What happened to mortgage rates this week

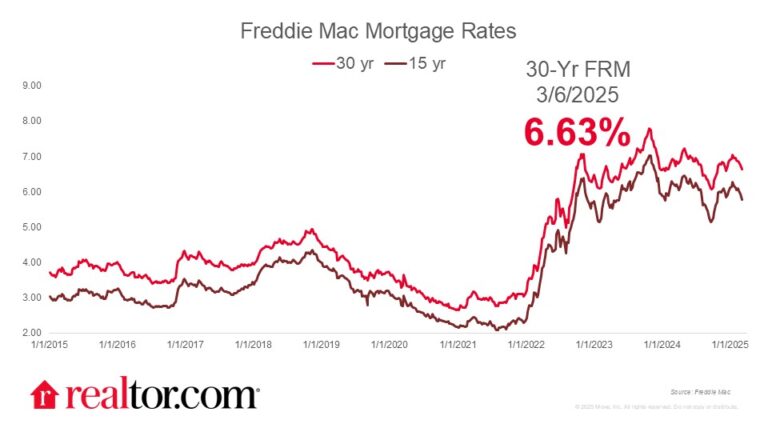

The Freddie Mac rate for a 30-year mortgage dropped by 13 basis points this week to 6.63%, the lowest point since December. Interest rates in general have dipped a bit as the 10-year Treasury yield has fallen near 4.2%. These lower rates will spur on the housing market as it enters the start of the spring buying season, but they remain in danger of remaining in an elevated state. This is because of inflation remaining stubbornly high, which will not be helped by the tariffs that the Trump administration appears committed to rolling out. Expectations of higher consumer prices in the future leads debt market investors to demand higher returns on their investments, indirectly pulling interest rates up at the same time that they deter the Federal Reserve from making direct cuts to interest rates.

What it means for the housing market

These improving conditions in home finance are coming at the same time that inventory is up and prices are down, providing some much-needed momentum to the housing market just in time for the start of the spring buying season. Last year was a particularly slow year for home sales, the slowest since 1996, and first-time home buyers were largely left out of the 2024 market. Given the fact that rents have been falling year over year for 18 consecutive months, we expect that many prospective first-timers have been able to save up for a down payment and will be able to become homeowners in 2025, even with mortgage rates relatively high.