More homes are changing hands as mortgage rates drop and buyers and sellers see more eye to eye on price. Still, deals are falling through at the highest rate on record due to lingering economic uncertainty, and some metros continue to see price declines.

New listings and pending home sales both climbed to the highest level in roughly a year in November as buyers and sellers got tired of waiting on the sidelines and mortgage rates ticked down. Home prices also jumped, posting the biggest year-over-year increase since late 2022.

New listings rose 1.3% month over month to the highest level since October 2022 on a seasonally adjusted basis, and increased 0.1% from a year earlier—a small gain, but the first in a year and a half. Active listings, or the total supply of homes for sale, grew 3.9% month over month—the biggest increase since July 2022 (though they fell 7.9% from a year earlier).

“Buyers and sellers are learning to live with uncertainty,” said Shay Stein, a Redfin Premier real estate agent in Las Vegas. “They’ve realized no one has a crystal ball that can predict exactly when mortgage rates will fall back to 5%, so they’re making moves now because they can only wait so long to be near their grandkids, live in an RV like they’ve always dreamt of or finalize their divorce.”

While rates aren’t back to 5%, they have fallen in recent weeks, which has motivated buyers, Stein said. In many cases, their monthly payment is $200 less than it would’ve been had they locked in a rate three weeks ago when they started looking, she explained. The average 30-year-fixed mortgage rate declined every week in November after hitting a 23-year high of 7.79% at the end of October. It ended November at 7.22%, and currently stands at 6.95%, though that’s still higher than the 6.3% rate of a year ago.

Pending home sales rose 2% month over month in November to the highest level in a year on a seasonally adjusted basis, and fell 0.1% from a year earlier.

“Another reason sales are ticking up is buyers and sellers are finally living in the same reality,” Stein said. “A year ago, sellers had trouble understanding why they weren’t getting $20,000 over the list price like their neighbor did during the pandemic homebuying boom. Now, they understand that to sell their home, they need to price it fairly and in some cases offer the buyer concessions like money toward closing costs or mortgage-rate buydowns.”

November 2023 Highlights: United States

| November 2023 | Month-Over-Month Change | Year-Over-Year Change | |

|---|---|---|---|

| Median sale price | $408,732 | -1.1% | 3.7% |

| Pending sales, seasonally adjusted | 406,687 | 2.0% | -0.1% |

| Homes sold, seasonally adjusted | 411,958 | 0.2% | -5.4% |

| New listings, seasonally adjusted | 504,263 | 1.3% | 0.1% |

| All homes for sale, seasonally adjusted (active listings) | 1,504,094 | 3.9% | -7.9% |

| Months of supply | 2.9 | 0.2 | -0.1 |

| Median days on market | 36 | 2 | -1 |

| Share of for-sale homes with a price drop | 18.7% | -1.3 ppts | -0.7 ppts |

| Share of homes sold above final list price | 28.7% | -3.0 ppts | 2.3 ppts |

| Average sale-to-final-list-price ratio | 99.0% | -0.3 ppts | 0.5 ppts |

| Pending sales that fell out of contract, as % of overall pending sales | 16.9% | 0.1 ppts | 1.3 ppts |

| 7.44% | -0.18 ppts | 0.63 ppts |

Note: Data is subject to revision

Home Prices Posted the Biggest Increase Since October 2022

The median U.S. home sale price was $408,732 in November. That’s up 3.7% from a year earlier—the biggest jump since October 2022—and down 1.1% from a month earlier.

Annual home price growth seems to be normalizing after prices surged as much as 26% at the height of the pandemic homebuying boom and then fell as much as 4% in early 2023 amid elevated mortgage rates. Price growth is now back to the 2%-7% range it was in prior to the pandemic.

Even though elevated mortgage rates have dampened demand in recent months, prices have continued rising in part because buyers are competing for a limited number of homes. While listings have inched up in recent months, they remain low by historical standards.

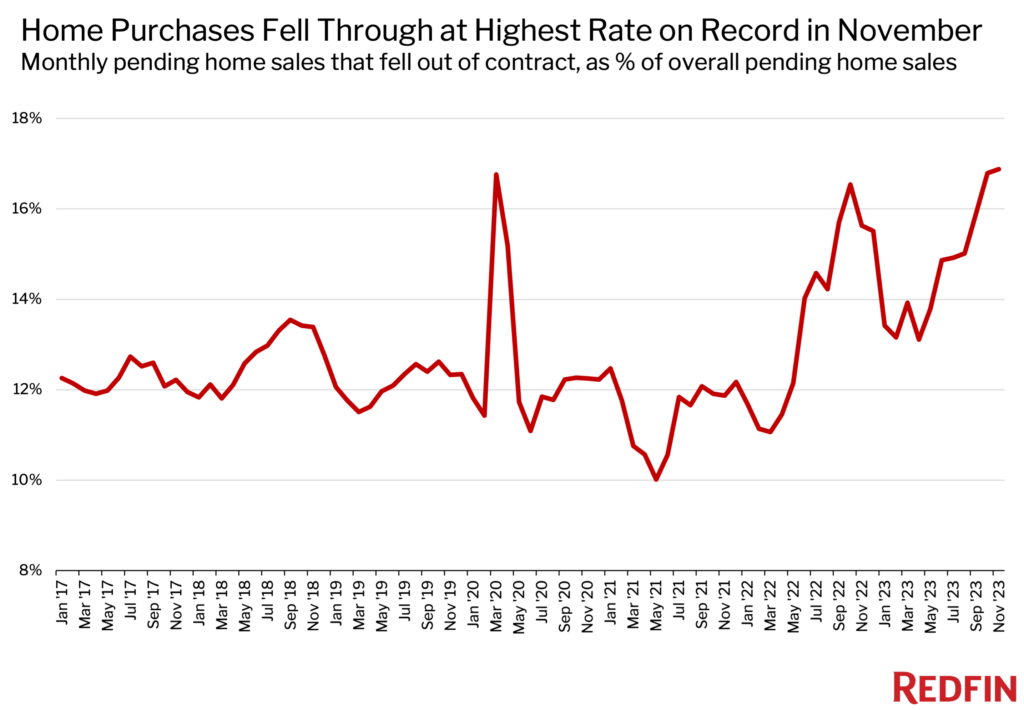

Purchases Fell Through at Record Rate as Some Buyers Got Cold Feet

While pending sales hit the highest level in a year in November, closed sales hovered near their recent low. They were little changed from a month earlier (0.2%) on a seasonally adjusted basis, and fell 5.4% from a year earlier. That’s partly because a lot of deals fell through at the last minute.

Roughly 45,000 U.S. home-purchase agreements were canceled in November, equal to 16.9% of homes that went under contract that month—the highest percentage in Redfin records that date back to 2017. That’s up from 16.8% one month earlier and 15.6% one year earlier.

While some buyers and sellers have come to terms with today’s economic uncertainty, that same uncertainty is causing many of them to get cold feet, Stein said. Even though mortgage rates have dropped, housing affordability remains strained, meaning a lot of buyers still get nervous when they see their monthly payment on paper.

Economic woes are keeping many people out of the housing market altogether. A lot of Americans feel that the economy is in a bad place despite economic growth, rising wages and low unemployment. One obvious culprit is the housing market, which is in its least affordable year on record.

Please note that homes that fell out of contract during a given month didn’t necessarily go under contract the same month. For example, a home that fell out of contract in November could have gone under contract in October. Scroll to the bottom of this report to find the deal cancellation rate for the 50 most populous U.S. metropolitan areas, along with other local insights.

Metro-Level Highlights: November 2023

Data in the bullets below came from a list of the 91 U.S. metro areas with populations of at least 750,000. Select metros may be excluded from time to time to ensure data accuracy. A full metro-level data table can be found in the “download” tab of the dashboard in the monthly section of the Redfin Data Center. Refer to our metrics definition page for explanations of metrics used in this report. Metro-level data is not seasonally adjusted.

- Pending sales: In Anaheim, CA, pending sales rose 18.7% year over year, more than any other metro Redfin analyzed. Next came San Antonio (16%) and Richmond, VA (14.5%). The biggest declines were in Greensboro, NC (-30.2%), Birmingham, AL (-27.6%) and Knoxville, TN (-27.4%).

- Closed sales: Closed sales climbed from a year earlier in just six metros, with the biggest increases in North Port, FL (26.1%), Orlando, FL (6.3%) and Cape Coral, FL (5.3%). They fell most in Tacoma, WA (-35.1%), Nassau County, NY (-20%) and New York (-19.7%).

- Prices: Median sale prices rose most from a year earlier in Rochester, NY (17.9%), Anaheim (17.7%) and Fort Lauderdale, FL (13.5%). They fell most in Austin, TX (-8.8%), San Antonio (-6.2%) and New Orleans (-3.7%).

- Listings: New listings rose most from a year earlier in North Port (34.1%), Omaha, NE (29.3%) and Cape Coral (22.5%). They fell most in Honolulu (-18%), Atlanta (-15.3%) and Greensboro (-13.9%).

- Supply: Active listings increased fastest in Cape Coral (50.7%), North Port (39.2%) and New Orleans (24.2%). They decreased fastest Las Vegas (-34.7%), Stockton, CA (-28.1%) and New Brunswick, NJ (-24.6%).

- Competition: In Rochester, 70.4% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came Newark, NJ (62.2%) and Buffalo, NY (59.7%). The shares were lowest in West Palm Beach, FL (8.9%), Cape Coral (10.1%) and New Orleans (11.5%).

- Speed: In Rochester, 66.2% of homes that went under contract did so within two weeks—the highest share among the metros Redfin analyzed. Next came Buffalo (52.8%) and Cincinnati (51.4%). The lowest shares were in Honolulu (5.7%), Knoxville (9.3%) and Lake County, IL (10.1%).

Home-Purchase Cancellations

Data below came from a list of the 50 most populous metro areas.

| Metro Area | November 2023: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales | October 2023: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales | November 2022: Pending Sales That Fell Out of Contract, as % of Overall Pending Sales |

|---|---|---|---|

| Anaheim, CA | 16.0% | 15.1% | 14.7% |

| Atlanta, GA | 24.8% | 24.2% | 26.1% |

| Austin, TX | 15.4% | 14.5% | 18.3% |

| Baltimore, MD | 14.3% | 13.5% | 13.2% |

| Boston, MA | 11.6% | 10.5% | 11.5% |

| Charlotte, NC | 14.0% | 12.9% | 14.9% |

| Chicago, IL | 18.5% | 18.0% | 17.3% |

| Cincinnati, OH | 15.0% | 14.8% | 13.9% |

| Cleveland, OH | 23.1% | 18.5% | 19.0% |

| Columbus, OH | 17.0% | 17.3% | 18.4% |

| Dallas, TX | 19.5% | 18.8% | 22.4% |

| Denver, CO | 18.3% | 20.0% | 18.5% |

| Detroit, MI | 18.3% | 16.9% | 15.4% |

| Fort Lauderdale, FL | 22.8% | 23.6% | 20.7% |

| Fort Worth, TX | 19.4% | 23.2% | 20.4% |

| Houston, TX | 21.0% | 20.1% | 20.5% |

| Indianapolis, IN | 18.3% | 19.0% | 18.4% |

| Jacksonville, FL | 24.8% | 24.7% | 25.6% |

| Kansas City, MO | 16.1% | 16.6% | 17.1% |

| Las Vegas, NV | 22.6% | 22.0% | 20.4% |

| Los Angeles, CA | 17.2% | 17.0% | 17.3% |

| Miami, FL | 21.0% | 18.3% | 18.1% |

| Milwaukee, WI | 12.2% | 10.9% | 11.2% |

| Minneapolis, MN | 12.0% | 11.5% | 11.8% |

| Montgomery County, PA | 8.8% | 7.6% | 9.3% |

| Nashville, TN | 18.0% | 17.0% | 15.8% |

| Nassau County, NY | 5.5% | 6.6% | 6.7% |

| New Brunswick, NJ | 12.5% | 13.7% | 12.9% |

| New York, NY | 9.7% | 10.7% | 8.0% |

| Newark, NJ | 10.3% | 10.5% | 11.9% |

| Oakland, CA | 10.6% | 9.9% | 8.8% |

| Orlando, FL | 22.1% | 23.2% | 23.2% |

| Philadelphia, PA | 12.9% | 13.1% | 14.6% |

| Phoenix, AZ | 19.3% | 20.2% | 19.0% |

| Pittsburgh, PA | 17.2% | 17.9% | 17.1% |

| Portland, OR | 15.7% | 15.9% | 16.6% |

| Providence, RI | 14.0% | 13.1% | 11.9% |

| Riverside, CA | 18.8% | 21.2% | 18.4% |

| Sacramento, CA | 16.7% | 18.9% | 17.4% |

| San Antonio, TX | 20.2% | 19.9% | 13.1% |

| San Diego, CA | 16.7% | 16.2% | 15.7% |

| San Francisco, CA | 5.8% | 5.9% | 6.2% |

| San Jose, CA | 6.7% | 8.6% | 8.2% |

| Seattle, WA | 11.5% | 11.8% | 12.4% |

| St. Louis, MO | 15.6% | 14.8% | 15.4% |

| Tampa, FL | 21.4% | 21.7% | 23.2% |

| Virginia Beach, VA | 17.3% | 16.9% | 13.8% |

| Warren, MI | 13.1% | 12.9% | 13.4% |

| Washington, D.C. | 13.1% | 12.5% | 13.2% |

| West Palm Beach, FL | 17.7% | 17.9% | 17.5% |

| National—U.S.A. | 16.9% | 16.8% | 15.6% |