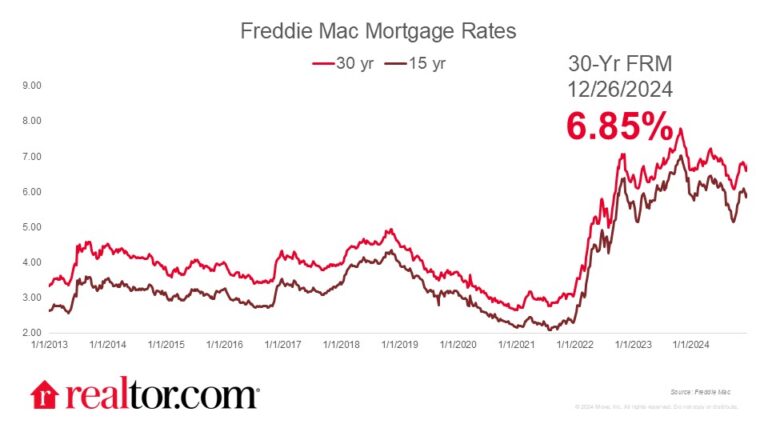

What happened to mortgage rates this week

The Freddie Mac rate for a 30-year mortgage jumped 13 basis points to 6.85% this week, reaching its highest level since July, as the impact of the December Fed meeting trickled through the market. The 10-year Treasury yield spiked last week in response to the Fed’s outlook, and remained elevated through the rest of the week, pulling mortgage rates higher. However, the PCE inflation data for December, which was released on Friday, showed a promising slow down in price growth, which could boost market optimism and take some pressure off of interest rates.

What it means for the housing market

With the last full week of the year upon us, many households are gearing up for 2025 and hoping for a more favorable housing market. On the plus side, we expect mortgage rates to ease and housing inventory to grow next year as builder activity and the weakening lock-in effect bring more homes to the market. However, still-limited home supply is expected to boost price growth, which means housing costs are likely to remain high. Some local markets are poised to see more significant price and sales growth in 2025, led by sunbelt metros with ample inventory, including new homes.