What happened to mortgage rates this week

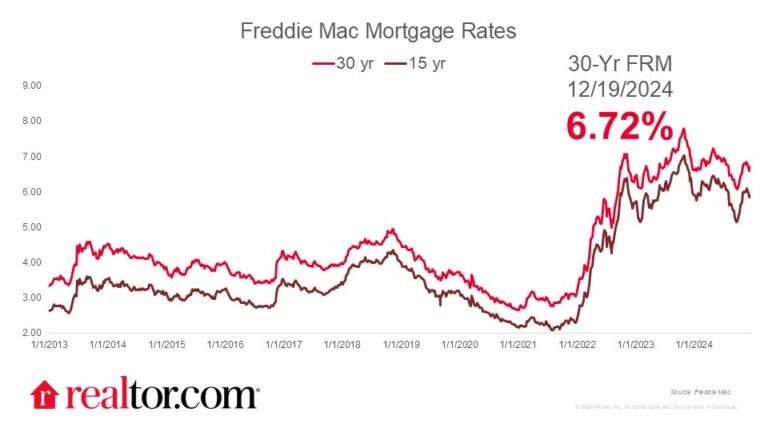

The Freddie Mac rate for a 30-year mortgage moved 12 basis points higher this week, to 6.72%, as markets prepared for Wednesday’s Fed meeting. The Federal Reserve’s Open Market Committee cut the Federal Funds rate 25 basis points, falling in line with market expectations. The committee also released its highly anticipated Summary of Economic Projections, which showed a pullback in anticipated rate cuts in the next couple of years relative to September’s expectation.

“Higher-for-longer” interest rates will be felt by consumers across the market, including mortgage borrowers. However, the market largely expected, and priced in, these shifts, so we might not see a strong reaction in mortgage rates.

What it means for the housing market

Generally, we expect mortgage rates to ease and home prices to tick higher in the coming year, resulting in very little, if any, change in the cost of purchasing a home. However, buyers in many areas, including the 2025 Top Markets, will be in a more favorable position as more new and existing homes are listed for sale.

At the national level, we expect that buyers will enjoy a balanced housing market in 2025 for the first time in nearly a decade. Though the market is expected to be the most buyer-friendly since 2016, it will not cross into buyer’s market territory, meaning sellers will also be in a good position next year, especially as household real estate equity remains near last quarter’s record high.