What happened to mortgage rates this week

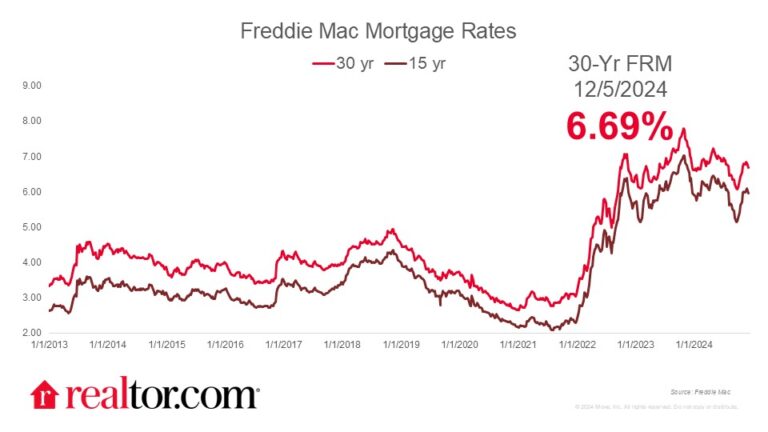

The Freddie Mac rate for a 30-year mortgage tumbled by over a tenth of a percent this week, following the trajectory of the 10-year Treasury yield, which dipped below 4.2% during the past week for the first time since October. Also for the first time since October, mortgage rates landed below 6.7%. Markets appear to be settling in, gaining confidence in the economic plans of the newly-elected Trump administration, leading to gains in both stock and bond prices. Though mortgage rates are moving in the right direction for prospective home buyers, they still find themselves in a tough spot as rates are only slightly lower than they were a year ago and more than double what they were three years ago. We expect rates to continue to inch down in coming months and spend much of 2025 in the low-6% range.

What it means for the housing market

Affordability remains a primary concern in the housing market. Prospective home buyers are closely attuned to movements of mortgage rates, and this week’s continuation of a decline is welcome news to many who have been on the sidelines trying to piece together a budget to purchase a home. Inventory growth over the past several months has been another encouraging factor, as the number of homes for sale is finally approaching pre-pandemic levels. With listing prices and mortgage rates remaining stubbornly high, though, buyers are seeing plenty of options but few that they can afford. Continued relief from mortgage rates combined with increasing numbers of price cuts may lead to a stronger 2025 in terms of home sales volume.