What happened to mortgage rates this week

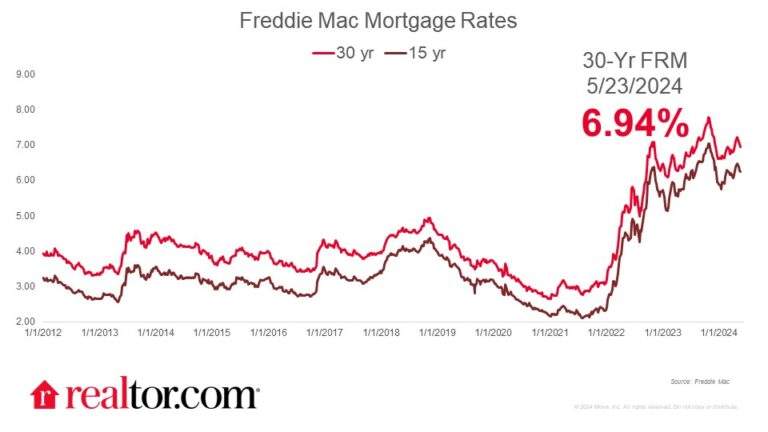

The Freddie Mac fixed rate for a 30-year mortgage dropped by 0.08 percentage points to 6.94% this week. Meanwhile, the 10-year Treasury yields dropped to 4.3% following the release of April’s CPI data before stabilizing around 4.4% this week.

The progress in inflation and labor market observed in April data will likely provide some stability in mortgage rates and may even lead to some additional declines.

While the market felt encouraged by the improvement, Fed officials were not convinced by the sparks and reiterated that more good data is needed for the confidence to cut rates. An interesting question is whether that level of confidence could be reached by the June FOMC meeting, with one more consumer price index reading by then. We expect that this confidence-building process will take longer, positioning the Fed for an adjustment in late summer or early fall, which could then subsequently affect mortgage rates.

What it means for the housing market

As mortgage rates have stopped climbing, buyers and sellers are eagerly anticipating lower mortgage rates to reignite the housing market. However, for rates to fall further below 7%, there must be consistent evidence that inflation is on track to return to 2%.

Recent research by Realtor.com® and the National Association of Realtors® indicates that buyers in Spokane-Spokane Valley, WA, Lakeland-Winter Haven, FL, Salt Lake City, UT, Deltona-Daytona Beach-Ormond Beach, FL, and Fresno, CA, will see the most significant affordability improvements with lower mortgage rates.

However, even with reduced rates, the market still faces a shortage of affordable listings. In a balanced market, buyers with an income of $125,000 should be able to afford 72% of the listings. Yet, at a 6% mortgage rate, these buyers can afford only 55% of today’s available listings.