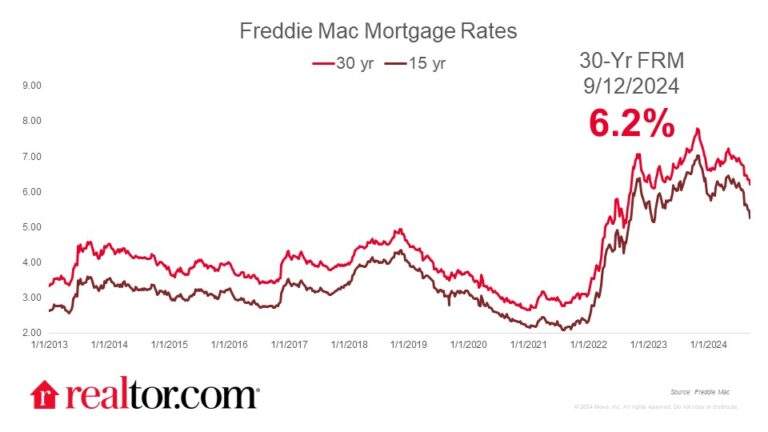

What happened to mortgage rates this week

The Freddie Mac rate for a 30-year mortgage fell 15 basis points to 6.2% this week, reaching the lowest level since February 2023 as incoming economic data tracked with expectations. The August jobs report showed that the U.S. added 142,000 net new jobs in the month, up from July’s level, but still in line with the anticipated trend of slowing job growth. Likewise, the latest consumer price inflation data showed that annual price growth fell to the lowest level (2.5%) since February 2021 in August. Cooling employment and inflation both came in near their anticipated levels, solidifying the Fed’s path toward a rate cut in next week’s meeting.

Though the market remains challenging for homebuyers, a few key shifts suggest that more favorable housing conditions might be ahead. Easing employment gains and cooling inflation both bolster expectations of a Fed rate cut next week. The market’s anticipation of rate cuts also has a positive impact on mortgage rates, which continue to move lower.

The typical monthly payment on a median-priced home at today’s mortgage rate is roughly $2,100, 14.0% ($340) lower than when rates hit a multidecade peak of 7.79% in October 2023, and 12.5% ($300) lower than the more recent mortgage rate peak of 7.22% in May.

With the mortgage rate side of affordability starting to improve, many buyers hope to see prices do the same. Seasonal market dynamics suggest that this year’s Best Time To Buy is quickly approaching, bolstered this year by lower mortgage rates and inventory at its highest level since May 2020.

What it means for the housing market

Home prices have not fallen considerably at the national level, despite cooling buyer demand, as inventory remains below pre-pandemic levels. However, local market conditions vary greatly.

Many Southern markets have seen a significant buildup in inventory, taking some pressure off of prices, while popular Midwest and Northeast markets continue to see high demand and price growth. The market is particularly tough for first-time homebuyers who do not have the advantage of existing home equity to leverage into a home purchase. Presidential candidate Kamala Harris has proposed a plan to assist first-time buyers with a down payment, which could be highly impactful and could even cover a whole down payment in some markets.