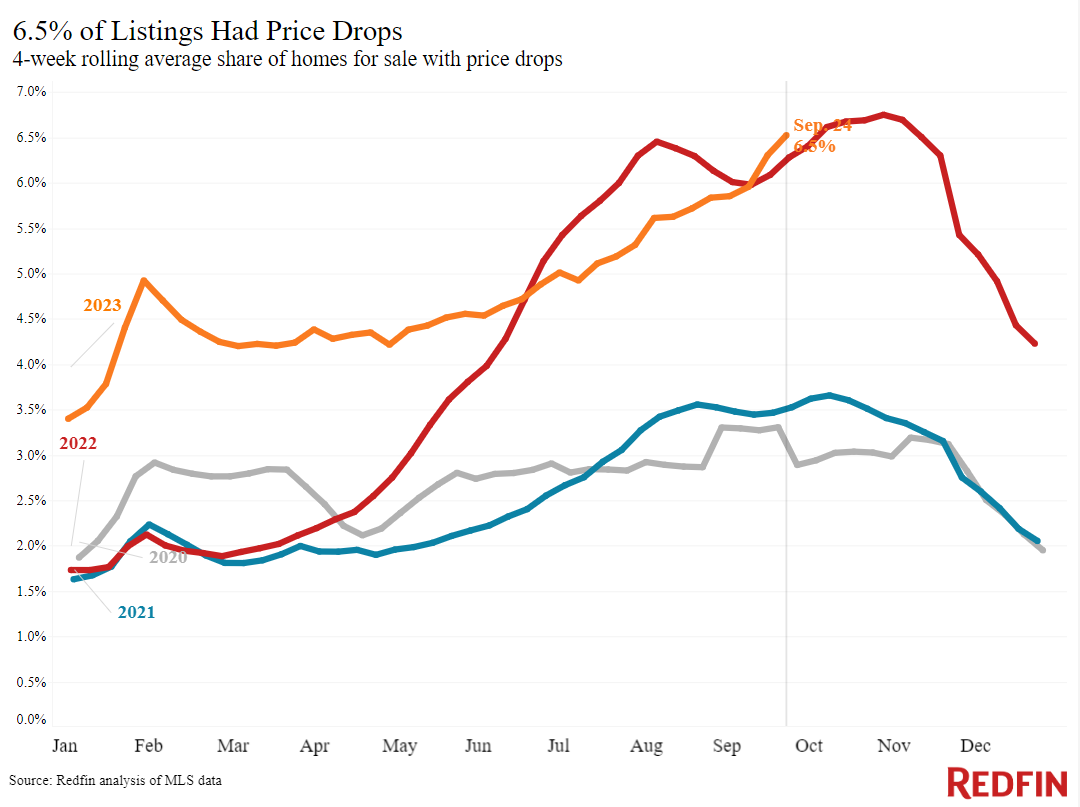

Record-high monthly mortgage payments are motivating sellers to drop asking prices to attract buyers, who are unwilling to pay a dollar more than necessary for their new home.

Roughly one in 15 (6.5%) U.S. homes for sale had a price drop during the four weeks ending September 24, on average, up from 5.8% a month earlier–a sharp monthly increase compared to the same period in years past. At the same time, the median home-sale price is up 3% year over year and the typical homebuyer’s monthly payment is at a record high as mortgage rates stay stubbornly elevated, with daily average rates hitting a two-decade high on September 27.

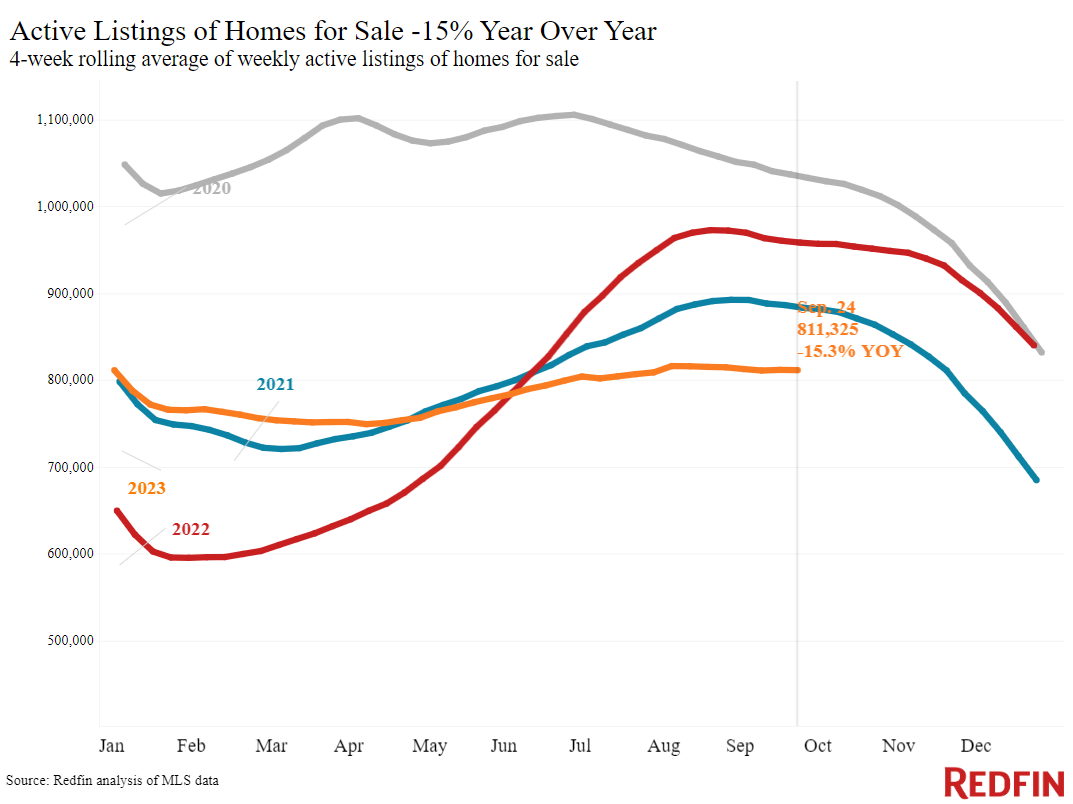

What this means for home sellers: Pricing your home right is a delicate science. Even though demand is relatively low, you’re likely to find a buyer who will pay a fair price. That’s because there are so few homes on the market, with total inventory down 15% year over year. But with monthly payments at an all-time high, buyers are picky and they don’t want to pay a dollar more than they need to. Be careful not to price too high, or you may be forced to cut your asking price to attract a buyer. “The feeling for buyers right now is this: For the interest rate I’m paying, this home better be exactly what I want or the price better be negotiable,” said Seattle Redfin Premier agent David Palmer.

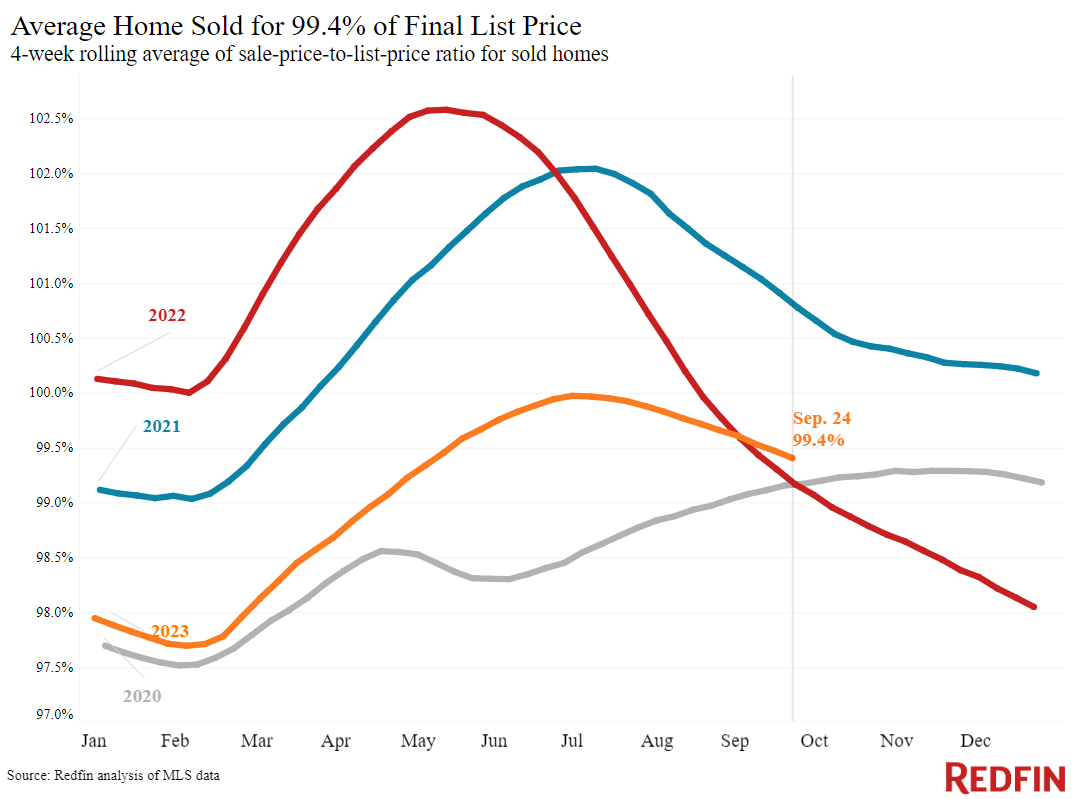

What this means for homebuyers: Negotiate with sellers. It’s still tough to win a home for under asking price, but sellers have come to terms with the fact that that 7%-plus mortgage rates are giving buyers cold feet and that homes aren’t as likely to attract multiple offers. Many sellers are open to making concessions, like paying for repairs or helping fund a mortgage-rate buydown. Additionally, new listings have posted an unseasonal uptick since the beginning of September, meaning buyers have a bit more to choose from if sellers aren’t willing to negotiate. “Buyers are using things like inspection negotiations and high insurance premiums to back out of deals,” said Jacksonville Redfin Premier agent Heather Kruayai. “They’re holding a lot of the cards; today’s sellers need to concede on some details to close the deal.”

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.65% (Sept. 27) | Highest level in over 2 decades | Up from about 6.8% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 7.19% (week ending Sept. 21) | Flat from 7.18% a week earlier | Up from 6.29% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Down 2% from a week earlier (as of week ending Sept. 22) | Down 27% | Mortgage Bankers Association | |

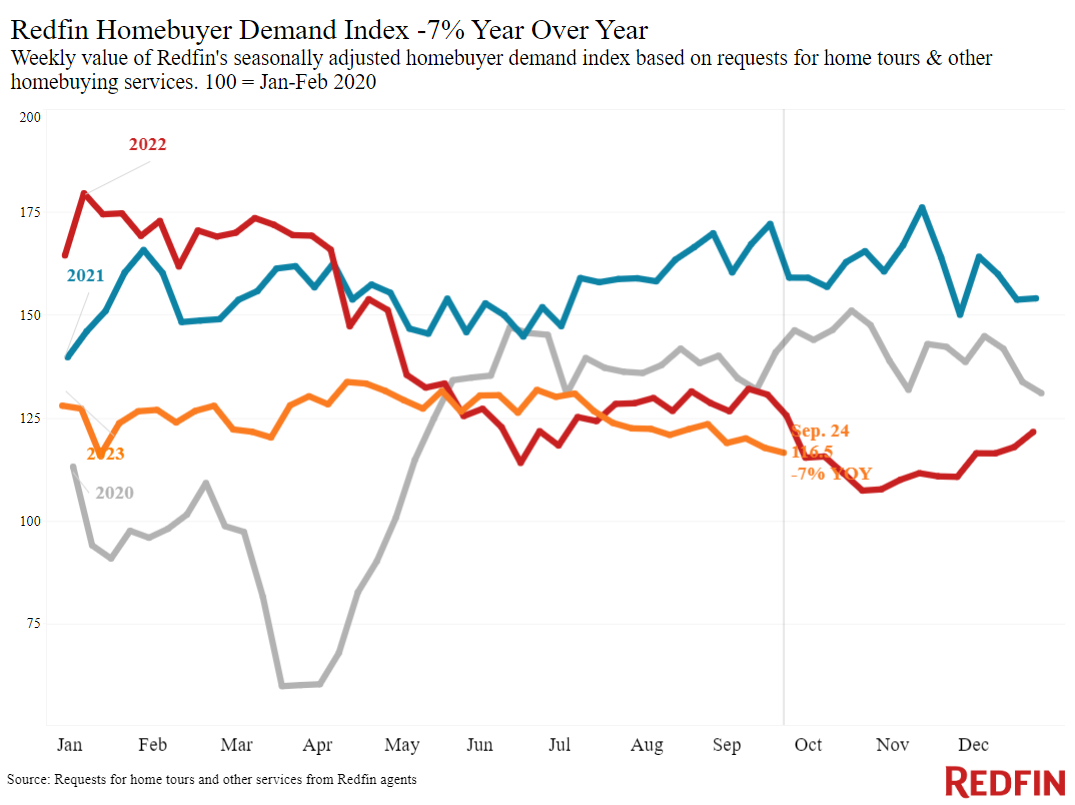

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down 6% from a month earlier (as of the 4 weeks ending Sept. 24), close to its lowest level since January | Down 7% | Redfin Homebuyer Demand Index, a measure of requests for tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Down 8% from a month earlier (as of Sept. 23) | Down 12% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending September 24, 2023 Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. | |||

| Four weeks ending September 17 | Year-over-year change | Notes | |

| Median sale price | $372,500 | 3.1% | Median sale prices are up partly because elevated mortgage rates were hampering prices during this time last year |

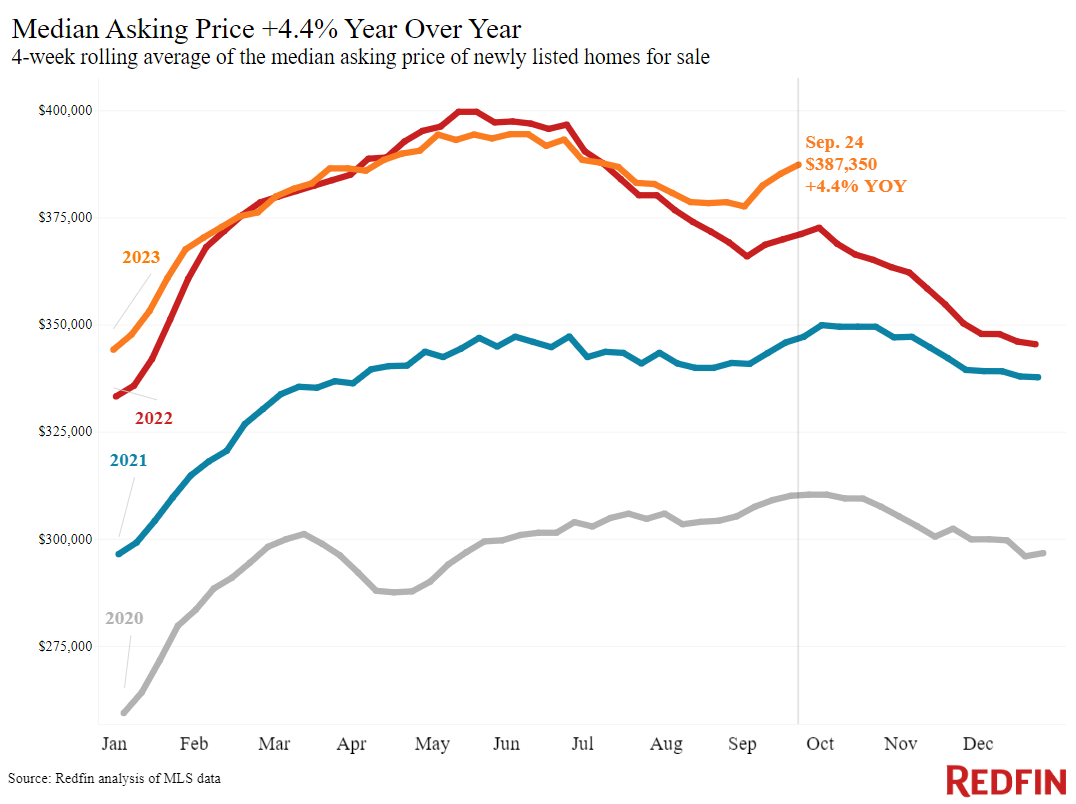

| Median asking price | $387,350 | 4.4% | Biggest increase since Oct. 2022 |

| Median monthly mortgage payment | $2,666 at a 7.19% mortgage rate | 8.5% | All-time high |

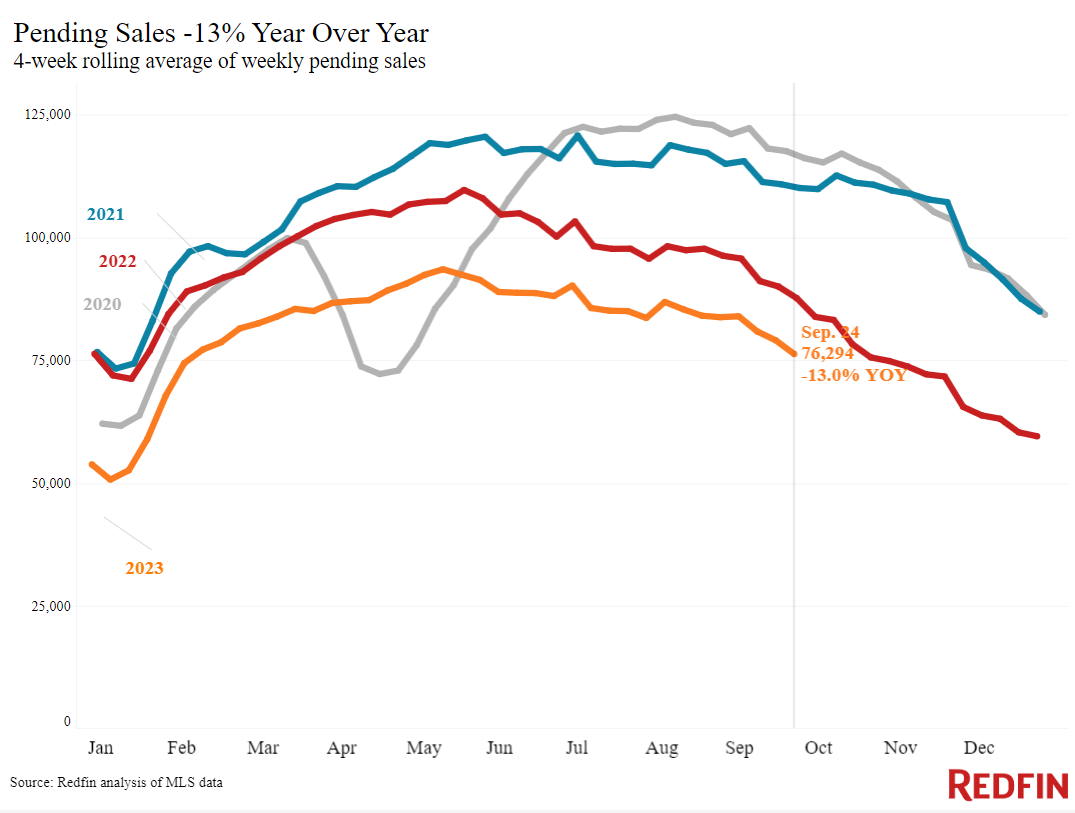

| Pending sales | 76,294 | -13% | |

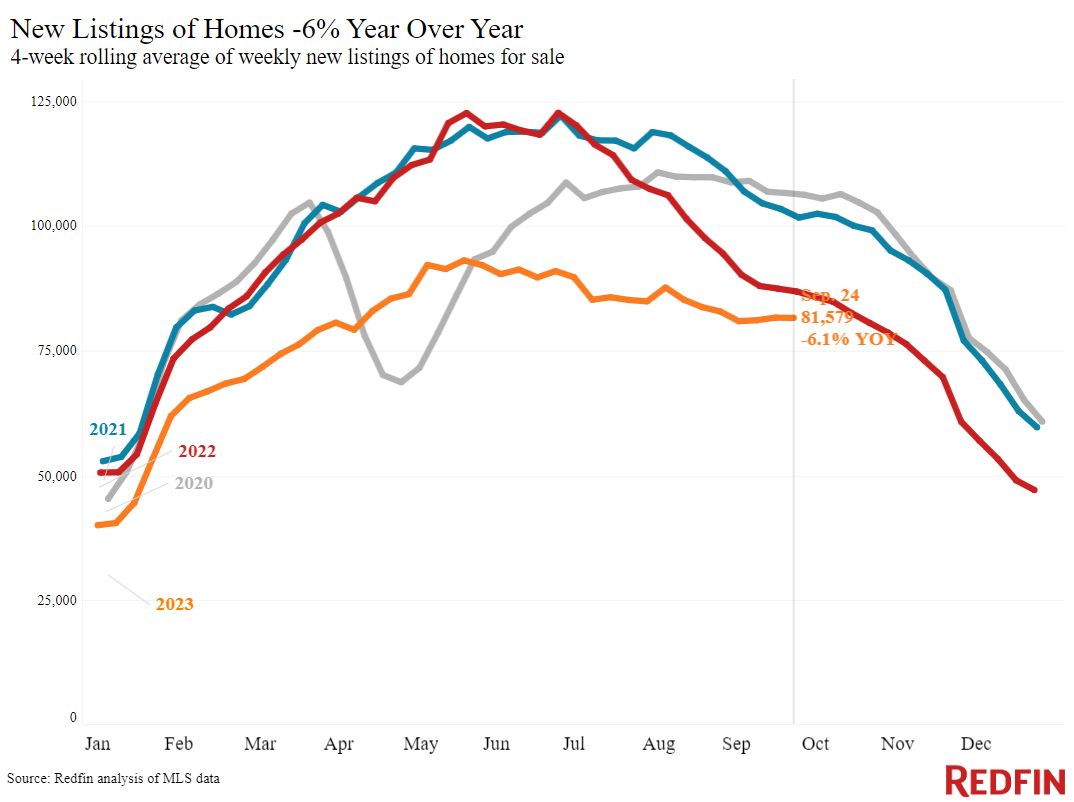

| New listings | 81,579 | -6.1% | Smallest decline in over a year, in part because new listings fell rapidly at this time in 2022 |

| Active listings | 811,325 | -15.3% | |

| Months of supply | 3.2 months | +0.1 pt. | Highest level since February. 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

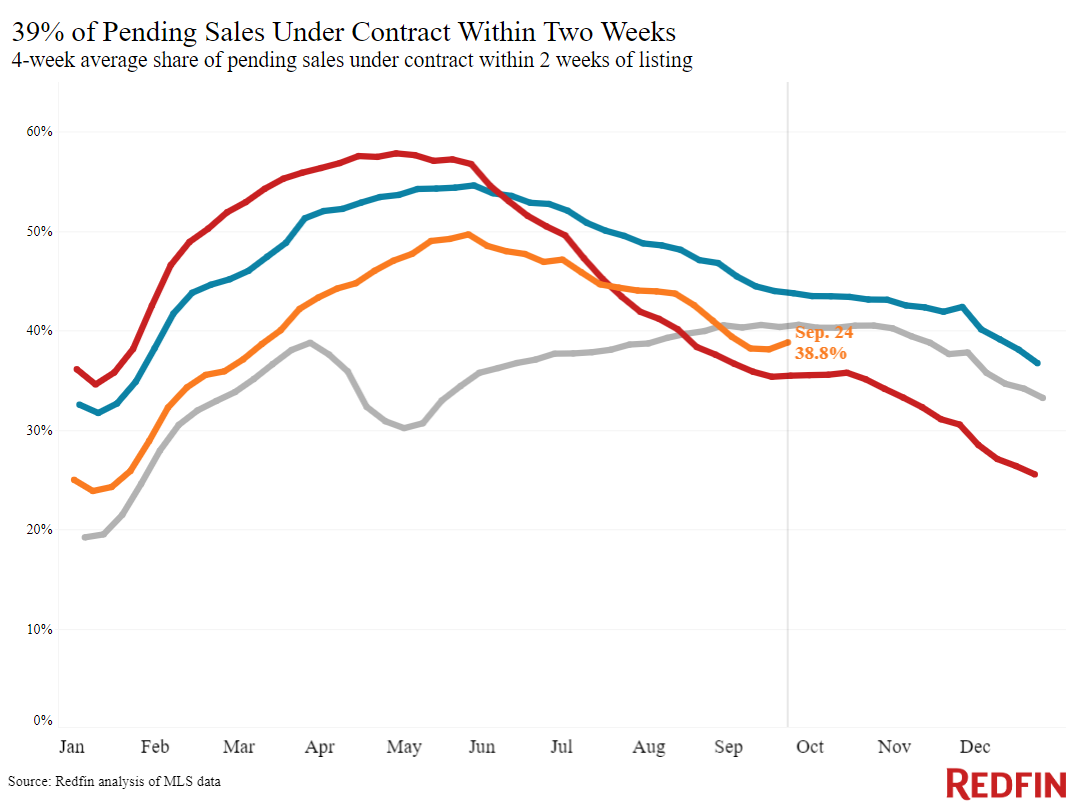

| Share of homes off market in two weeks | 38.8% | Up from 35% | |

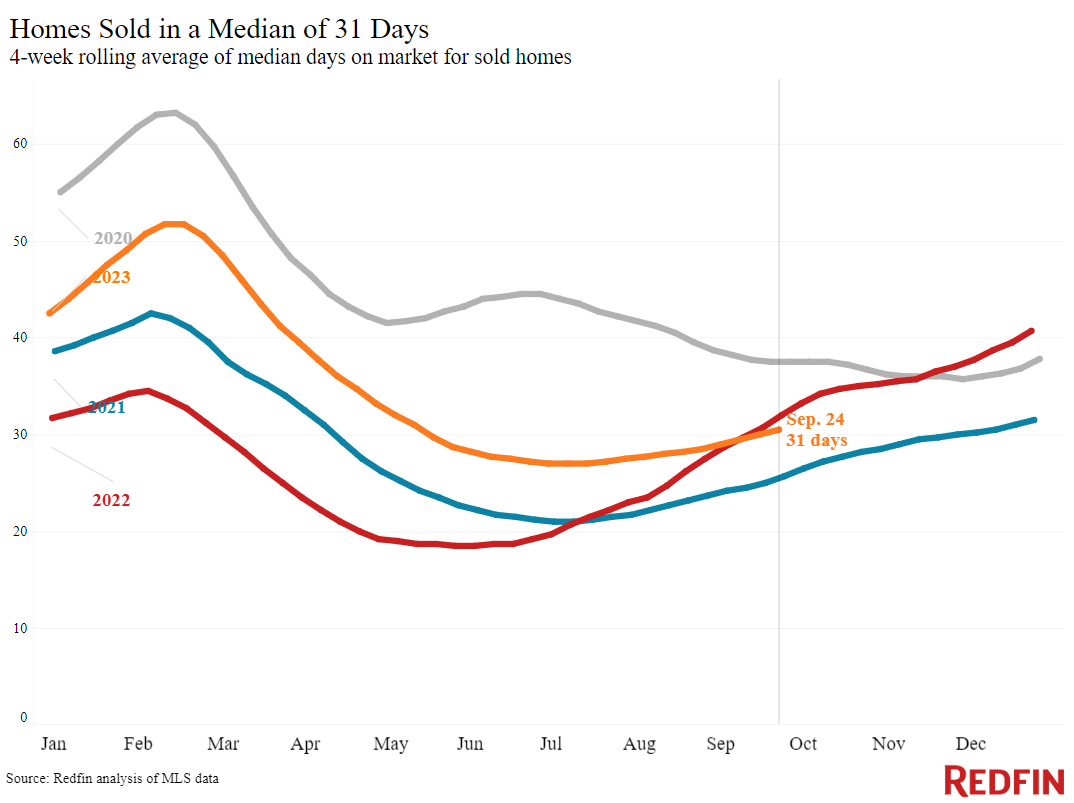

| Median days on market | 31 | -1 day | |

| Share of homes sold above list price | 31.8% | Unchanged | |

| Share of homes with a price drop | 6.5% | +0.2 pts. | Highest share since November 2022 |

| Average sale-to-list price ratio | 99.4% | +0.2 pts. | |

| Metro-level highlights: Four weeks ending September 24, 2023 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. | |||

| Metros with biggest year-over-year increases | Metros with biggest year-over-year declines | Notes | |

| Median sale price | Anaheim, CA (14.2%) San Jose, CA (10.6%) Fort Lauderdale, FL (10.5%) New Brunswick, NJ (10%) Newark, NJ (9.8%) | Austin, TX (-4.4%) Houston, TX (-2.2%) San Antonio, TX (-1.7%) Fort Worth, TX (-1.6%) Las Vegas (-1%) Phoenix (-1%) Nashville, TN (-0.7%) Dallas (-0.1%) | Declined in 8 metros |

| Pending sales | n/a | New York, NY (-36%) New Brunswick, NJ (-27.3%) Atlanta (-24.5%) Providence, RI (-23.7%) Seattle (-22.5%) | Declined in all metros |

| New listings | San Jose, CA (7.2%) West Palm Beach, FL (4.1%) Miami, FL (3.6%) Cleveland (3.6%) San Antonio, TX (3.3%) Cincinnati (2.8%) Minneapolis (1%) Pittsburgh (0.7%) Houston (0.5%) Fort Lauderdale, FL (0.1%) | Atlanta (-30%) Las Vegas (-17.7%) Riverside, CA (-17.6%) Portland, OR (-16.4%) Newark, NJ (-16.2%) | Declined in all but 10 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.