The world of real estate and mortgages is ever-changing, with interest rates playing a significant role in shaping the housing market’s dynamics. In 2023, the surge in inflation has led to an increase in mortgage rates. In this blog post, we will delve into the latest mortgage rate predictions, the factors influencing their fluctuations, and expert predictions for the future, helping potential homebuyers and homeowners make informed decisions.

Will Mortgage Rates Go Down?

As we navigate through 2023, mortgage rates are experiencing fluctuations driven by the Federal Reserve’s actions and the economic outlook. The recent rise in rates has prompted many potential homebuyers to adjust their budgets to accommodate the new reality. However, expert predictions offer hope for a potential decline in mortgage rates once the Federal Reserve’s rate hikes conclude.

Observing economic indicators and inflation trends can help individuals gauge the future trajectory of mortgage rates. For those considering homeownership or refinancing, staying informed about the latest mortgage rate predictions is crucial in making sound financial decisions.

Mortgage Rates Rise Amidst the Fed’s Inflation Fight:

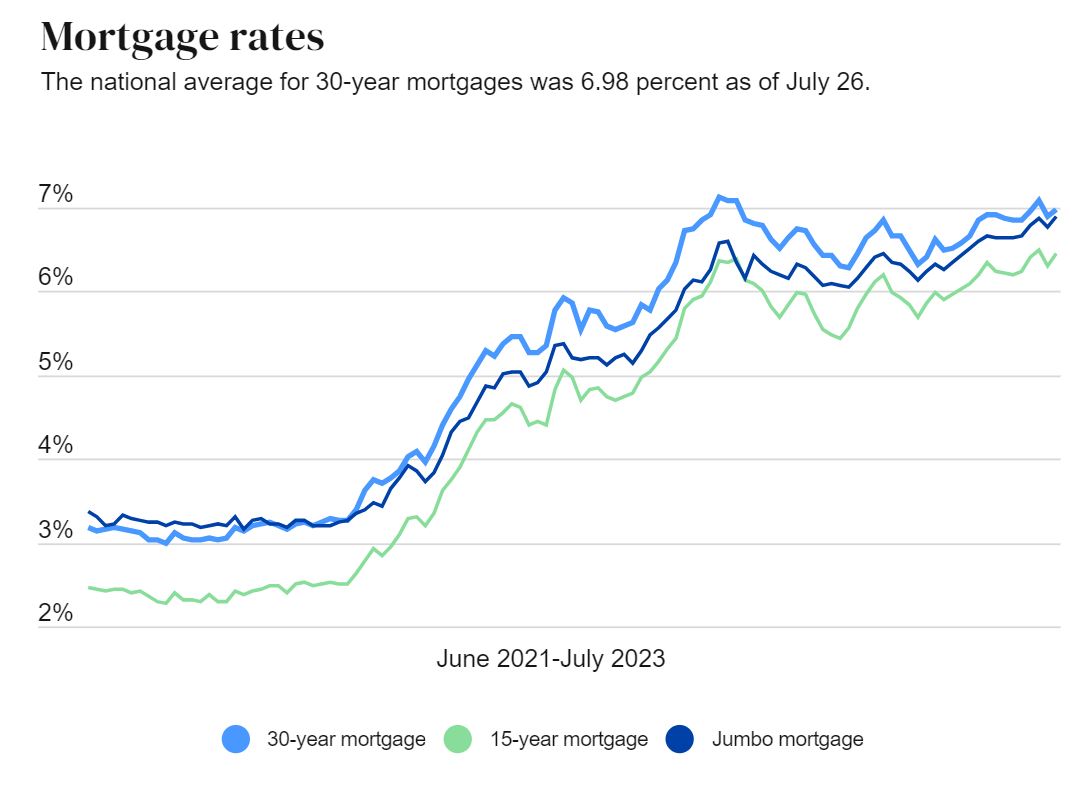

According to Bankrate’s weekly national survey, U.S. mortgage rates experienced a notable rise, climbing to an average of 6.98 percent for 30-year mortgages. The Federal Reserve resumed rate increases as it re-engaged in its battle against inflation. Although the central bank does not directly set fixed mortgage rates, its policies have a significant impact on the mortgage market.

ALSO READ: How To Invest in Mortgage Estate Notes?

Understanding the Relationship Between Inflation and Mortgage Rates:

The link between inflation and mortgage rates is crucial to grasp the current market dynamics. As the Federal Reserve strives to control inflation, mortgage rates tend to remain chained to inflation metrics. The relevant benchmark, in this case, is the 10-year Treasury yield, which has exhibited fluctuations in recent weeks. Experts anticipate that further disinflation in the coming months could lead to modest downward movements in Treasury yields, which often influence mortgage rates.

The Impact of Economic Outlook on Mortgage Rates:

While the Federal Reserve’s actions guide the mortgage market, mortgage rates are more directly influenced by the overall economic outlook and inflation expectations. A slowing economy and easing inflation pressures are prerequisites for lower mortgage rates. Homebuyers and homeowners should pay close attention to economic indicators and inflation trends when gauging the potential direction of mortgage rates.

Current Mortgage Rate Trends:

The recent trend in mortgage rates indicates a gradual rise, with the average rate for 30-year fixed mortgages sitting at 6.98 percent as of July 26. Over the past 52 weeks, the benchmark 30-year fixed-rate mortgage averaged 6.58 percent, showing a significant increase from 5.59 percent a year ago. Observing these trends can help individuals make informed decisions about their mortgages and refinancing options.

Mortgage Rates Predictions by Experts for 2023:

Experts had initially projected a decrease in mortgage rates by the end of 2023 as the Federal Reserve concluded its rate hikes. However, the robustness of the U.S. economy has impacted these forecasts. Despite this uncertainty, many economists believe that once the Federal Reserve signals the peak of its rate hikes, mortgage rates should trend down. As inflation slows down, it is expected to create downward pressure on mortgage rates, potentially leading to more favorable conditions for homebuyers and homeowners.

Mortgage Rates Predictions 2023 [Year End]

Mortgage experts see rates decreasing over the coming months as the economy slows. Lawrence Yun, the chief economist of the National Association of Realtors, said he expects rates to fall to 5.5 percent by mid-2023. Fannie Mae sees the average rate of a 30-year fixed getting to 6.8% in 2023. Meanwhile, the prediction from Freddie Mac is 6.4%.

According to an updated prediction from the Mortgage Bankers Association as well, mortgage rates are also anticipated to fall in 2023, MBA economists also predicted that the United States would enter a recession in the first half of next year, owing to tighter financial conditions, reduced business investment, and slower growth globally. According to their mortgage rate prediction, this will raise the unemployment rate from 3.5% to 5.5% by the end of 2023.

“Next year will be particularly challenging for the US and global economies,” said Mike Fratantoni, chief economist and senior vice president for research and industry technology. “The sharp increase in interest rates this year – a consequence of the Federal Reserve’s efforts to slow inflation, will lead to an equally sharp slowdown in the economy, matching the downturn that is happening right now in the housing market.”

However, the good news for homeowners is that mortgage rates are projected to fall next year, according to Fratantoni. According to MBA, mortgage rates will conclude in 2023 at roughly 5.4%. According to Freddie Mac, the average rate for a 30-year fixed-rate mortgage is currently 6.94%. Fratantoni warned that mortgage rates will remain volatile in the coming months because the Fed is projected to continue raising interest rates this year.

According to the forecast, the Fed’s continuous attempts to contain inflation will eventually limit homebuyer demand for mortgages in 2023. Mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022, according to MBA. The forecast calls for purchase mortgages to drop by 3% next year, while refinance volume is anticipated to decline by 24%. The slowdown in housing activity and higher mortgage rates will cut the pace of home price growth, according to MBA. The forecast projects national home prices to be roughly flat in 2023 and 2024.

Sources

- https://www.mba.org/

- https://www.bankrate.com/mortgages/rate-trends/

- https://www.bankrate.com/mortgages/mortgage-rates/

- https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

- https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

- https://edition.cnn.com/2023/03/09/homes/mortgage-rates-march-9/index.html