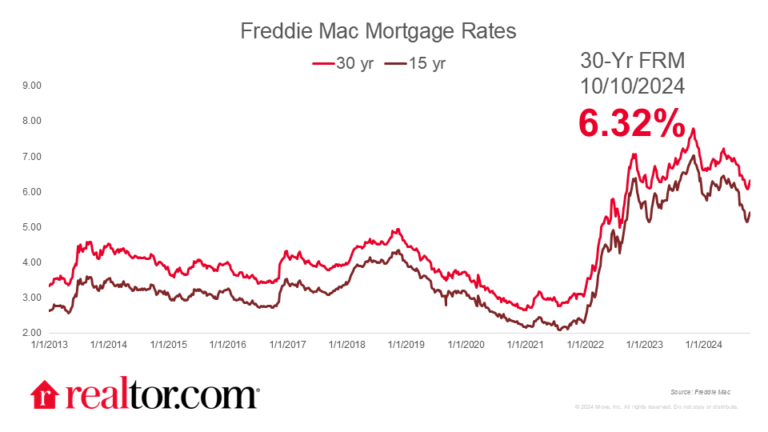

What happened to mortgage rates this week

The Freddie Mac rate for a 30-year mortgage rose by 20 basis points this week to 6.32% as 10-year Treasury yields surpassed the 4% threshold. Despite being three weeks since the Fed’s rate cut, mortgage rates did not decrease further as many had expected. While September’s strong jobs report alleviated some employment concerns, the recent surge in jobless claims introduces another layer of uncertainty to the overall picture. Meanwhile, the consumer price index’s continued slowdown in September supports the case for two 25 basis point cuts, one in November and another in December, despite initial market expectations of a cumulative 75 basis point cut by year-end. As a result, buyers should be prepared for mortgage rates to remain steady or potentially rise in the near term. Nevertheless, the recent Fannie Mae sentiment survey revealed that an all-time high share of respondents believe mortgage rates will decrease in the next 12 months.

What it means for the housing market

Although mortgage rates have fluctuated recently, the recent declines may have offered some relief to homebuyers who have been grappling with high rates. Specifically, homebuyers in markets with higher mortgage usage, such as Washington, DC, Denver, CO, and Raleigh, NC, may be more sensitive to these lower rates and more likely to return to the market. In contrast, markets like New Orleans, LA, Buffalo, NY, and Pittsburgh, PA, which have a higher percentage of outright homeowners, may experience a degree of insulation from the impact of declining mortgage rates.

While we don’t expect any significant declines in mortgage rates by the end of the year, existing homeowners could continue to leverage their record-high equity to take advantage of opportunities in today’s housing market, despite 84% of existing mortgages having a rate of 6% or lower.