What happened to mortgage rates this week

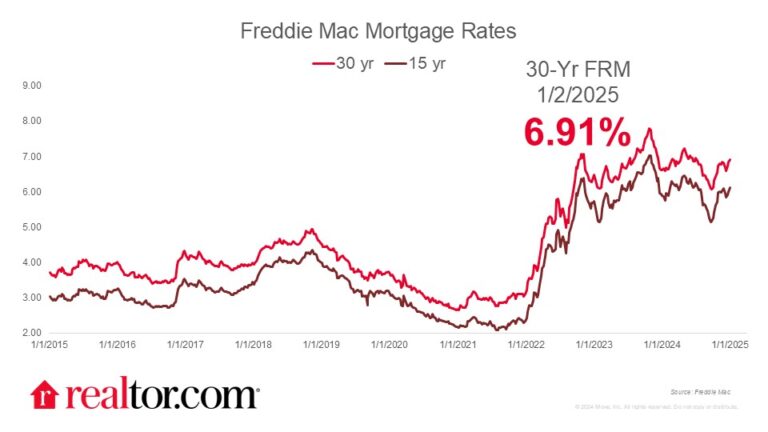

The Freddie Mac rate for a 30-year mortgage increased again this week, rising 6 basis points to 6.91%. It is once again at its highest level since early July 2024 and almost 30 basis points higher than it was in the first week of 2024. This follows closely on the heels of the 10-year Treasury yield reaching 4.63% last week in the wake of the December Federal Reserve meeting in which a plan for fewer-than-expected rate cuts in 2025 was announced. With the embers of the post-pandemic inflation fire still burning, mortgage rates are getting stuck near 7% and the housing market is feeling the heat.

What it means for the housing market

Though these high mortgage rates are a serious affordability headwind for prospective homebuyers who are already struggling with high listing prices that continue to grow, there are some positive indicators that the market is still chugging along. The most recent releases of pending home sales, new-home sales, and existing-home sales data showed growth from a year ago. At this point, it seems that buyers have accepted high 6% mortgage rates as “the new normal” and are starting to make the moves that they had previously postponed instead of trying to time the market for more favorable financing. For those with a new year’s resolution of buying a home, we expect to see 2025 usher in continued growth in the inventory of homes for sale. So even if mortgages remain expensive, prospective homebuyers should have more options to choose from in the new year.