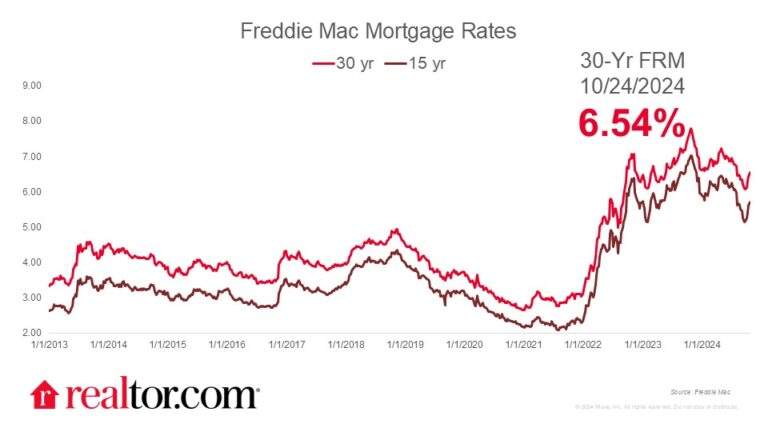

What happened to mortgage rates this week

Mortgage rates climbed for the fourth consecutive week, reaching 6.54% as the 10-year Treasury marched higher toward 4.25%, the highest level since July. This rapid runup in mortgage rates has sapped some of the burgeoning enthusiasm in the market, which was spurred by near-6% rates in September. However, rates are expected to generally move lower in the coming months, despite recent volatility. Stronger-than expected economic data, including robust employment data and stubborn core inflation, have prevented downward progress in mortgage rates over the past month. The antidote to the recent climb will be if upcoming economic data falls more in line with expectations.

What it means for the housing market

Existing-home sales eased in September, despite lower mortgage rates, as many buyers held off in anticipation of bigger rate drops in the future. Despite still-slow buyer activity, single-family home construction picked up in September, setting the stage for even more home options, and therefore less price pressure, in the coming months. While home prices remain stubbornly high, rents dipped slightly at the national level, and more significantly in metros like Nashville, Dallas, and Denver, in September. Rents have fallen annually for the past 14 months at the national level, but have not fallen significantly below COVID-19 pandemic-era highs. Easing mortgage rates not only help homebuyers, but could also help rental demand ease, which would take some pressure off rental prices, too.