- 24% of LGBTQ+ renters are unlikely to buy a home due to lack of financial support from family/friends, compared with 14% of non LGBTQ+ renters, a Redfin survey found.

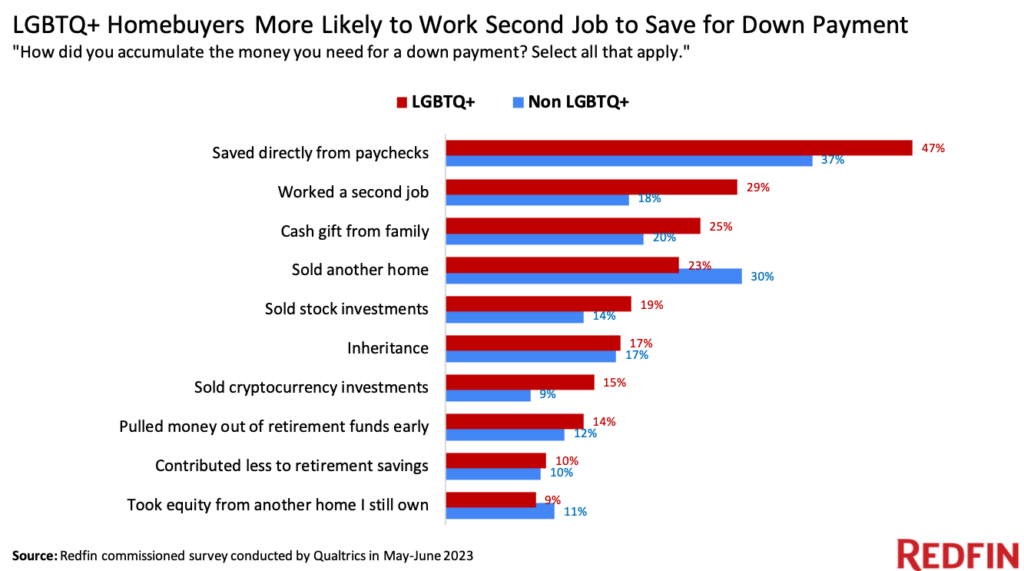

- LGBTQ+ homebuyers are more likely than non LGBTQ+ buyers to work a second job in order to come up with a down payment.

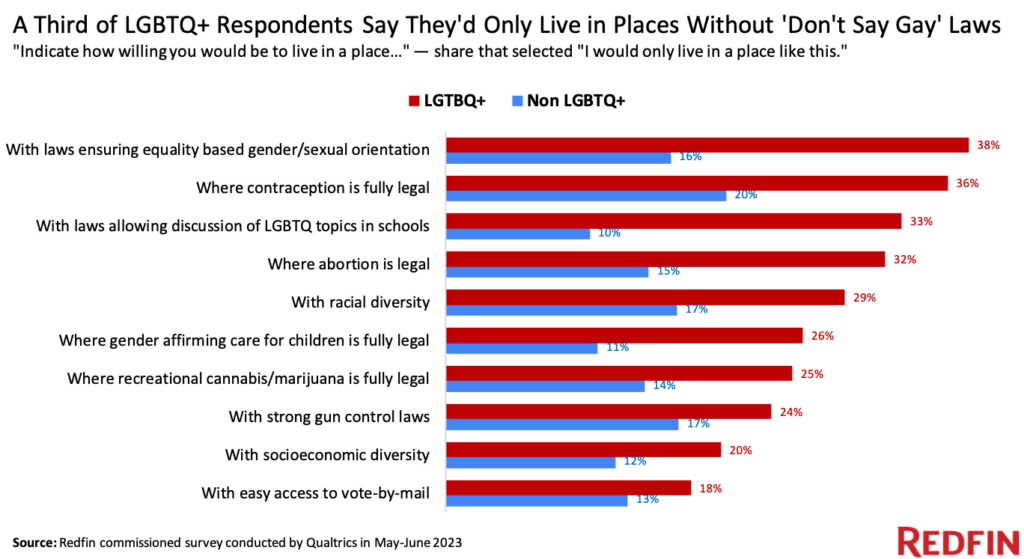

- 38% of LGBTQ+ respondents said they’d only live in a place with laws ensuring equality based on gender or sexual orientation.

LGBTQ+ renters are more likely to face financial barriers to homeownership than non LGBTQ+ renters, according to a survey commissioned by Redfin.

Nearly one-quarter of LGBTQ+ renters (23.5%) said they’re unlikely to buy a home in the near future due to lack of financial support from family or friends, compared with 14% of non LGBTQ+ renters—the largest gap among the barriers respondents chose from.

LGBTQ+ renters were also more likely than non LGBTQ+ renters to say student loan debt is preventing them from buying a home (18.4% vs 11.4%).

That’s according to a Redfin-commissioned survey conducted by Qualtrics in May and June 2023. The survey was fielded to more than 5,000 U.S. residents. This portion of the report focuses on renter respondents. Subsequent sections focus on recent homebuyers and all respondents.

Housing affordability was the top barrier to homeownership for surveyed renters across the board, but LGBTQ+ renters were more likely than non LGBTQ+ renters to list it as an obstacle.

More than half (51.2%) of LGBTQ+ renters said they’re unlikely to buy a house in the near future because homes are too expensive, compared with 43.1% of non LGBTQ+ renters. Similarly, 44.9% of LGBTQ+ renters cited saving for a down payment as an obstacle, versus 35.7% of non LGBTQ+ renters. For virtually every barrier listed, LGBTQ+ respondents were more likely than non LGBTQ+ respondents to check the box.

One answer choice bucked the trend: LGBTQ+ renters were less likely (13.2%) than the non LGBTQ+ renters (20.1%) to say they’re unlikely to buy a home in the near future simply because they’re not interested in owning one.

“Young people are often rewarded financially for fulfilling heteronormative expectations around getting married and having kids,” said Redfin Chief Economist Daryl Fairweather. “For example, it’s common for a bride and groom to receive thousands of dollars in cash gifts when they get married, which they can put toward buying or renovating a home. LGBTQ+ couples, on the other hand, often get married later in life, and may not receive financial support if they’ve been shut out by their families.”

LGBTQ+ Homebuyers More Likely to Work Second Job to Fund Down Payment

We also surveyed people who bought a home in the past year to see how they saved up for down payments. Recent LGBTQ+ homebuyers were more likely to say they worked a second job (29.1% vs 18.3% of non LGBTQ+ buyers), sold stock investments (18.5% vs 13.8%) and sold cryptocurrency investments (14.8% vs 8.5%). They were also more likely to save directly from paychecks (46.6% vs 36.5%).

The wage gap is likely one reason LGBTQ+ buyers are more likely to take on a second job to fund their down payment; LGBTQ+ workers earn about 90 cents for every dollar the typical worker earns, according to the Human Rights Campaign.

Recent LGBTQ+ homebuyers were less likely than non LGBTQ+ buyers to say they put the proceeds from the sale of another home toward their down payment (23.3% vs 29.5%). That’s in part because LGBTQ+ Americans are less likely to own homes. The LGBTQ+ homeownership rate is 51%, compared with 71% for people who identify as both straight and cisgender. LGBTQ+ Americans skew younger, which is one reason for the disparity, but the income gap may also be at play.

38% of LGBTQ+ Respondents Say They’d Only Live Somewhere With Protections Against Discrimination Based on Gender, Sexual Orientation

Nearly two of every five LGBTQ+ respondents (37.9%) said they would only live in a place that has laws ensuring equality based gender or sexual orientation, compared with 16.3% of non LGBTQ+ respondents. LGBTQ+ respondents were nearly three times as likely to say they’d only live somewhere with laws allowing discussion of LGBTQ topics in schools (33% vs 10.4%). And one-quarter of LGBTQ+ participants (25.9%) indicated that they would only live in a place where gender affirming care for children is fully legal, versus 11% of non LGBTQ+ respondents.

Racial diversity, strong gun control laws and legal abortion were also more likely to be “musts” for LGBTQ+ respondents than for non LGBTQ+ respondents.

At a time when LGBTQ+ rights are becoming increasingly restricted, it’s not surprising that many LGBTQ+ Americans only want to live in places with legal protections. Lawmakers in 37 states have introduced at least 142 bills to limit gender-affirming healthcare this year, and 21 states now ban abortion or restrict it earlier in pregnancy than the standard set by Roe v. Wade. In April, Florida expanded its so-called “Don’t Say Gay” law, which bars lessons on gender identity and sexual orientation in the classroom.

A separate Redfin report based on this same survey found that 22% LGBTQ+ people who recently moved believe they were discriminated against based on their sexual orientation during their most recent home search, and another 19% think they may have been discriminated against.

Methodology

This report is based on a Redfin-commissioned survey conducted by Qualtrics in May and June 2023. The survey was fielded to more than 5,000 U.S. residents who either moved in the last year, plan to move in the next year, or rent their home. Of those respondents, roughly 900 were LGBTQ+, meaning they self identified as lesbian, gay, bisexual, pansexual, asexual, transgender, intersex, two spirit and/or non binary.