What happened to mortgage rates this week

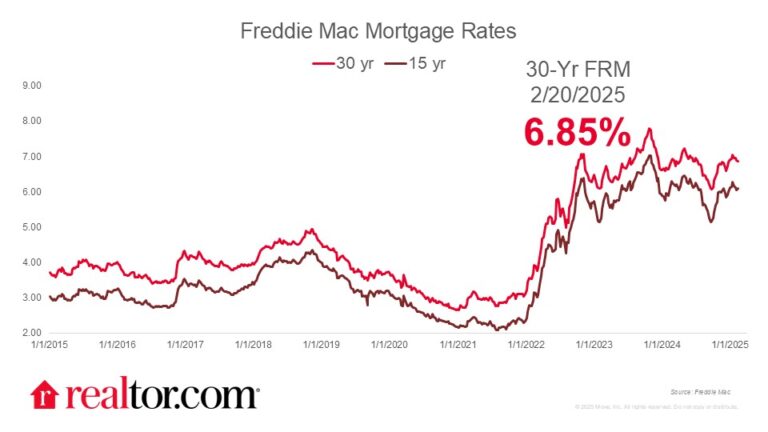

The Freddie Mac rate for a 30-year mortgage drifted lower to 6.85% this week as the market digested recent inflation data. Last week’s consumer price index data showed a third-consecutive monthly increase in inflation, pushing the annual inflation rate to 3% in January. Core inflation, which excludes the more volatile prices of food and energy, also ticked higher, suggesting that inflation will continue to be tricky to conquer. Hotter-than-desired CPI inflation strengthened the market’s expectation that the Fed will hold off on further rate cuts until later in the year.

What it means for the housing market

Stubborn inflation will likely continue to hinder any significant mortgage rate progress. As a result, hopeful homeowners are at an all-too-familiar crossroads and must decide to whether continue renting or take the plunge into the housing market. Many markets have become more affordable for both buyers and renters over the past year, but it is still more affordable to rent than to buy a starter home in 48 of the 50 largest U.S. metros. The wealth-building potential and stability that homeownership provides might outweigh the additional costs for some home shoppers, especially as the market boasted the highest level of for-sale inventory in years in January. However, renters who feel “stuck” need not worry, as they are in a strong position to leverage easing rents into building their savings. More affordable housing costs give renters the option to save up to buy in a more friendly market, or to choose an alternate approach to grow their wealth.