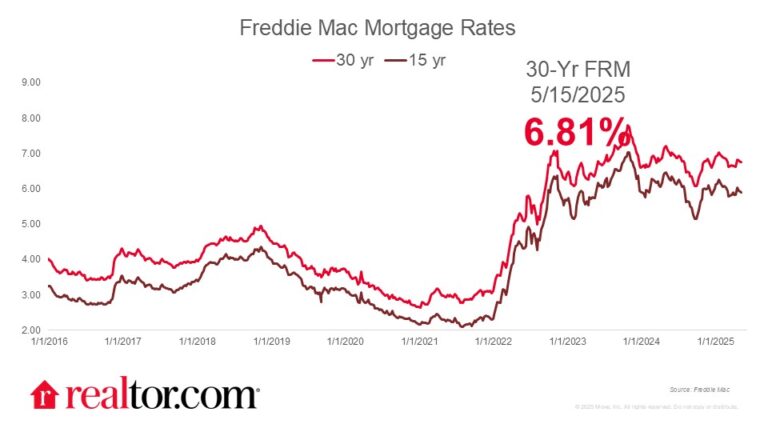

What happened to mortgage rates this week

This week, the Freddie Mac 30-year mortgage rate edged 5 basis points higher, to 6.81%, following a rise in the 10-year Treasury yield. This uptick was largely driven by recent U.S. trade agreements with the U.K. and China, which boosted bond yields as markets priced in expectations of higher prices and reduced foreign demand. While U.S. tariff policies remain in flux, the agreements suggest increased costs for imported goods, though these effects have yet to appear in CPI inflation data.

What it means for the housing market

Persistently high mortgage rates and home prices mean that buyers continue to grapple with affordability challenges. However, there’s a silver lining: For-sale inventory has reached its highest level in over five years, offering buyers more choices across many parts of the country. New-construction activity has been a major driver of this trend in some regions as builders deliver smaller and more affordable home inventory. Roughly 1 in 4 listings in the South is newly built, contributing to climbing inventory and easing prices across much of the region. However, in the Northeast, only about 1 in 10 homes for sale is newly built, and these relatively scarce homes see a bigger price premium as a result.

For buyers sidelined by affordability constraints, the rental market might offer temporary relief. In April, national rents were down 3.4% from their peak, with even steeper declines in some markets. The Midwest and South remain more affordable as rents claim a smaller share of household income than many markets on the coasts.