What happened to mortgage rates this week

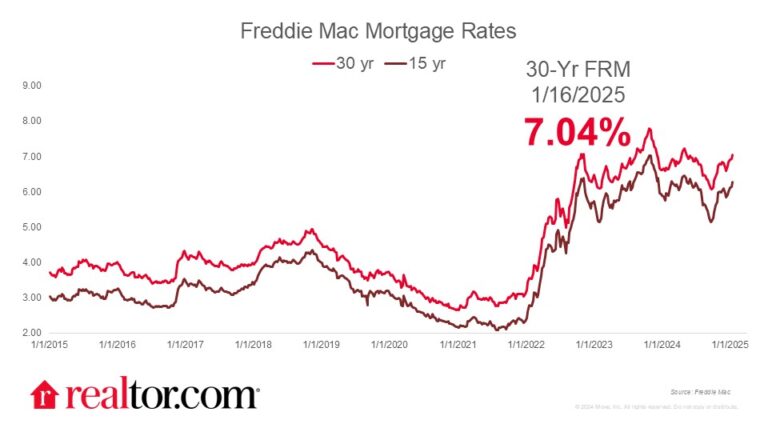

The Freddie Mac rate for a 30-year mortgage climbed 11 basis points this week to 7.04%, topping the 7% threshold for the first time since May 2024. On the plus side, the data reporting period largely covered the time before the release of Wednesday’s consumer price inflation data, which has ushered in a decent reprieve in rates that is not picked up in this reading.

After December’s strong jobs market reading, the 10-year treasury rate surged higher in advance of the key inflation point as the market cautiously positioned for a higher reading that might slow the Fed’s rate cuts in 2025. Although headline inflation did move up, it was largely driven by an uptick in energy prices. Key components of the measure–particularly shelter inflation and core inflation–slowed, casting a positive signal for later-year price trends.

What could be ahead

As a result, I expect mortgage rates to stop climbing in the second half of January. The new administration, the Fed’s late-month meeting, and early February labor data will introduce new information for the market to digest and potential volatility in early February. On the bright side for shoppers hoping for lower rates, the market does not expect the Fed to move too early in the year, which increases the possibility of a surprise that could nudge rates lower.

What it means for the housing market

Mortgage rates continue to have an outsized impact on housing activity as the share of existing homeowners with low-rate debt remains sizable. Existing-home sales climbed higher in recent months following fall’s lower mortgage rates, but we have yet to see the impact of the latest rate surge on home sales. The Realtor.com 2025 Housing Forecast anticipates a slower start to the year, but an eventual modest drop in mortgage rates will provide the foundation for a gradual improvement in home sales. Every drop in the inflation rate will not only reduce the pain consumers experience as costs of groceries, gas bills, and even Homeowners Association dues climb higher, it will also relax a key source of pressure on mortgage rates and help bring our expectation for home sales in 2025 closer to reality.