What happened to mortgage rates this week

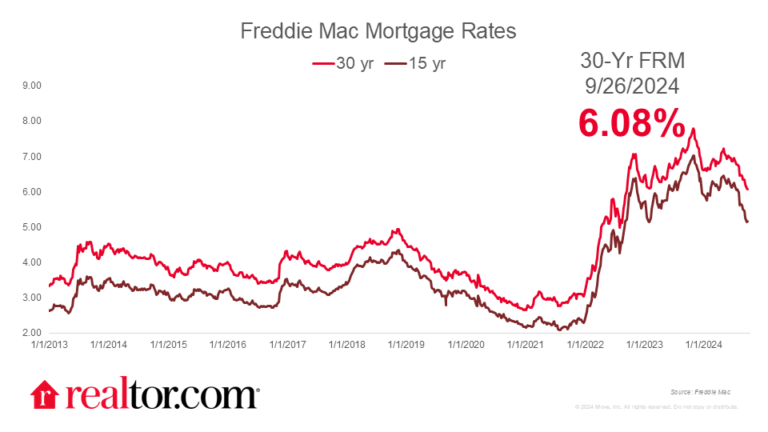

The Freddie Mac rate for a 30-year mortgage rose slightly by 4 basis points to 6.12% this week, coming off its lowest level in two years from the week prior.

Why are rates rising? Because of market adjustments of Fed expectations. The market has continued to favor a cumulative 75 basis point cut by the end of the year, suggesting that at least one of the cuts will be another “jumbo,” or 50 basis point, cut. In contrast, Chairman Jerome Powell this week hinted nothing of the sort in his comments at the annual National Association of Business Economists meeting in Nashville, TN, suggesting that cuts are only likely to be on the order of 25 basis points each in November and December.

If Powell’s comments are accurate, then the market may be pricing too much of a drop by the end of the year, which could continue to push the 10 Treasury upward in the coming months as they adjust, sending mortgage rates slightly higher.

What it means for the housing market

It’s tough to say since prevailing mortgage rates are determined not just by 10-year Treasury yields but also by the magnitude of spreads with mortgage rates. As of today, the spread is higher than the long-run average, so there is room for it to fall—even if Treasury yields stay the same or even rise. But if the market is indeed mispricing the magnitude of rate cuts by December, the directionality of mortgage rates over the coming months will be determined by both an adjusting spread and adjusting market expectations—meaning they could fall, rise, or stay flat throughout the rest of the year.

While predicting and timing rates can at times be a fool’s errand, the good news for homebuyers is that homes are moving slowly, inventory is rising, and price cuts are elevated, giving them a leg up in the market they haven’t had in years.