What happened to mortgage rates this week

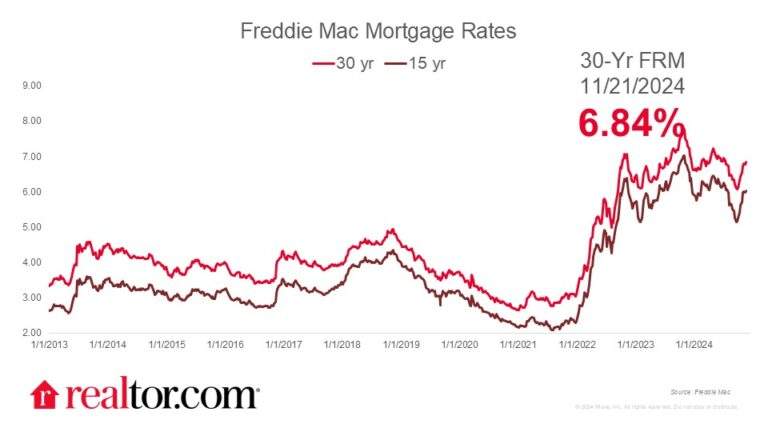

The Freddie Mac rate for a 30-year mortgage ticked up 6 basis points, to 6.84%, this week as the market digested incoming economic data and weighed geopolitical risks. Mortgage rates reached the high-6% range in late October, and have remained elevated since, much to the disappointment of buyers hoping to find some relief in the late-fall housing market.

Last week’s inflation report showed a modest uptick in price growth, which could mean a pause in rate cuts in December, especially in light of market uncertainty and Donald Trump’s return to office early next year.

What it means for the housing market

Existing-home sales notched higher in October as a result of falling mortgage rates in August and into September. However, the recent climb in mortgage rates has cooled the late-fall housing market.

In the same vein, new construction activity eased in October, as builders applied the brakes given lackluster buyer demand as well as uncertainty ahead of the presidential election. New homes have become increasingly important as existing homeowners remain hesitant to sell. Roughly 84% of mortgages have a rate of 6% or lower, emphasizing the importance of lower rates to bring sellers back into the housing market.

The incoming presidency could also influence buyer sentiment in the coming months. A recent survey from Realtor.com found that 1 in 5 Republicans are more likely to consider buying a home due to the outcome of the election, while 1 in 4 Democrats are less likely.