What happened to mortgage rates this week

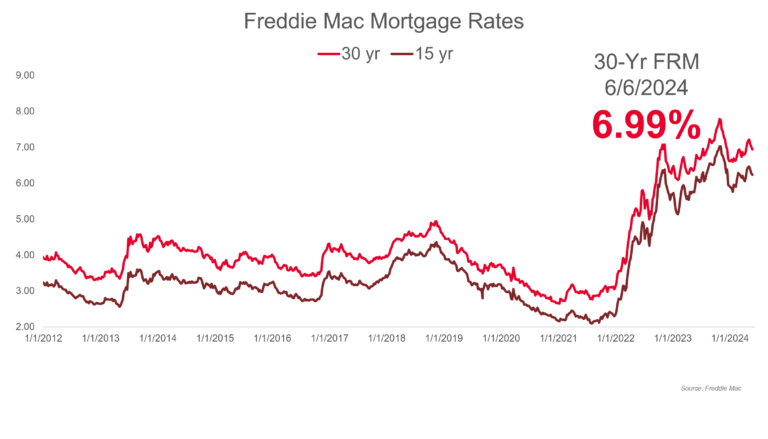

The Freddie Mac rate for a 30-year mortgage fell 11 basis points to 6.09% this week, reaching a tie for the lowest level since September 2022. However, it’s important to note this is not due to Wednesday’s 50 bps rate cut but rather due to market expectations of the number and magnitude of future rate cuts.

Over the past month, we’ve seen a 180-degree turn of what markets expect. On Aug. 16, markets priced in a 75% chance of a 25 bps rate cut and just 25% for a 50 bps cut. Those expectations heightened just a week ago to an 86% chance of a 25 bps cut and a 14% chance of a 50 bps cut. Leading up to Wednesday’s cut, those chances reversed to a 64% chance of a 50 bps cut and just a 36% chance of a 25 bps cut—and it turned out to be an accurate prediction. As of Thursday, the market is expecting the Fed to cut by a total of 75 bps more by its December meeting.

What it means for the housing market

Why have the markets reversed course on their expectations? Fed Chair Jerome Powell made it very clear that the FOMC believes the battle against inflation has ended, and that their primary concern on the road ahead will be maintaining a healthy labor market. After a sequence of less-than-stellar job reports in July and August, markets are expecting the Fed to deliver another jumbo cut by the end of the year to help ease concerns about a softening labor market.

How far can mortgage rates fall and what does it mean for the housing market?

Since markets have already priced in Wednesday’s 50 bps rate cut and the Fed is still being mum about its future plans, we don’t think there’s a major drop in the future and that rates could bottom out in the 6%–6.2% range through the rest of the year and into the high 5% by next spring. As mortgage rates continue to come down, albeit slowly, we should initially expect signals of increased activity to emerge from the refi market then followed by higher mortgage application activity at the beginning of next year as both buyers and sellers ramp up their activity in the spring buying season. Since buying power increases as mortgage rates fall, we should expect home price growth to reaccelerate sometime in the spring, especially if historically laggy inventory is slow to respond.