economic growth, more fiscal spending, and higher prices/inflation (because of more tariffs and lower taxes). While we still expect mortgage rates to stabilize by the end of the year, they will likely be at a higher level than markets were initially expecting prior to election week. It’s also important to note that although the Fed is still likely to cut the funds rate by 25 basis points today, markets are now showing a 33% chance that the Fed will hold off on a December rate cut.

What it means for the housing market

Homebuyers hoping for another dip in mortgage rates by the end of the year will likely be disappointed, but the good news is we still expect the long-run trend in rates to be downward as the fight against pandemic-induced inflation comes to an end. Homebuyers frustrated by higher interest rates should instead turn their optimism to other buyer-friendly characteristics in the housing market, such as the highest inventory since December 2019, the slowest seasonal market in five years, and nearly 20% of listings coming with price cuts.