What happened to mortgage rates this week

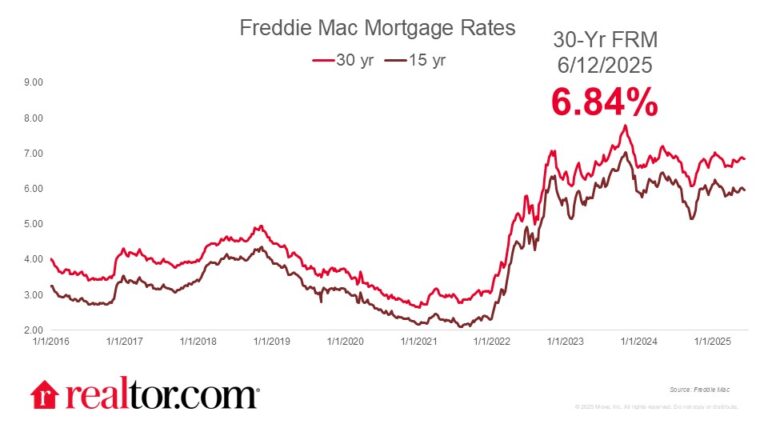

The Freddie Mac 30-year mortgage rate eased 1 basis point this week, to 6.84%, as cooler-than-expected inflation data helped alleviate concerns about a potential reversal in the downward trend of inflation. Last week’s employment report also boosted confidence, with modest job gains pointing to a stable labor market. On Wednesday the CPI inflation data showed that consumer prices climbed 2.4% year over year in May, and just 0.1% month over month. The market expected price growth to rise in response to new U.S. tariffs, so the cooler inflation reading came as a welcome surprise. Yields on the 10-year Treasury note declined in response to the encouraging economic data, and mortgage rates followed suit.

The Fannie Mae Home Purchase Sentiment Index also came in relatively rosy for May, with home purchase sentiment climbing to a 2025 high, and concerns over financial security eased. In May, roughly 1 in 4 survey respondents said it is a good time to buy a home, the highest share since March 2022. Though the share remains relatively low, recent progress toward a more balanced housing market is helping to improve buyer optimism.

What it means for the housing market

After a fairly slow spring, the summer housing market could bring a boost in activity as buyers take advantage of a more buyer-friendly market. Inventory reached a new post-pandemic high in May, indicating that buyers have more home options and may find sellers to be more accommodating. Affordability remains a challenge for the typical buyer, but with more price cuts, an easing market pace, and ample home supply, prospective buyers have a better chance of finding what they’re looking for.