When it comes to keeping your hard-earned money safe, one of the most important factors to consider is the financial institution where you choose to deposit it. This is where the Federal Deposit Insurance Corporation (FDIC) comes in. The FDIC is an independent U.S. government agency that provides insurance coverage to depositors in case their bank or financial institution fails. One of the best ways to ensure that your money is safe and protected is by keeping it in an FDIC-insured bank.

This means that your deposits are insured up to $250,000 per depositor, per account category, in case the bank fails. This insurance provides peace of mind to depositors, knowing that their funds are safe and secure. The importance of keeping your money in an FDIC-insured bank cannot be overstated. By doing so, you can protect your savings from loss in case of bank failure. The FDIC has been around since the Great Depression and has provided insurance protection for over 88 years.

With over 4,700 FDIC-insured banks in the United States, there are plenty of options to choose from. It’s worth noting that not all financial institutions are FDIC-insured. Before you deposit your money, it’s important to do your research and ensure that the bank you’re considering is FDIC-insured. You can easily check this by looking for the FDIC logo or by searching for the bank on the FDIC’s website.

How to Find the List of FDIC-Insured Banks?

The FDIC website provides information on the number of insured institutions and branch offices, total assets, and total deposits of FDIC-insured banks. In 2021, there were 4,236 FDIC-insured commercial banks in the United States. The number of such registered banks has been declining since 2000 when there were over 8,300 FDIC-insured banks in the country. As of March 17, 2023, there are 4,703 insured institutions and 81,166 insured branch offices.

The total assets of these institutions were $23.7 trillion as of December 31, 2022, while the total deposits amounted to $19.3 trillion. These statistics are updated weekly or quarterly and are important indicators of the overall health and stability of the banking industry. It is crucial for consumers to choose FDIC-insured banks for their deposits to ensure the safety of their money.

Tool to Check Banks That Are Not on FDIC Insured List

Are you unsure if your bank is FDIC-insured or not? Don’t worry, the FDIC has you covered. By using their tool, you can easily determine if your bank is on the FDIC-insured list. But what if your bank is not on the list? Read on to learn how to find banks that are not on the FDIC-insured list.

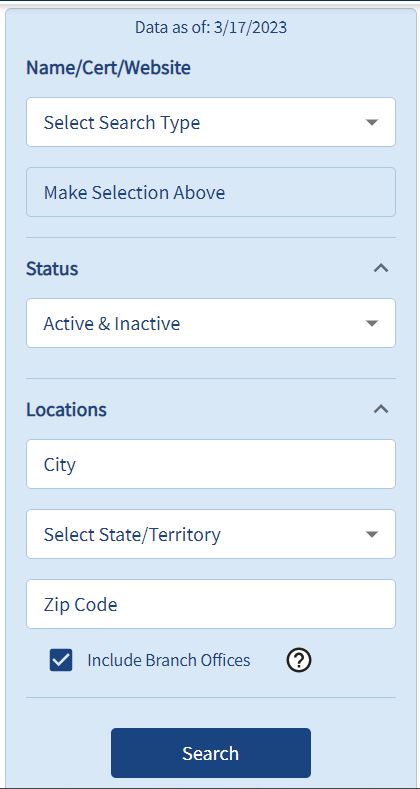

The BankFind Suite is a comprehensive tool provided by the FDIC that allows individuals to search for FDIC-insured banks and branches using the Name & Location Search feature. Users can use this tool to check if a bank is FDIC-insured, locate bank branches, see the history of a bank’s mergers and acquisitions, and review a bank’s history.

By accessing the tool, users can access current and historical data of FDIC-insured banks and their locations, including any changes in the bank’s name, location, and other relevant details. This tool can be a valuable resource for individuals and businesses who are looking for information about banks and their histories.

It provides current and historical data about these banks, including any mergers or acquisitions they may have undergone. Additionally, the tool allows users to review a bank’s history, such as name changes or relocations, to get a better understanding of its background. By using the BankFind Suite, customers can make informed decisions about their banking needs and have access to important information about the banks they do business with.

This search function enables users to search for banks and branches by their name or location, providing a convenient and efficient way to find financial institutions that are insured by the FDIC. The Name & Location Search feature is particularly useful because it allows users to search for banks and branches dating all the way back to 1934.

This means that users can search for institutions that have been around for decades and have a long-standing reputation for stability and reliability. Additionally, the search feature provides up-to-date information, allowing users to find banks and branches that have been newly established or have recently changed their name or location.

When searching for a bank on the FDIC website, there are some quick tips to keep in mind that can help make the process smoother.

- Firstly, it’s recommended to use a partial name search instead of the whole name as it will produce more results. Additionally, the website provides an auto-complete feature that can save time and reduce typing.

- Another important thing to remember is that all fields are optional, so it’s not necessary to fill in every line. However, providing more information will result in fewer search results, allowing for a more targeted search.

- If you’re not getting the results you expected, it’s advised to adjust your search input.

By following these quick tips, you can easily find FDIC-insured banks and branches on the FDIC website.

Which Deposit Accounts Are Insured by the FDIC?

It’s also important to know what types of accounts are protected by the Federal Deposit Insurance Corporation (FDIC) in case something happens to your bank or financial institution. The FDIC is an independent U.S. government agency that provides insurance to protect depositors in case their bank fails.

So, what types of accounts are insured by the FDIC? The FDIC lists several types of insurable accounts, including checking accounts, savings accounts, money market deposit accounts (MMDA), certificates of deposit (CDs), cashier’s checks, money orders, and other official items issued by a bank.

In addition, certain retirement accounts and benefit plans are also covered, such as IRAs, self-directed 401(k) plans, revocable trust accounts, and employee benefit plan accounts. However, it’s important to note that banks must apply to become FDIC-insured for this protection. If a bank isn’t FDIC-insured, your deposits won’t be covered. So, it’s always a good idea to check if your bank is FDIC-insured before opening an account.

What isn’t insured by the FDIC? While the FDIC does insure a lot of different accounts, there are some investments that are not covered. For example, stock investments, bond investments, mutual funds, and crypto assets are not insured by the FDIC. Life insurance policies, annuities, and municipal securities are also not covered. Safe deposit boxes or their contents are not insured either. Treasury bills, bonds, or notes are not covered by the FDIC, but they are “backed by the full faith and credit of the U.S. government,” according to the FDIC.

In short, it’s always a good idea to be aware of what types of accounts are insured by the FDIC and what types of investments are not covered. If you’re unsure about the insurance coverage on your accounts, contact your bank or financial institution for more information.

Largest Banks in the United States

In the United States, the banking industry is dominated by four major banks, namely JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These financial institutions hold the largest market share and are also among the top banks worldwide by market capitalization. According to data published in January 2023 by Statista Research Department, JPMorgan Chase is the most valuable bank globally, with total assets worth about 3.31 trillion U.S. dollars in 2021.

Although JPMorgan Chase is the largest bank in the U.S., the top four positions in the global banking industry in terms of total assets were held by Chinese banks in 2021. Nevertheless, these big four banks in the U.S. have a stable financial position with a common equity tier 1 (CET1) capital ratio well above the required 4.5 percent.

During the second quarter of 2022, JPMorgan Chase recorded a CET1 ratio of 12.17 percent, which is higher than the required minimum. It is worth noting that TD Bank, the ninth-largest bank in the United States in 2022, had the highest CET1 ratio among U.S. banks, which was 16.6 percent.

Knowing the largest banks in the U.S. by assets can provide useful insights for investors and consumers alike. These banks play a vital role in the country’s economy and provide various financial services, including deposit accounts, loans, and credit cards. By understanding the stability of these institutions, individuals can make informed decisions when choosing a bank for their financial needs.

Source:

- https://banks.data.fdic.gov/bankfind-suite/bankfind

- https://www.fdic.gov/resources/tools/bank-data-guide/banks.html

- https://www.statista.com/statistics/799197/largest-banks-by-assets-usa/